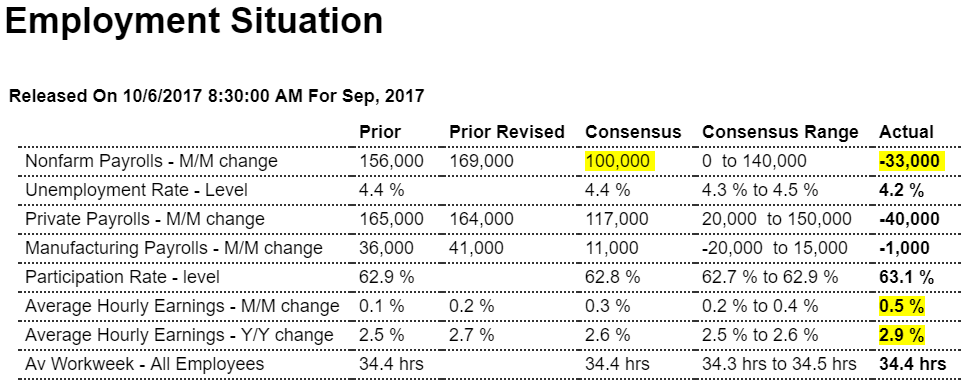

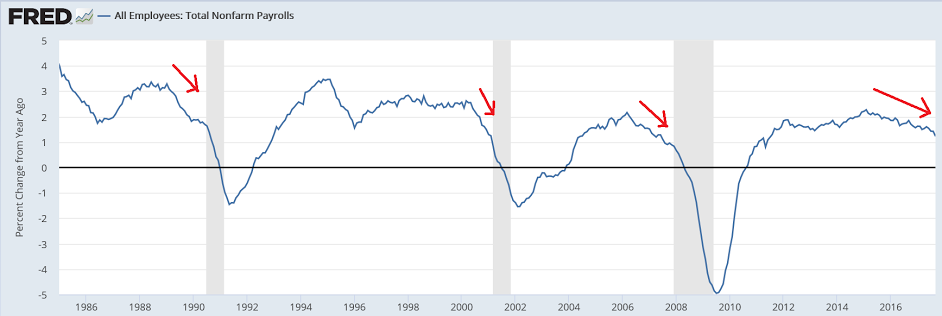

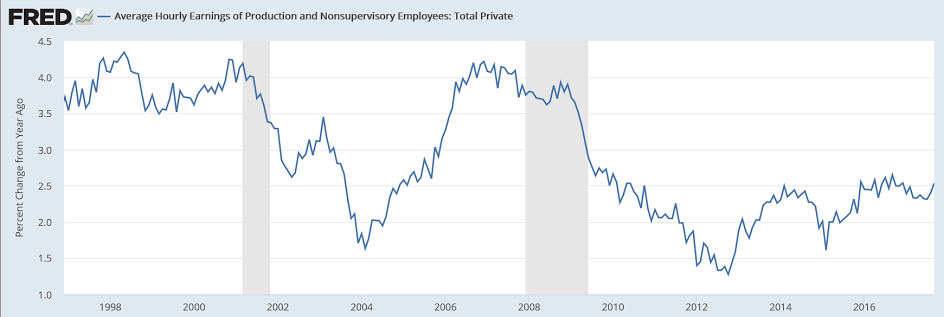

Year over year growth has been decelerating for all practical purposes in a straight line, as per the chart. And the downward revisions in prior months are further evidence of the weakness which began with the collapse in oil capex at the end of 2014. And wage growth increased at least partially because the jobs lost were largely those of lower income workers. Also, at this point with low levels of deficit spending, both public and private, the economy is more likely to be path dependent. In other words, a drop in employment and sales for any reason is also a drop in income which probably means less subsequent spending, less income, etc. etc. but it take another month or so of data to see if that’s what’s happening: Highlights The Department of Labor can’t quantify

Topics:

WARREN MOSLER considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

Year over year growth has been decelerating for all practical purposes in a straight line, as per the chart. And the downward revisions in prior months are further evidence of the weakness which began with the collapse in oil capex at the end of 2014. And wage growth increased at least partially because the jobs lost were largely those of lower income workers.

Also, at this point with low levels of deficit spending, both public and private, the economy is more likely to be path dependent. In other words, a drop in employment and sales for any reason is also a drop in income which probably means less subsequent spending, less income, etc. etc. but it take another month or so of data to see if that’s what’s happening:

Highlights

The Department of Labor can’t quantify September’s hurricane effects on payrolls or the unemployment rate but they appear to be very dramatic nonetheless. Nonfarm payrolls were negative in September and, at minus 33,000, were well below Econoday’s low estimate. But the big surprise in today’s report are sudden indications of excessive labor market tightness as the unemployment rate fell 2 tenths to 4.2 percent and average hourly earnings spiked 0.5 percent with the year-on-year rate jumping 4 tenths to 2.9 percent. This report on the surface — and needing confirmation from the October employment report to follow next month — appears to change the dynamics for the labor market and suggests that the Federal Reserve, the decline in September payrolls aside, has fallen behind the inflation curve.

The 0.5 percent spike in earnings now matches July, which has been revised 2 tenths higher, as the strongest monthly surge of the expansion. The 2.9 percent yearly rate matches December last year as the expansion high. Revisions here are important and very sharp with August’s monthly change revised 2 tenths higher to a 0.3 percent increase with the yearly rate revised 2 tenths higher to 2.7 percent.

The 4.2 percent unemployment rate, derived from a separate set of data that also include the self-employed who are not on payrolls, is not only lowest of the expansion but of the prior expansion as well, going all the way back to January 2001. Here employment, likely reflecting a jump in those now actively looking for work, rose 906,000 at the same time that the number of unemployed fell 331,000. The pool of available workers which includes those who can work but aren’t pounding the pavement fell a very sizable 547,000 to 12.429 million. This reading is a sleeper in this report and points squarely at the risk of a wage flash point. The labor participation rate, reflecting the move toward employment, rose 0.2 percent to 63.1 percent to exceed Econoday’s high estimate by 2 tenths.

Turning now to payrolls, they were pulled lower by a 104,700 drop at restaurants. Again, the Labor Department says it can’t pin this on hurricanes but it does seem likely. Both August and July nonfarm payrolls were revised lower by a net 38,000. Manufacturing payrolls fell 1,000 in September following an upward revised 41,000 surge in August but also following a sharply downward revised 11,000 decline in July. But averaged together and including a 21,000 rise in June, manufacturing is definitely improving and is a further risk to wage inflation.

Other data include, in what perhaps is a surprise given the hurricane disruptions in the South, no change in the workweek, at 34.4 hours in a measure that tracks all private sector employees. Government payrolls are a positive in the report, up 7,000 and making for a 40,000 decline in private payrolls in what, in an aside, is yet another miss for ADP which called here for respectable growth.

The hurricanes are one factor that may or may not have skewed payrolls sharply lower, and probably did, but it’s the wage pressures that will make everyone on the FOMC, even the most dovish, suddenly concerned that wage-push inflation has arisen from the dead. The Department of Labor hasn’t offered adequate explanations of these results which puts the focus on individual Fedspeak with the chances of a rate hike at the month-end meeting, let alone the December meeting, now likely in play.

Even with this recent ‘spike’ it’s still very low by historically:

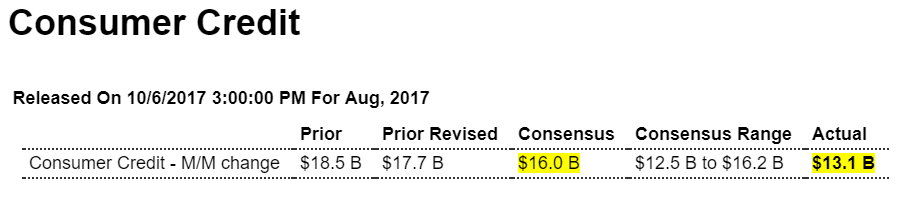

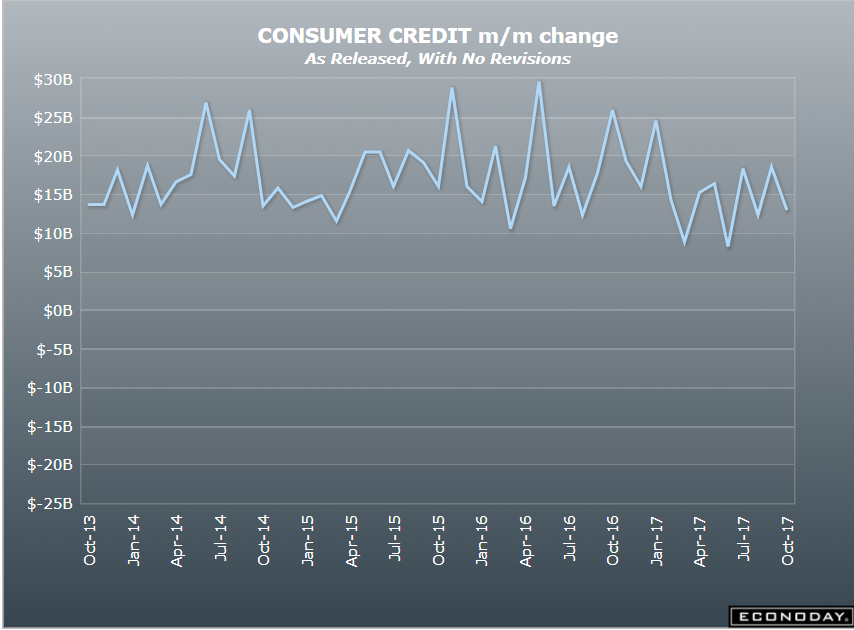

The deceleration continues, in line with recent data showing a deceleration in consumer spending. The jump in credit card borrowing could be due to falling incomes, aka ‘dipping into savings’, and also an unsustainable process:

Highlights

Consumer credit rose a lower-than-expected $13.1 billion in August which masks, however, a sharp gain for revolving credit. This component, which is where credit-card debt is tracked, rose a sizable $5.8 billion in a gain that will renew talk of slackening credit standards among lenders. The gain for the nonrevolving component, where auto financing and also student loans are tracked, is an undersized $7.3 billion and explains the weakness in the headline. But this report is not about weakness but about strength, at least strength for consumer spending.

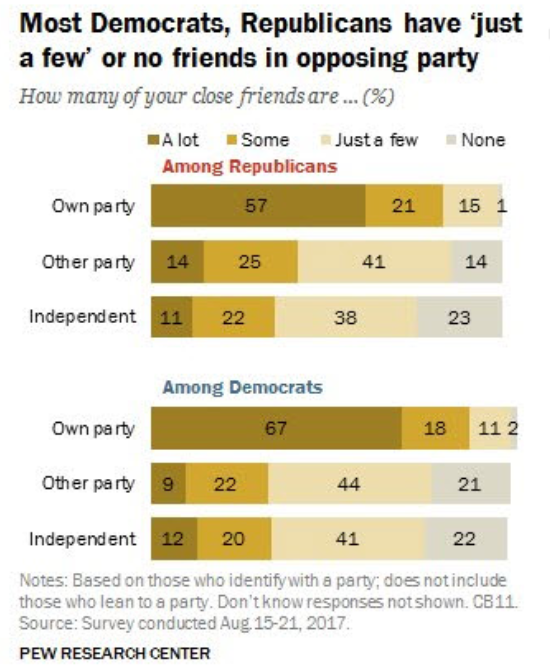

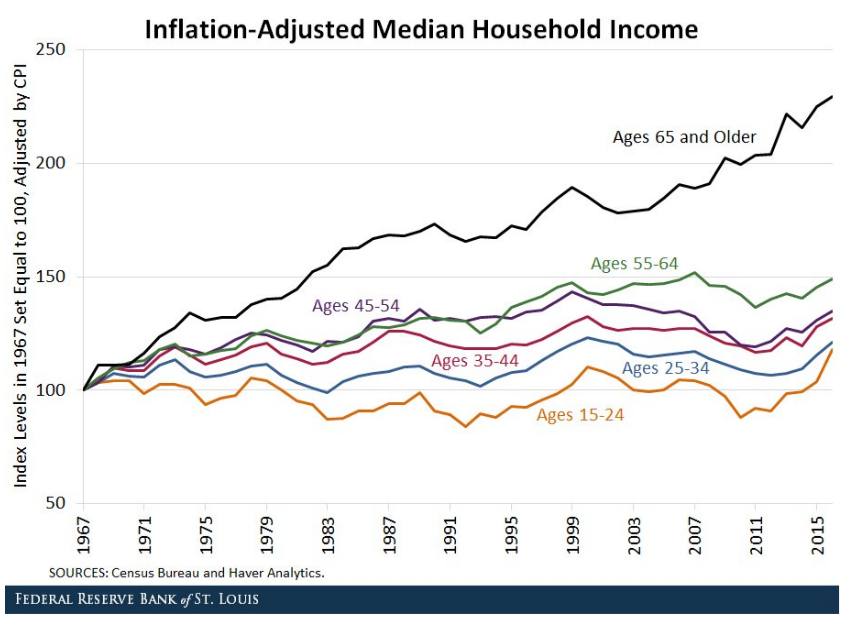

This is social security at work vs a low demand economy where support for labor has been removed. Game theory tells you ‘the labor market’ isn’t a ‘fair game’ as people need to work to eat, while business only hires if it likes the returns on investment:

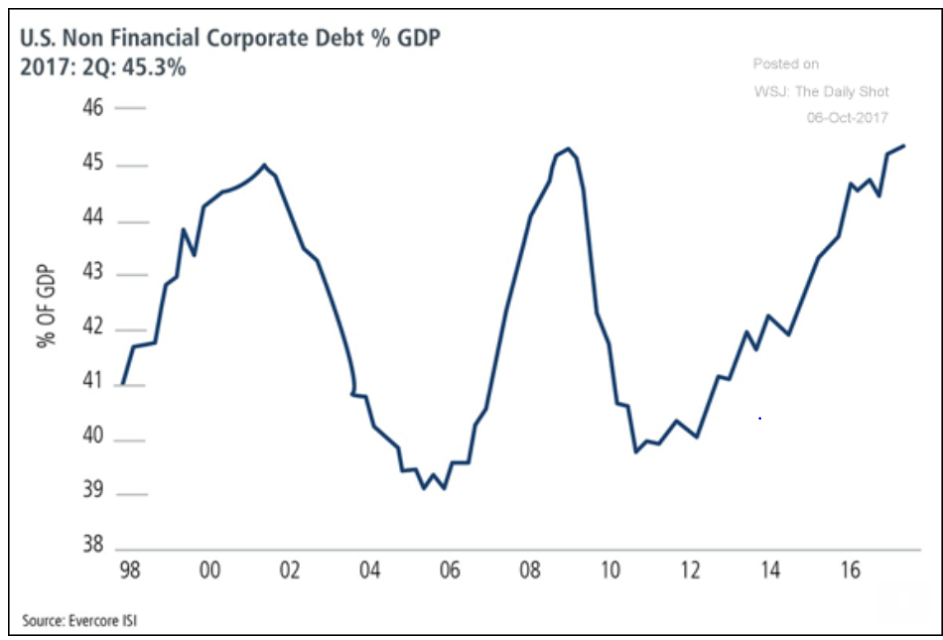

Another way to look at corporate debt. Note that it grew slower this cycle, which is in line with slower gdp growth. Second, this is about as high as it’s gotten in past cycles and when it’s no longer contributing to growth GDP tends to slow. Third, looks like it flattened with the collapse of oil capex, then had a move up, and has most recently turned sideways: