Settling down a bit: Highlights A little less strength is probably welcome in the New York Fed’s manufacturing sample where gains at times have been unsustainable. The Empire State index came in at 9.8 in July vs Econoday’s consensus for 15.0 and against June’s very hot 19.8. New orders are strong at 13.3 but down nearly 5 points from June while unfilled orders moved back into contraction to minus 4.7. Employment slowed to 3.7 for a 4 point dip while shipments also slowed but are still very solid at 10.5. Another sign of slowing is a nearly 8 point dip in general expectations to 34.9 which is relatively moderate for this reading, one that always runs well above current assessments. Inventory building is slowing this month with price readings stable and favorable as both

Topics:

WARREN MOSLER considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

Settling down a bit:

Highlights

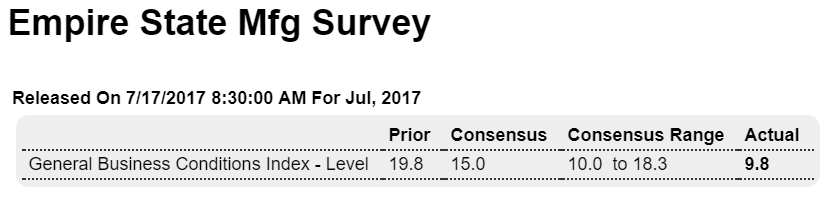

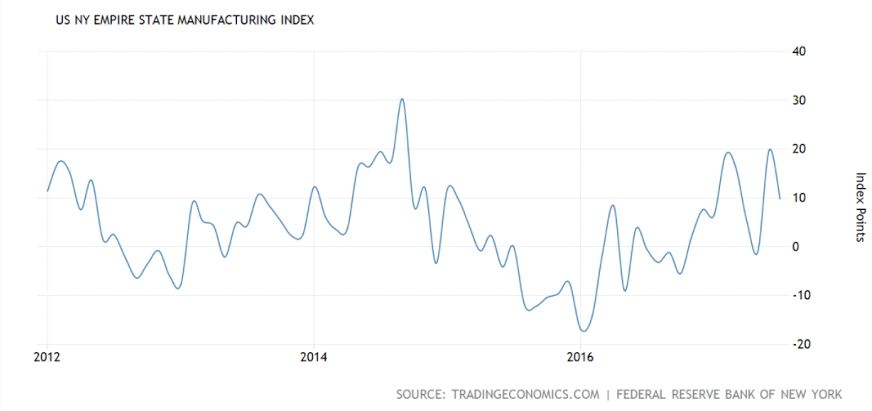

A little less strength is probably welcome in the New York Fed’s manufacturing sample where gains at times have been unsustainable. The Empire State index came in at 9.8 in July vs Econoday’s consensus for 15.0 and against June’s very hot 19.8.

New orders are strong at 13.3 but down nearly 5 points from June while unfilled orders moved back into contraction to minus 4.7. Employment slowed to 3.7 for a 4 point dip while shipments also slowed but are still very solid at 10.5.

Another sign of slowing is a nearly 8 point dip in general expectations to 34.9 which is relatively moderate for this reading, one that always runs well above current assessments. Inventory building is slowing this month with price readings stable and favorable as both inputs and selling prices are showing positive pressure.

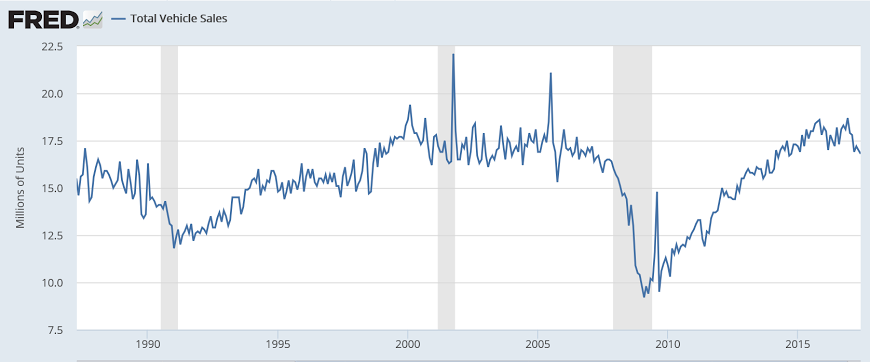

Total vehicle sales typically roll over in front of recessions, also in line with the credit aggregates: