Seems revenues continue to fall indicating the two years of deceleration of growth may have already gone below 0, and with unemployment claims a lot harder to get that source of transfer payments seems to have been reduced, reducing what otherwise would have been that much counter cyclical deficit spending: US Budget Gap Doubles in December The US government reported a billion budget deficit in December, a 94.4% increase from a .4 billion gap a year earlier and slightly above market expectations of a billion. Receipts slumped 8.9% to 9 billion and outlays fell 4.7% to 7 billion. Three months into the government’s fiscal year, the budget deficit is at 8.4 billion vs 5.5 billion this time last year. Outlays are down 3.3 percent so far this fiscal year with Medicare down 11 percent to offset a 16 percent rise in net interest. Receipts are down 3.2 percent with corporate income tax down 11 percent. The deficit for December totaled .5 billion. This chart is not population adjusted! Employment in the sector grew by 672,700 workers during the three-month holiday hiring period of 2016, according to an analysis of government employment data by global outplacement consultancy Challenger, Gray & Christmas, Inc. That was down 9.0 percent from the 738,800 jobs added in 2015.

Topics:

WARREN MOSLER considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

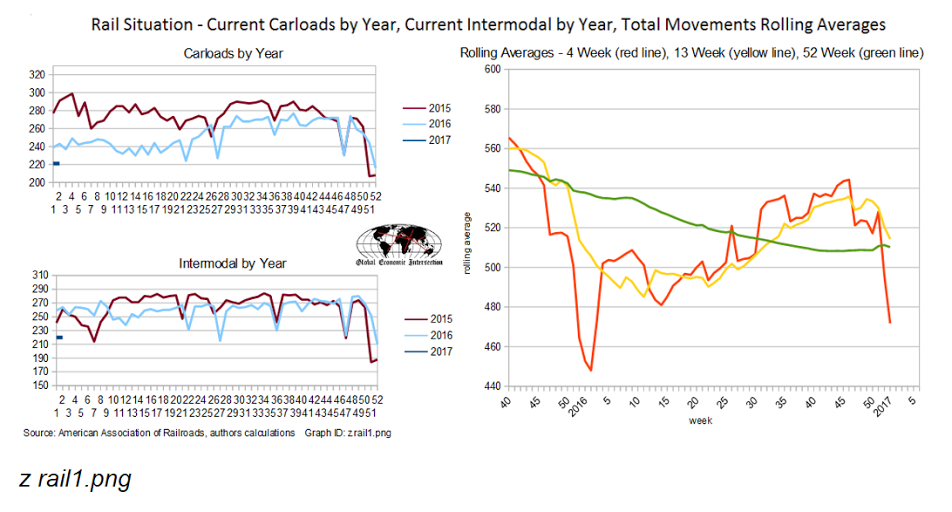

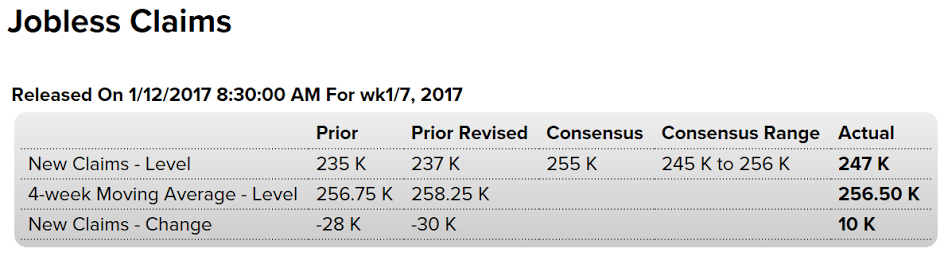

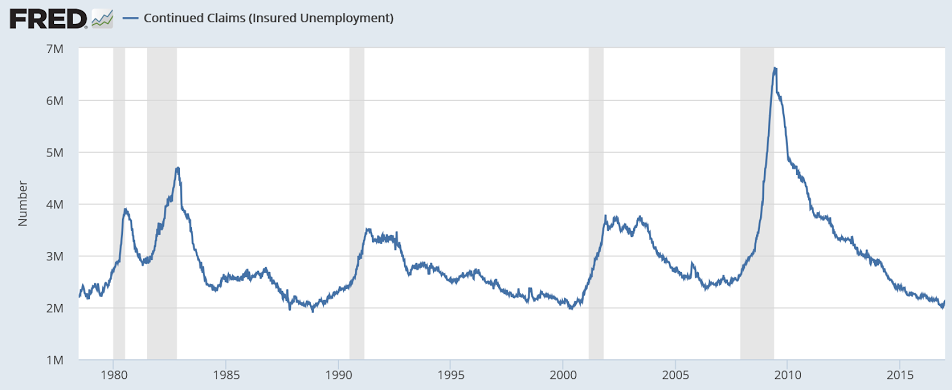

Seems revenues continue to fall indicating the two years of deceleration of growth may have already gone below 0, and with unemployment claims a lot harder to get that source of transfer payments seems to have been reduced, reducing what otherwise would have been that much counter cyclical deficit spending:

US Budget Gap Doubles in December

The US government reported a $28 billion budget deficit in December, a 94.4% increase from a $14.4 billion gap a year earlier and slightly above market expectations of a $25 billion. Receipts slumped 8.9% to $319 billion and outlays fell 4.7% to $347 billion.

Three months into the government’s fiscal year, the budget deficit is at $208.4 billion vs $215.5 billion this time last year. Outlays are down 3.3 percent so far this fiscal year with Medicare down 11 percent to offset a 16 percent rise in net interest. Receipts are down 3.2 percent with corporate income tax down 11 percent. The deficit for December totaled $27.5 billion.

This chart is not population adjusted!

Employment in the sector grew by 672,700 workers during the three-month holiday hiring period of 2016, according to an analysis of government employment data by global outplacement consultancy Challenger, Gray & Christmas, Inc. That was down 9.0 percent from the 738,800 jobs added in 2015.

This marked the third consecutive decline in holiday employment gains. The 2016 -holiday hiring total was the lowest since 647,600 jobs were added to retail payrolls during the closing months of 2010, when the economy was in the first year of recovery following the Great Recession. Said John A. Challenger, chief executive officer of Challenger, Gray & Christmas:

The retail landscape is going through a sea change. The shift toward online shopping has being ramping up for years. It is obvious in the sales numbers and in the falling level of in-store traffic during the holidays. In this environment, retailers simply don’t need as many extra workers during the holidays.

Bad start: