You can see from the longer term charts not much to write home about here: Highlights Increasing strength in capital goods is the good news in today’s factory orders report where a headline 1.2 percent gain is 2 tenths above Econoday’s consensus. The split between the report’s two main components shows a 2.0 percent gain for durable goods, which is a 3 tenths upgrade from last week’s advance report, and a 0.4 percent gain for non-durable goods which is the fresh data in today’s report and reflects gains for petroleum and coal. Hurricane Harvey’s late month impact was not able to be quantified by the Commerce Department though its effects appear to be marginal. Sticking to durables, today’s report upgrades core capital goods orders (nondefense ex-aircraft) to monthly gains

Topics:

WARREN MOSLER considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

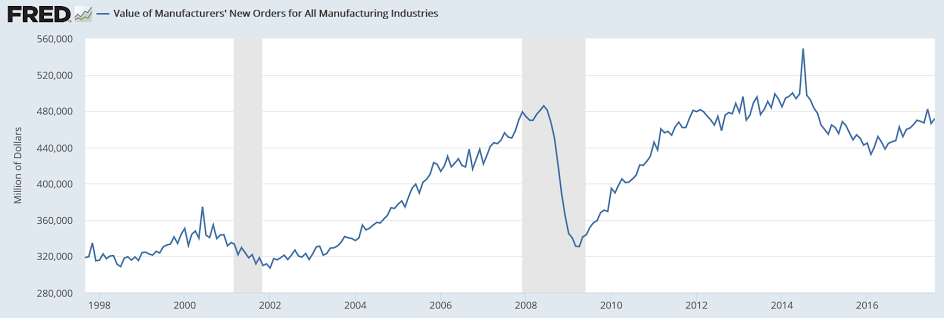

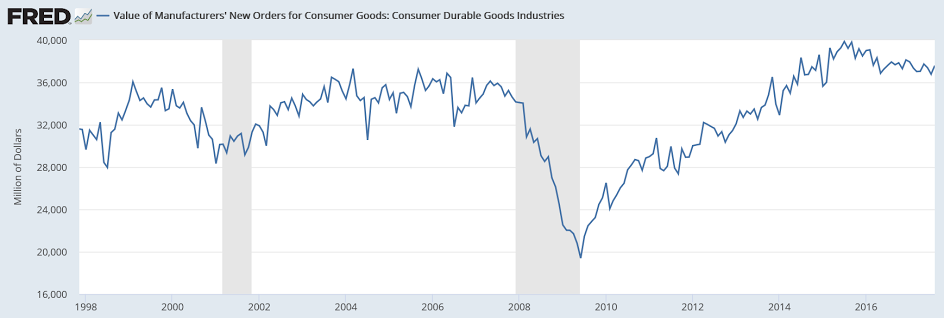

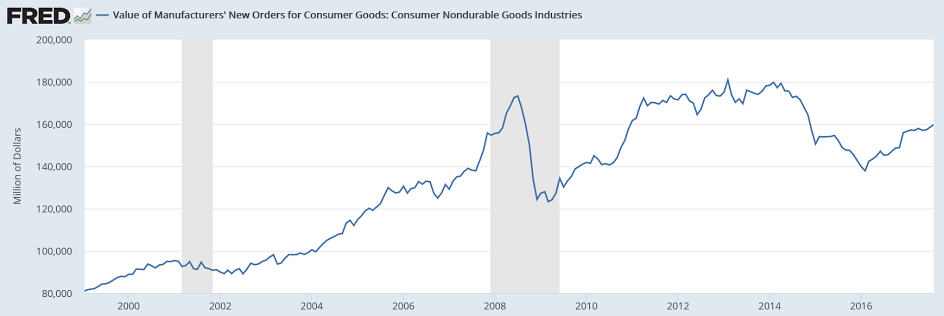

You can see from the longer term charts not much to write home about here:

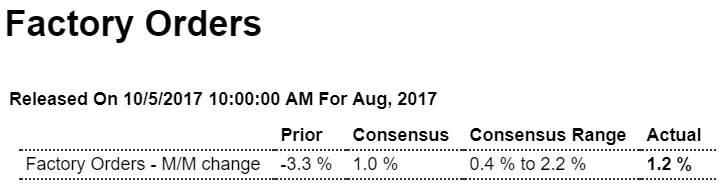

Highlights

Increasing strength in capital goods is the good news in today’s factory orders report where a headline 1.2 percent gain is 2 tenths above Econoday’s consensus. The split between the report’s two main components shows a 2.0 percent gain for durable goods, which is a 3 tenths upgrade from last week’s advance report, and a 0.4 percent gain for non-durable goods which is the fresh data in today’s report and reflects gains for petroleum and coal. Hurricane Harvey’s late month impact was not able to be quantified by the Commerce Department though its effects appear to be marginal.

Sticking to durables, today’s report upgrades core capital goods orders (nondefense ex-aircraft) to monthly gains of 1.1 percent in August and 1.3 percent in July versus prior readings of 0.9 and 1.1 percent. Shipments for core capital goods, which are inputs into GDP business investment, are revised a very sharp 4 tenths higher in August to 1.1 percent offset only in part by a 1 tenth downward revision to July to what is a still very sharp gain of 1.0 percent.

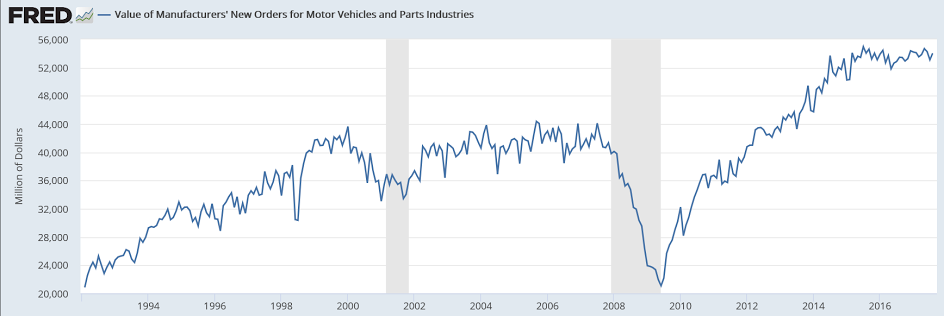

Commercial aircraft is always volatile in this report with orders up 72 percent following a drop of 83 percent in August-to-July swings that are behind the monthly swings in the headline. Vehicles are another positive in today’s report, up 0.7 percent for orders following a 2.2 percent drop in July. Excluding transportation equipment, which is considered a smoother barometer for underlying change, orders are up 0.4 and 0.5 percent the last two months.

Unfilled factory orders were unchanged in the month following the July’s 0.3 percent decline. Weakness here is not a positive indication for factory labor demand. But shipments, up 0.5 percent, are very favorable as are inventories which are keeping pace with a 0.4 percent rise that keeps the inventory-to-shipments ratio unchanged at 1.38.

The strength in ex-transportation and especially capital goods are outstanding positives and help offset what has been a very disappointing run in the manufacturing component of industrial production, a separate report released by the Federal Reserve, where August fell 0.3 percent and July was unchanged. Today’s factory orders report closes the book on what was, despite Hurricane Harvey, a mostly strong August for manufacturing.

This is not adjusted for inflation:

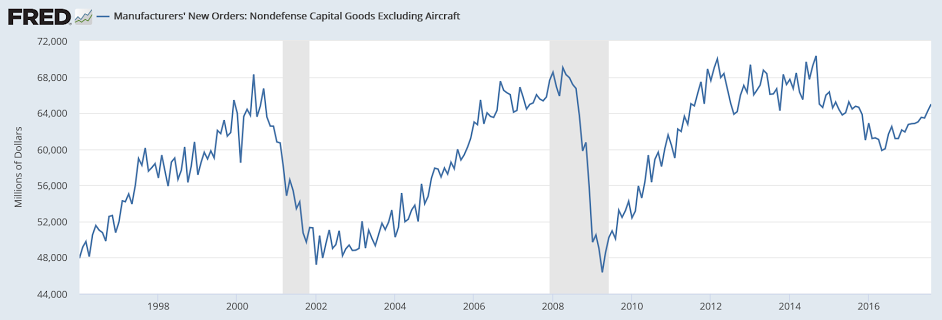

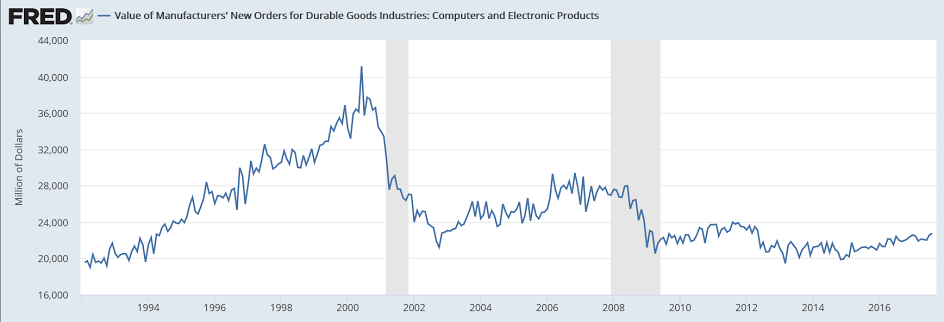

Note the .com/y2k boom:

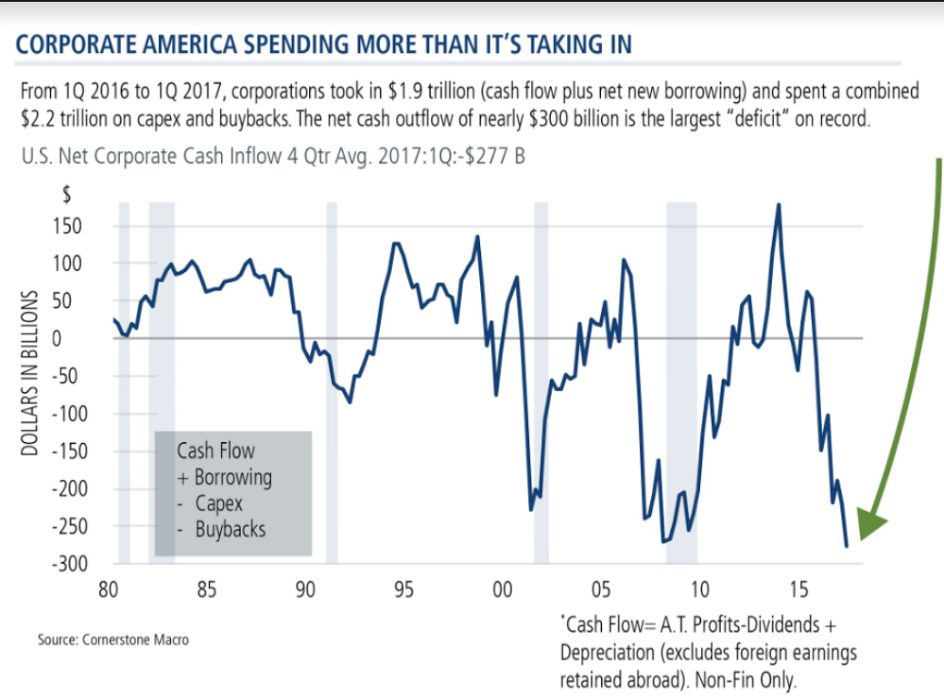

Looks like we’ve been getting a bit of help from corporate ‘deficit spending’ which works to support gdp growth,-to the extent it’s ultimately spent on goods or services- while it lasts. And while this may have further to go, it is not, as Wynne Godley used to say, a sustainable process:

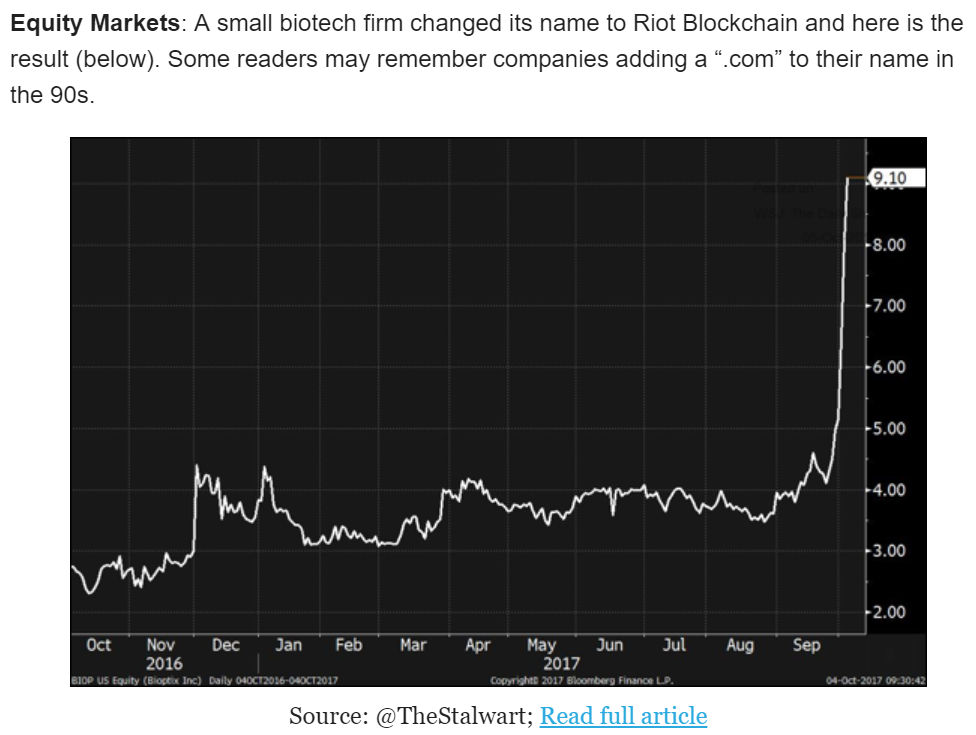

Call a tulip a blockchain…