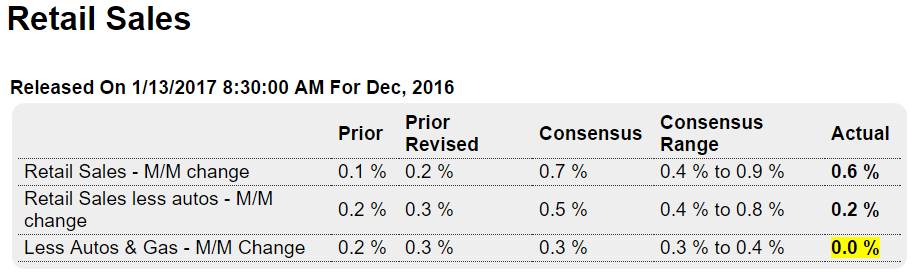

Less than expected and held up by vehicle sales which were about flat for the year and are unlikely to be any better than that in 2017, and therefore not contributing anything to growth: Highlights Outside of cars, consumers weren’t in much of a spending mood this holiday season. Retail sales did post a very solid gain in December, up 0.6 percent, but without autos the gain falls to only 0.2 percent. And exclude gasoline as well, which isn’t really a common holiday gift, and sales come in dead flat at zero. And gifts were on the light side this year based on department store sales which fell 0.6 percent in the month and also electronic & appliance stores where sales fell 0.5 percent. And in a clear sign of discretionary weakness, restaurant sales fell 0.8 percent for the largest monthly decline in a nearly year. Vehicle sales, which jumped 2.4 percent in the month, pull the report to the upside as do gasoline sales which rose 2.0 percent. But retail sales excluding gasoline do show a very solid 0.5 percent vehicle-driven gain and underscore that this report, despite the softness in holiday categories, is still a solid plus for fourth-quarter GDP. And there are positives led once again by ecommerce as nonstore retailers saw a 1.3 percent monthly rise.

Topics:

WARREN MOSLER considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

Less than expected and held up by vehicle sales which were about flat for the year and are unlikely to be any better than that in 2017, and therefore not contributing anything to growth:

Highlights

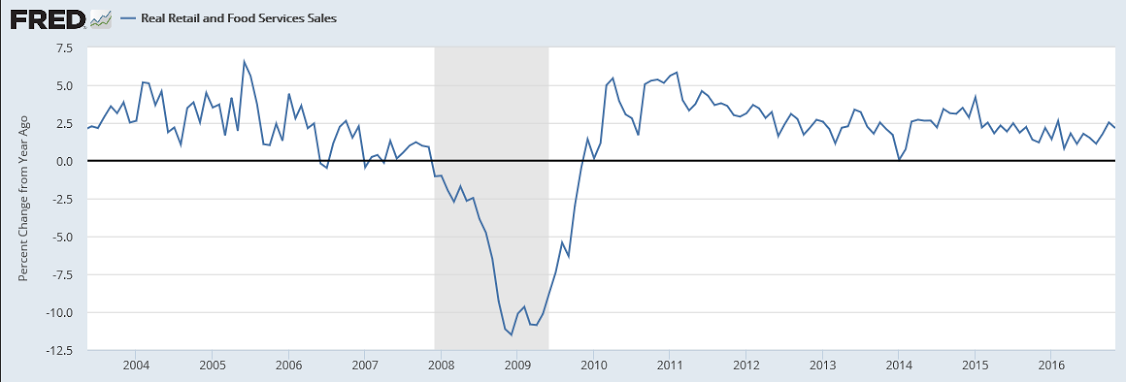

Outside of cars, consumers weren’t in much of a spending mood this holiday season. Retail sales did post a very solid gain in December, up 0.6 percent, but without autos the gain falls to only 0.2 percent. And exclude gasoline as well, which isn’t really a common holiday gift, and sales come in dead flat at zero.

And gifts were on the light side this year based on department store sales which fell 0.6 percent in the month and also electronic & appliance stores where sales fell 0.5 percent. And in a clear sign of discretionary weakness, restaurant sales fell 0.8 percent for the largest monthly decline in a nearly year.

Vehicle sales, which jumped 2.4 percent in the month, pull the report to the upside as do gasoline sales which rose 2.0 percent. But retail sales excluding gasoline do show a very solid 0.5 percent vehicle-driven gain and underscore that this report, despite the softness in holiday categories, is still a solid plus for fourth-quarter GDP. And there are positives led once again by ecommerce as nonstore retailers saw a 1.3 percent monthly rise.

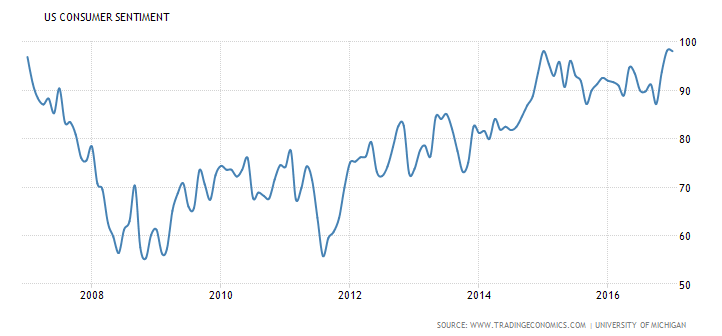

The bottom line is best characterized by apparel where sales were flat, posting no change for the second month in a row. Consumer spirits may be very high, and if this benefited retail sales in December it was mostly isolated to vehicles.

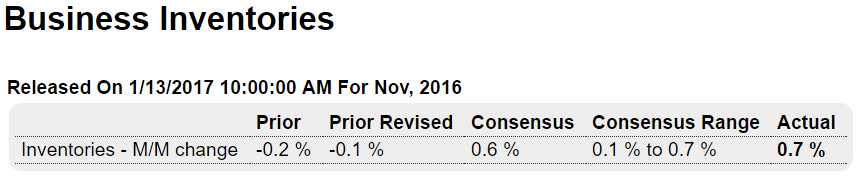

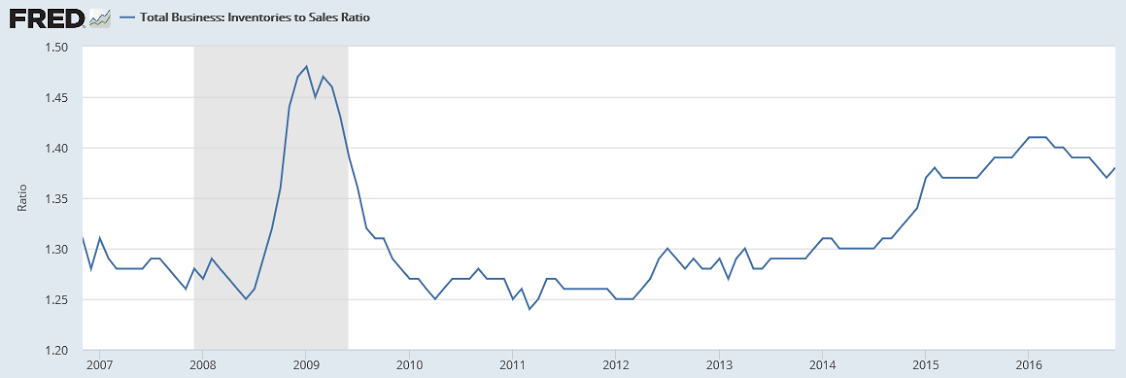

More bad news on inventories which were already way too high:

Highlights

Data on fourth-quarter inventories are looking heavy, up 0.7 percent in November in an offset to a revised 0.1 percent draw in October. Both retailers and wholesalers show large 1.0 percent builds in November with manufacturers at a 0.2 percent build. Given weakness in total sales, up only 0.1 percent, the stock-to-sales ratio rose 1 tenth in the month to 1.38.

Still trumped up but moderating some:

Post-election confidence readings have been very high but have not equated to the same proportional punch for consumer spending which, nevertheless, has been respectable. The report notes that partisanship is extreme right now with 44 percent of the sample citing the importance of government policies (whether positive or negative). The cycle average for this reference is 20 percent.

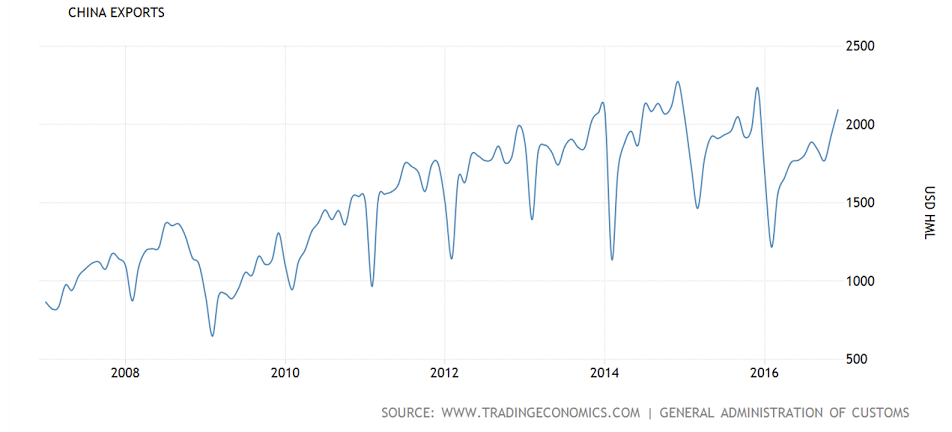

Exports from China declined by 6.1 percent from a year ago to USD 209.42 billion in December of 2016, following a revised 1.6 percent drop in the prior month while markets expected a 3.5 percent drop. Considering the full year of 2016, sales fell 7.7 percent, the second straight year of decline and the worst since the depths of the global crisis in 2009. In yuan-denominated terms, exports rose 0.6 percent from a year earlier, following a 5.9 percent rise in a month earlier. From January to December of the year, sales dropped by 2 percent.

Improving global environment?

German GDP Grows at Fastest Rate in Five Years

By Nina Adams and Andrea Thomas

Jan 12 (WSJ) – Gross domestic product expanded 1.9% in 2016 in inflation-adjusted terms, the Destatis statistics body said on Thursday. This is the highest rate since 2011, beating the government’s own prediction of 1.8% growth. A statistician with Destatis said GDP probably expanded by around 0.5% in the fourth quarter from the third quarter. An official forecast is due Feb. 14. “The restraint seen in the third quarter has been overcome,” the economics ministry said in its monthly report on Thursday, pointing to solid industrial production and an improving global environment.

Interesting divergence?