Lower than expected and last month revised lower: Highlights ADP sees June private payrolls rising 158,000 which misses Econoday’s ADP consensus of 180,000. Econoday’s consensus for actual private payrolls in Friday’s employment report is 164,000 which isn’t likely to shift following ADP’s results. Estimates this year from ADP have been hit and miss with a wild upside miss in May. Decent number for this survey but still reflects trumped up expectations: Highlights ISM’s non-manufacturing sample continues to report extending strength with the index up 5 tenths in June to 57.4 which tops Econoday’s high estimate for 57.1. New orders, at 60.5, remain unusually strong with backlog orders, at 52.0, also rising in the month. New orders for export, at 55.0, are also up solidly

Topics:

WARREN MOSLER considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

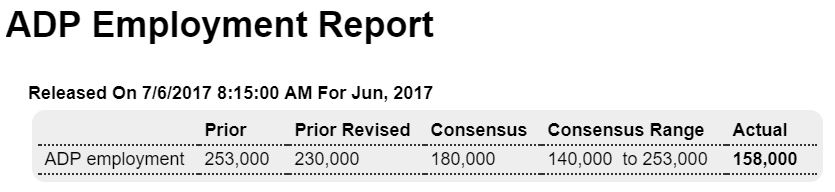

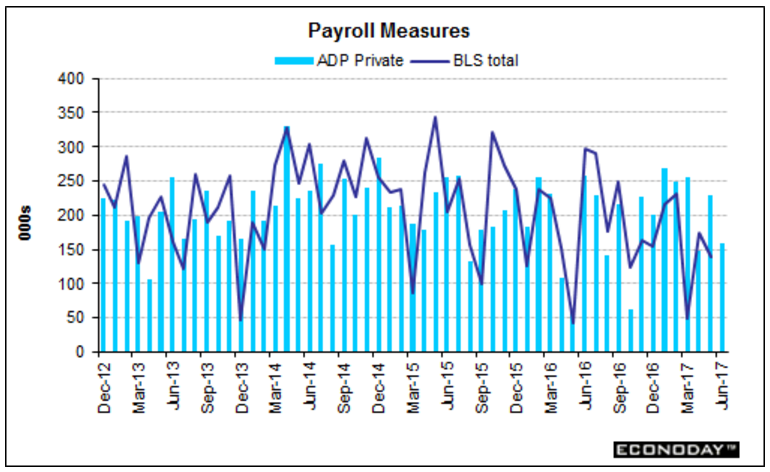

Lower than expected and last month revised lower:

Highlights

ADP sees June private payrolls rising 158,000 which misses Econoday’s ADP consensus of 180,000. Econoday’s consensus for actual private payrolls in Friday’s employment report is 164,000 which isn’t likely to shift following ADP’s results. Estimates this year from ADP have been hit and miss with a wild upside miss in May.

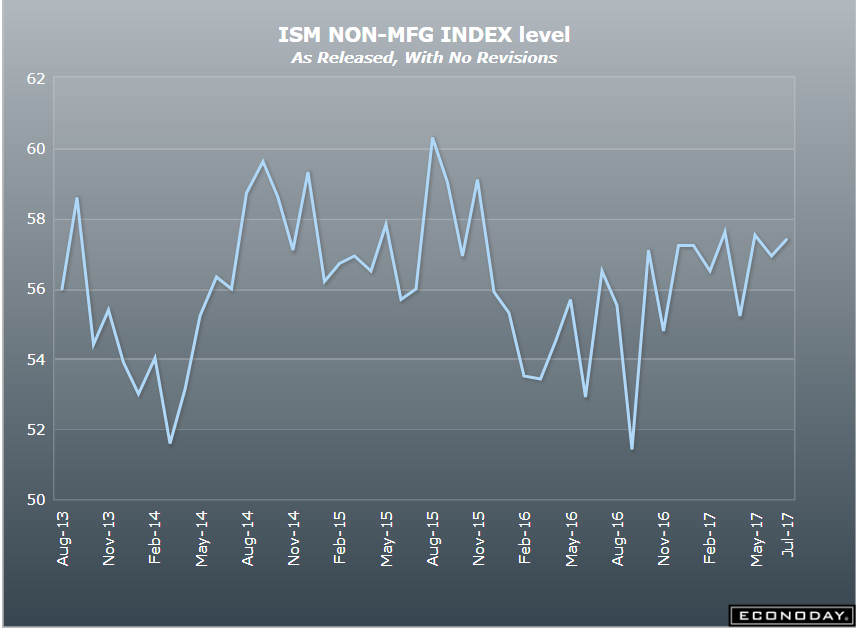

Decent number for this survey but still reflects trumped up expectations:

Highlights

ISM’s non-manufacturing sample continues to report extending strength with the index up 5 tenths in June to 57.4 which tops Econoday’s high estimate for 57.1. New orders, at 60.5, remain unusually strong with backlog orders, at 52.0, also rising in the month. New orders for export, at 55.0, are also up solidly though to a lesser degree than domestic orders.

Employment growth is very solid at 55.8 but is down slightly from May’s unusually strong 57.8 in results that won’t disturb expectations for improving strength in tomorrow’s employment report. Business activity (output) is very strong at 60.8 with inventories, at 57.5, on the rise in further confirmation of the sample’s confidence.

The strength in this report continues to be impressive but has yet to pan out to similar strength in government data.

My recent radio interview:

https://soundcloud.com/financialexchange/warren-mosler-2

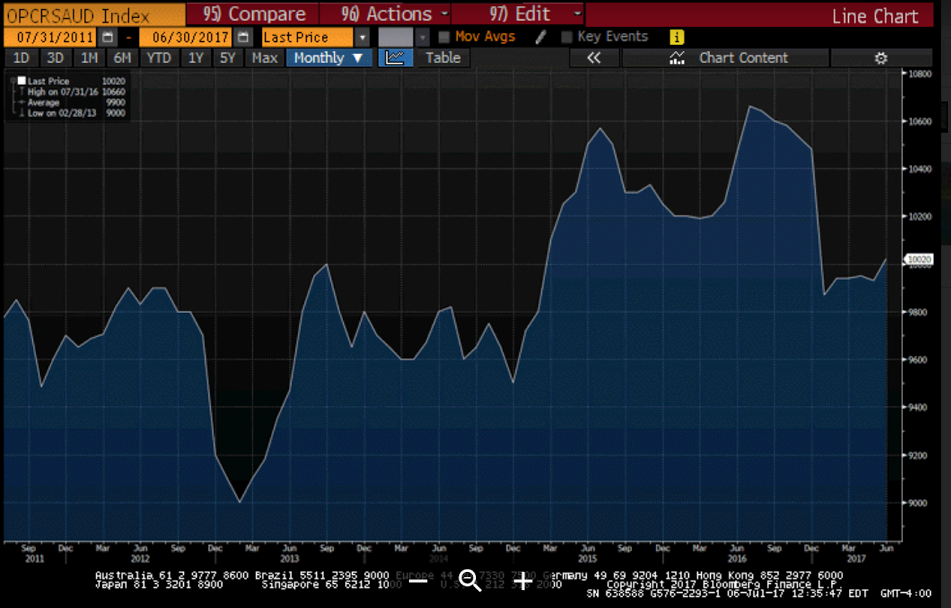

Saudi output shows they remain swing producer and price setter:

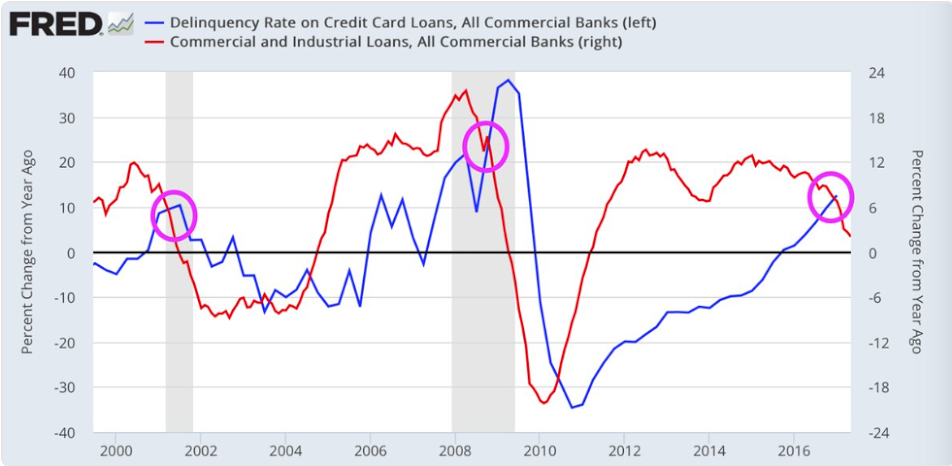

Another way to look at where we might be in the cycle:

https://twitter.com/northmantrader/status/882670288177172480