Energy capex collapsed first, followed by non energy capex about a year later. Question now is whether the Q1 non energy capex recovery continues into Q2. I suspect not. In any case the contribution to growth from energy capex is no longer negative but not all that much as a % of GDP: Tells me we still are experience an obvious lack of aggregate demand. We haven’t even gotten back prior highs and growth of these components has slowed dramatically from where it was before the crisis: In case you thought any of these people had a clue. It’s all just more of the blind leading the blind: Federal Reserve warned over maintaining big balance sheet The Federal Reserve risks political interference and losing its independence if itmaintains a large balance sheet in the longer

Topics:

WARREN MOSLER considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

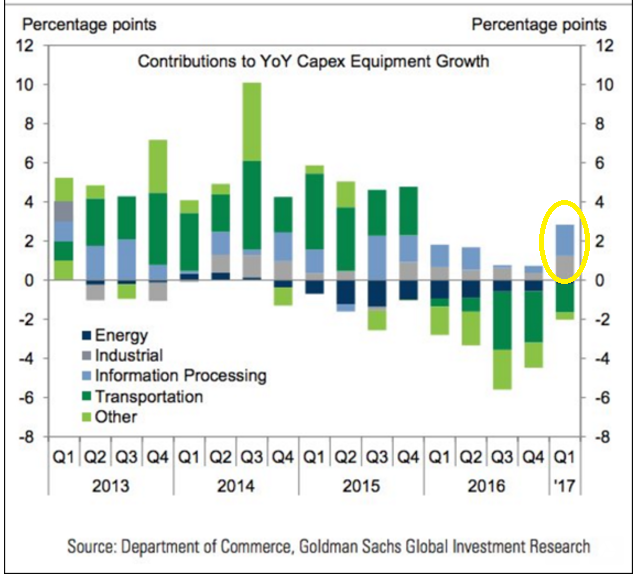

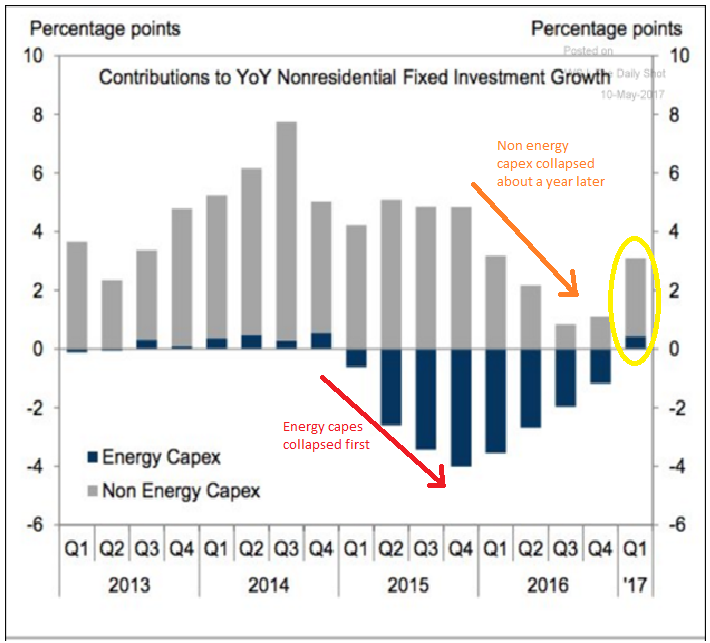

Energy capex collapsed first, followed by non energy capex about a year later. Question now is whether the Q1 non energy capex recovery continues into Q2. I suspect not. In any case the contribution to growth from energy capex is no longer negative but not all that much as a % of GDP:

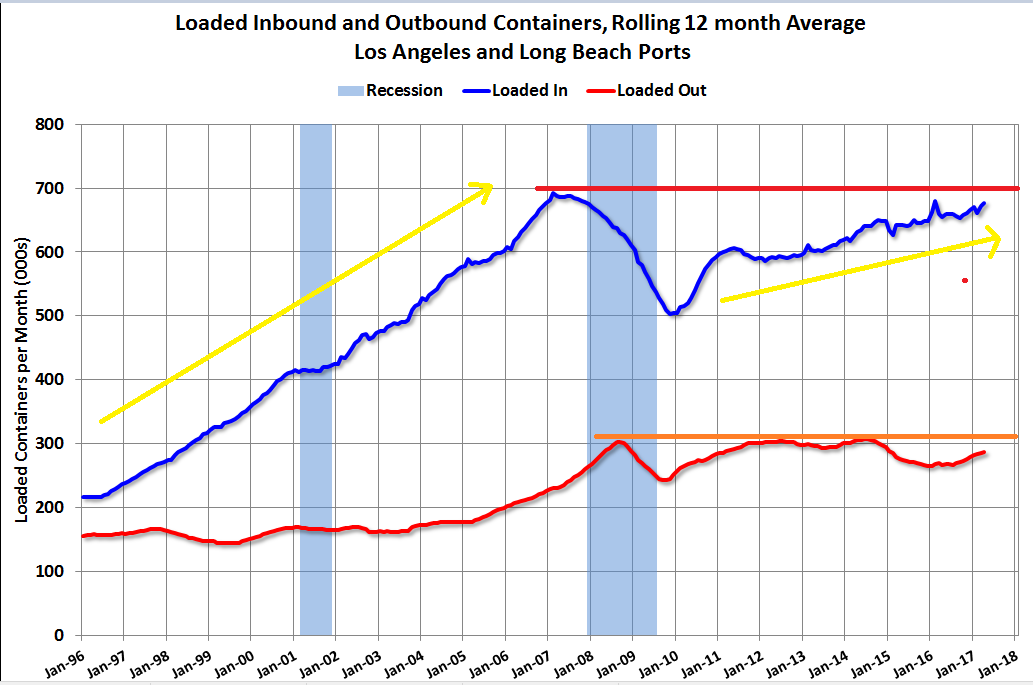

Tells me we still are experience an obvious lack of aggregate demand. We haven’t even gotten back prior highs and growth of these components has slowed dramatically from where it was before the crisis:

In case you thought any of these people had a clue. It’s all just more of the blind leading the blind:

Federal Reserve warned over maintaining big balance sheet

The Federal Reserve risks political interference and losing its independence if it

maintains a large balance sheet in the longer term, former Fed officials have claimed, as

debate (https://www.ft.com/content/99734cd6-2cf1-11e7-9555-23ef563ecf9a )

intensifies over the central bank’s strategy for unwinding its interventions in financial

markets.Kevin Warsh, a visiting fellow at the Hoover Institution at Stanford University and

former Fed governor, said that permanently holding vast quantities of assets like

treasuries was “fiscal policy in disguise” and risked turning the central bank into a

general purpose agency of the government“A large balance sheet is a dangerous temptation for the rest of the political class,” he

said in an interview at a conference at Stanford on Friday.Charles Plosser, former president of the Philadelphia Fed, said that politicians might, as

an example, push the Fed to purchase infrastructure bonds to help fund public works

and argue they were not interfering with monetary policy. “They will see that balance

sheet as a great opportunity to fund their spending without raising taxes,” Mr Plosser

said.