Still decelerating, and data releases seem to confirm that the credit deceleration is reflecting something similar in the macro economy: Annual growth is down to about 1.5%: This would have been maybe 0 billion higher if it had not decelerated: Housing and cars contribution to growth also looking a lot lower than last year: This chart is only through year end. It’s since decelerated as per the above current charts. Note how the downturn in credit growth tends to lead recessions: And forecasts for last quarter, Q2, continue to fall:

Topics:

WARREN MOSLER considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

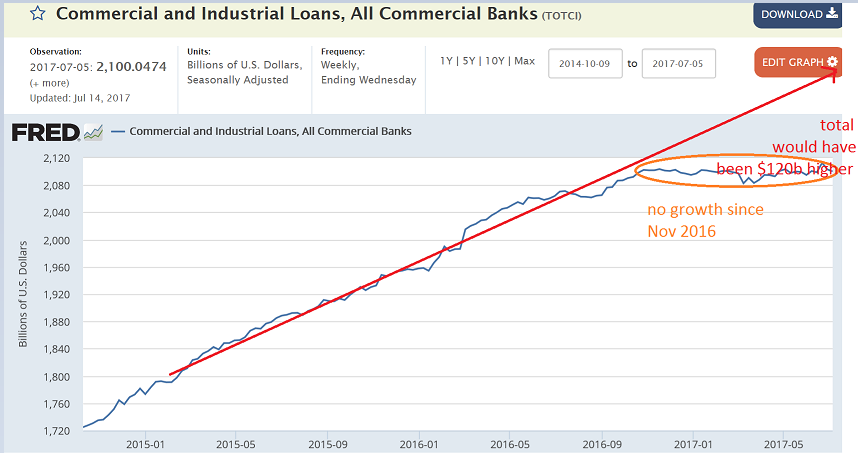

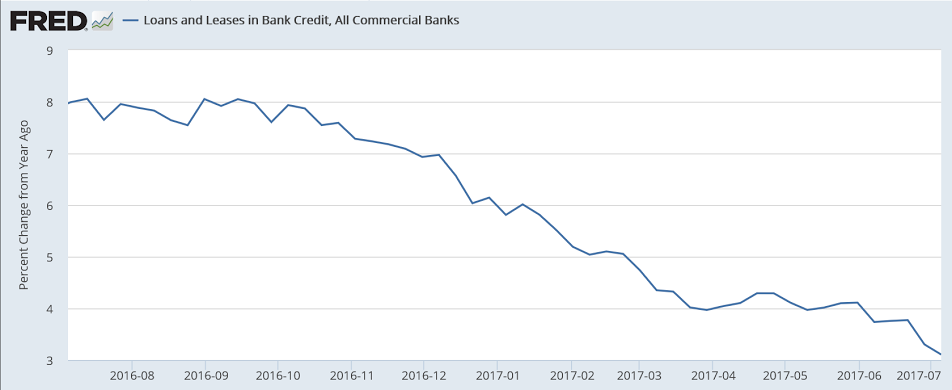

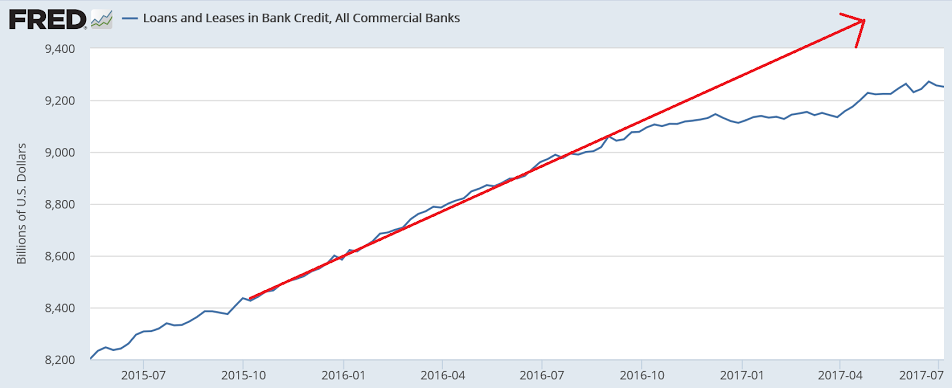

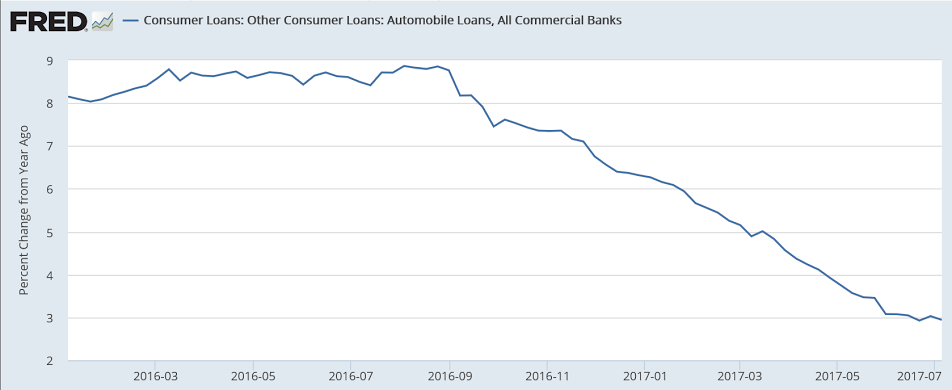

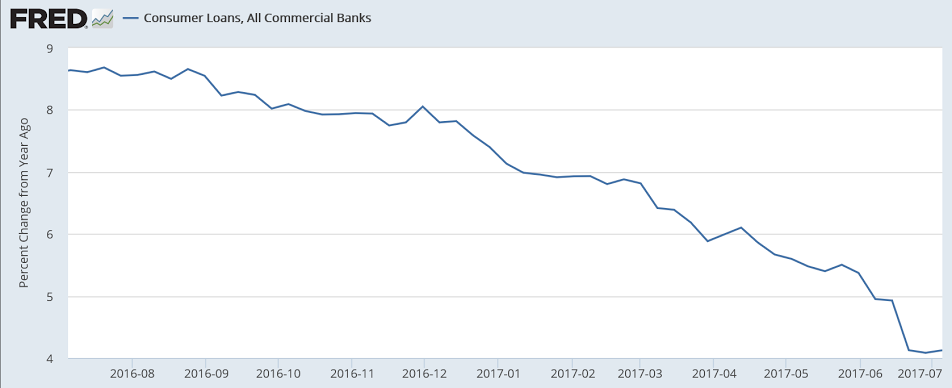

Still decelerating, and data releases seem to confirm that the credit deceleration is reflecting something similar in the macro economy:

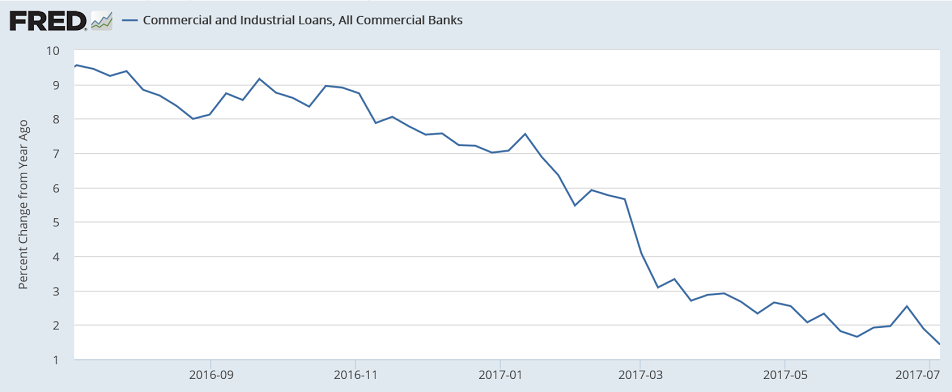

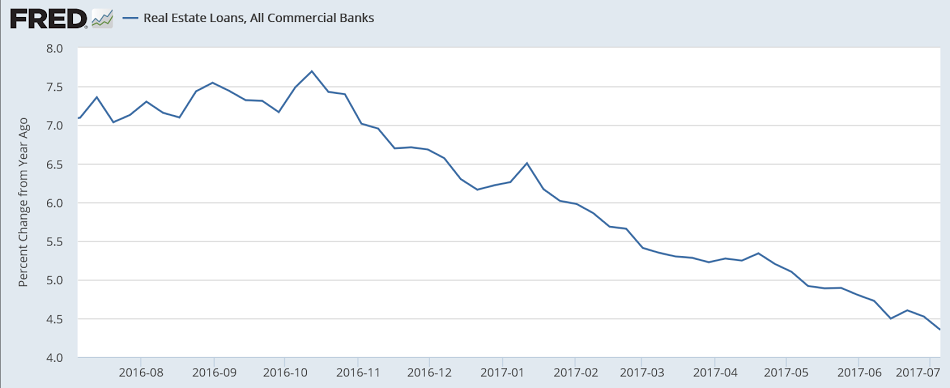

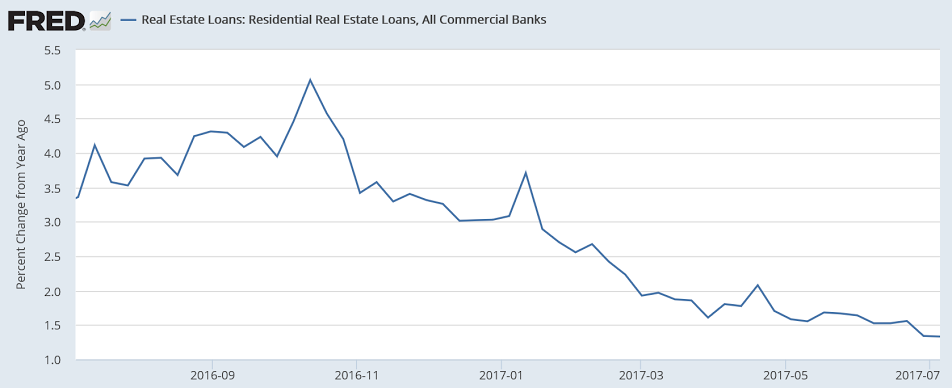

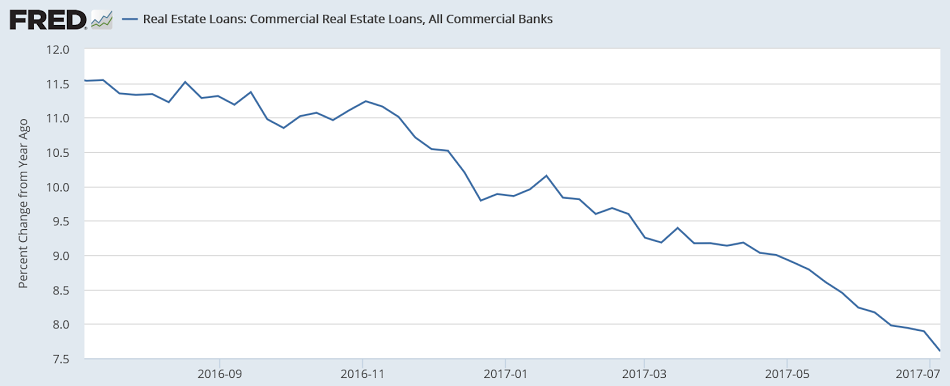

Annual growth is down to about 1.5%:

This would have been maybe $500 billion higher if it had not decelerated:

Housing and cars contribution to growth also looking a lot lower than last year:

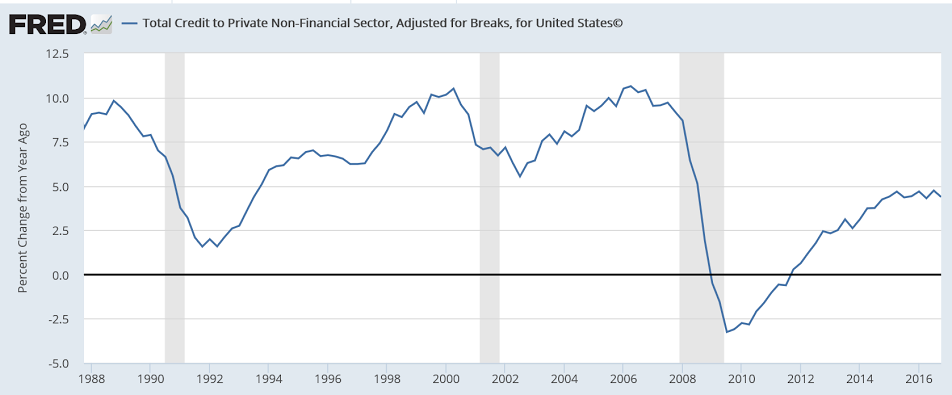

This chart is only through year end. It’s since decelerated as per the above current charts. Note how the downturn in credit growth tends to lead recessions:

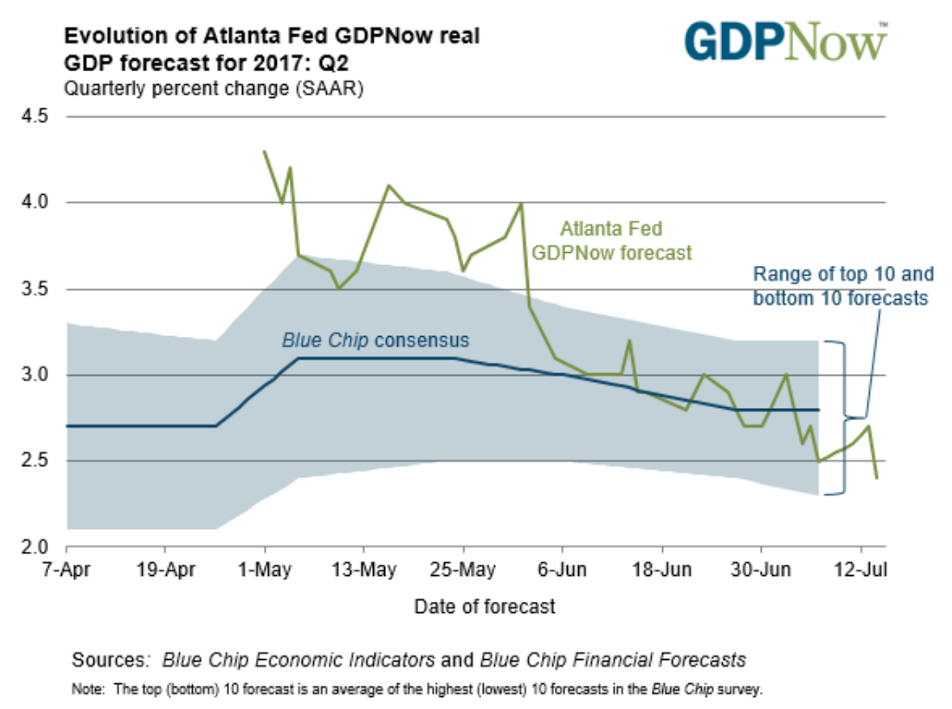

And forecasts for last quarter, Q2, continue to fall: