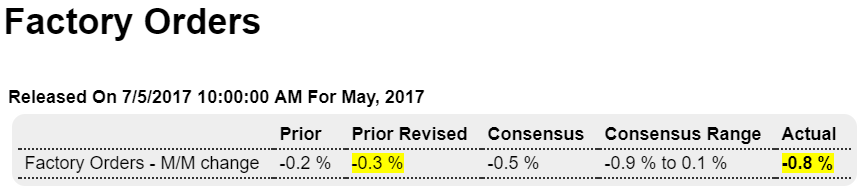

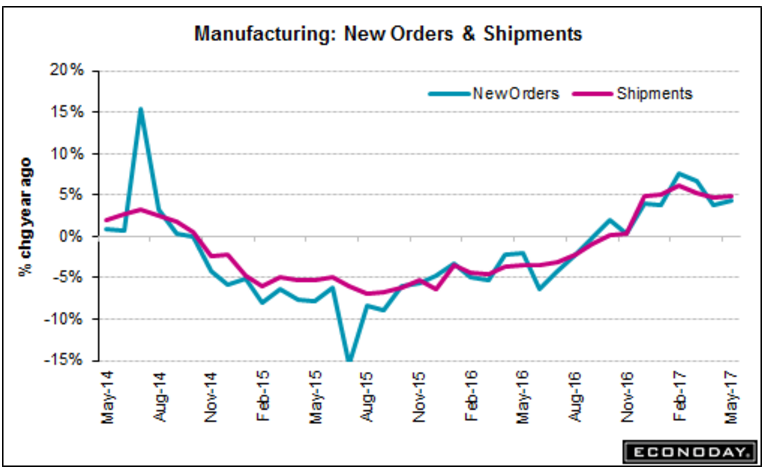

Weaker q2 vs q1, and muddling along at about 3% year over year as previously discussed: Highlights Forecasters thought factory orders would get a lift from nondurables but they didn’t as total orders fell 0.8 percent in May vs Econoday’s consensus for minus 0.5 percent. Nondurable orders, held down by weakness in petroleum and coal, also fell 0.8 percent as did durable orders where last week’s advance data showed a 1.1 percent decline. But there are positives in today’s report and they include a small lift for core capital goods orders (nondefense ex-aircraft) which, boosted by a jump in mining equipment, rose 0.2 percent vs last week’s initial estimate for a 0.2 percent decline. A small plus is a 1 tenth upward revision to April which is now at plus 0.3 percent.

Topics:

WARREN MOSLER considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

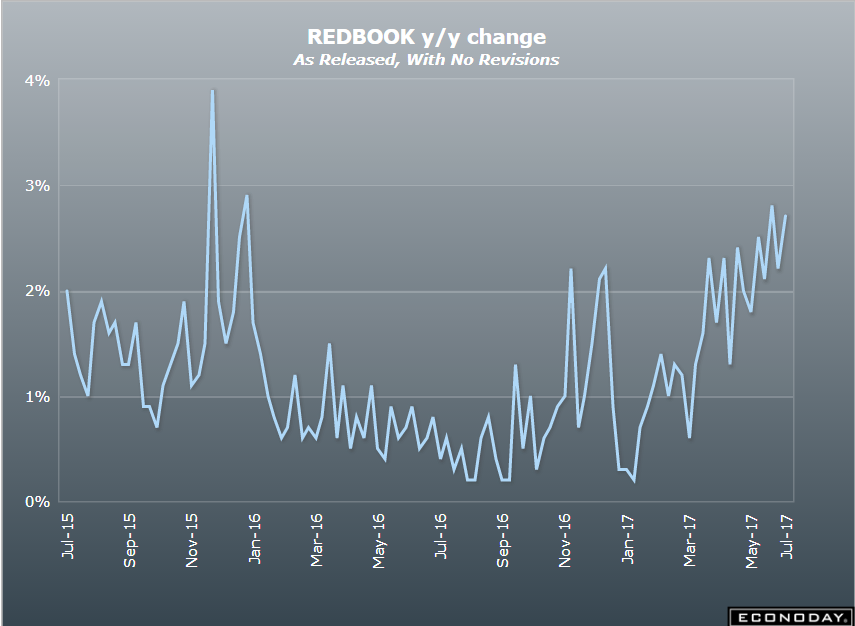

Weaker q2 vs q1, and muddling along at about 3% year over year as previously discussed:

Highlights

Forecasters thought factory orders would get a lift from nondurables but they didn’t as total orders fell 0.8 percent in May vs Econoday’s consensus for minus 0.5 percent. Nondurable orders, held down by weakness in petroleum and coal, also fell 0.8 percent as did durable orders where last week’s advance data showed a 1.1 percent decline.

But there are positives in today’s report and they include a small lift for core capital goods orders (nondefense ex-aircraft) which, boosted by a jump in mining equipment, rose 0.2 percent vs last week’s initial estimate for a 0.2 percent decline. A small plus is a 1 tenth upward revision to April which is now at plus 0.3 percent. Shipments for core capital goods, which are inputs into second-quarter business investment, are similarly revised upward, now at plus 0.1 percent and 0.2 percent in May and April.

Weakness in the report includes aircraft orders with both commercial and defense falling in the double digits in the month. Orders for motor vehicle & parts rose a very solid 1.2 percent though consumer goods fell 0.2 percent.

But manufacturing activity, as described in last week’s PMI manufacturing report, is no better than subdued as total shipments rose only 0.1 percent following no change and minus 0.2 percent in the two prior months. A clear negative is a 0.2 percent decline in unfilled orders. Inventories fell 0.1 percent following no change in April, keeping inventories-to-shipments steady at a lean 1.38 ratio that points, however, to a defensive outlook that won’t be helping second-quarter GDP.

There are bright spots in this report which overall, however, is consistent with a sector that is struggling to find momentum.

Also in line with weak demand

Small business hires dropped in June, but employees saw wages rise, Paychex survey shows

Small business hiring fell in June, but wages continued to increase, Paychex says. The Small Business Jobs Index is at its lowest level since late 2011. “The decline in this month’s index and modest growth in wages seem to reflect an unclear regulatory picture combined with a narrowing labor market,” Paychex President and CEO Martin Mucci says.

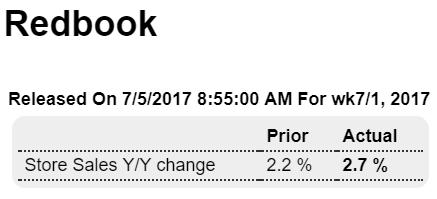

Definitely looking up some, though probably a lot fewer of these types of retailers now:

Highlights

Same store sales were up 2.7 percent year-on-year in the July 1 week, picking up the pace by 0.5 percentage points from the previous week to a tick below the strongest growth since January 2016 posted two weeks ago. Month-to-date same store sales versus the prior month also strengthened and were up 0.7 percent, an 0.1 percentage point improvement from the prior week. Full month year-on-year same store sales were up 2.5 percent, back up to the strongest pace in at least year also seen in the June 3 and June 17 weeks. The week’s survey results put a strong finish on a very good month for retailers in Redbook’s sample, who are reporting the best sales performance comparisons in 17 months after faltering sales in May, and suggest strong ex-auto less gas retail sales for the month.