Another hurricane influenced number. Without the receipts from foreign insurance companies looks like it would have been about the same as last month: Highlights Hurricane receipts from foreign insurance companies for losses resulting from hurricanes Harvey, Irma, and Maria shaved .9 billion from the nation’s current account deficit to a much lower-than-expected 0.6 billion in the third quarter. But the quarter also benefited from a .2 billion narrowing in the goods deficit to 5.3 billion which saw gains for capital goods exports and aircraft. Other details include a narrowing in the secondary income deficit on higher income from government fines and penalties and a widening in the primary income surplus on increases in portfolio investment income and in direct

Topics:

WARREN MOSLER considers the following as important: Economic Releases

This could be interesting, too:

WARREN MOSLER writes Consumer sentiment, real retail sales, industrial production, wages

WARREN MOSLER writes New manufacturers orders, vehicle sales, unemployment claims, rents, oil prices

WARREN MOSLER writes Saudi price hike, private payrolls, new hires, corporate profits

WARREN MOSLER writes Pending home sales, Durable goods orders, oil rigs and production

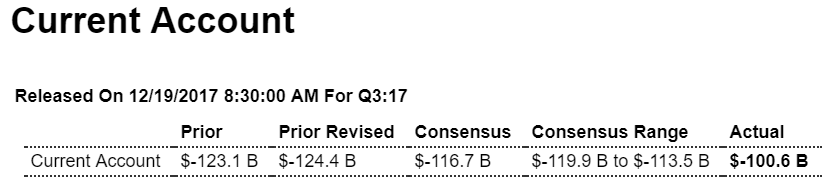

Another hurricane influenced number. Without the receipts from foreign insurance companies looks like it would have been about the same as last month:

Highlights

Hurricane receipts from foreign insurance companies for losses resulting from hurricanes Harvey, Irma, and Maria shaved $24.9 billion from the nation’s current account deficit to a much lower-than-expected $100.6 billion in the third quarter.

But the quarter also benefited from a $6.2 billion narrowing in the goods deficit to $195.3 billion which saw gains for capital goods exports and aircraft. Other details include a narrowing in the secondary income deficit on higher income from government fines and penalties and a widening in the primary income surplus on increases in portfolio investment income and in direct investment income.

As a percentage of GDP, the quarter’s current account deficit came in at 2.1 percent, well down from 2.6 percent in the prior quarter and the lowest rate since second-quarter 2014. This report of course is skewed by the hurricane effect but other details, especially the narrowing in the goods gap, are nevertheless positive.

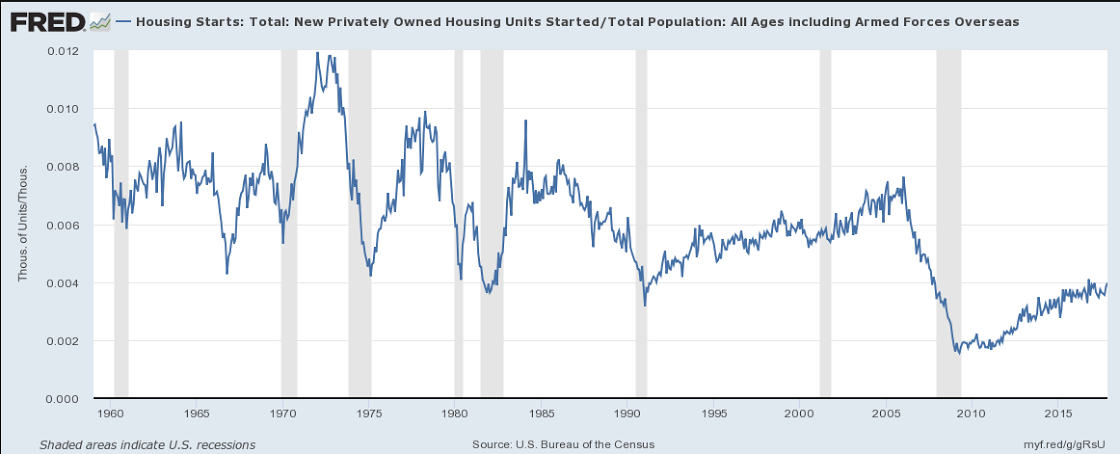

Also reads like a bounce back from the hurricane damage:

Highlights

A pivot higher is underway in the new home market. The latest evidence comes from housing starts and permits which matched their unusual October strength with stronger-than-expected results for November. Starts rose 3.3 percent to a 1.297 million annualized rate and though permits fell 1.4 percent to 1.298 million, they show a 1.4 percent gain for the key single-family category to a 862,000 rate. And starts for single-family homes, up 5.3 percent to 930,000, are the highest of the expansion, since 2007.

Total completions fell 6.1 percent to a 1.116 million rate which is bad news for supply where thin conditions have held back sales. But homes under construction rose, up 1.0 percent to 1.110 million. Regional data show start strength in the West and South where permits were also strong in possible evidence of a hurricane reversal.

New home sales shot higher in September and data from the sector haven’t slowed down since in what looks to be a major positive for the fourth-quarter economy.

This chart is not population adjusted:

On this capita basis housing starts are for all practical purposes are still at or below all time lows of prior recessions: