A bit weaker than expected, prior month revisions about a wash. Highlights Retail sales did recover in April but not as much as expected, up 0.4 percent overall and up 0.3 percent excluding autos which both miss Econoday’s consensus estimates by 2 tenths. Core readings are likewise soft, up 0.3 percent ex-auto ex-gas which misses the consensus by 1 tenth and up only 0.2 percent for the control group where a 0.4 percent gain was the call. Vehicle sales rose 0.7 percent in April following three straight sizable declines. Nonstore retailers continue to outperform with electronics & appliances showing a second strong gain. But showing a third month of weakness and hinting at lack of demand for basic goods is the general merchandise category where the department store

Topics:

WARREN MOSLER considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

A bit weaker than expected, prior month revisions about a wash.

Highlights

Retail sales did recover in April but not as much as expected, up 0.4 percent overall and up 0.3 percent excluding autos which both miss Econoday’s consensus estimates by 2 tenths. Core readings are likewise soft, up 0.3 percent ex-auto ex-gas which misses the consensus by 1 tenth and up only 0.2 percent for the control group where a 0.4 percent gain was the call.

Vehicle sales rose 0.7 percent in April following three straight sizable declines. Nonstore retailers continue to outperform with electronics & appliances showing a second strong gain. But showing a third month of weakness and hinting at lack of demand for basic goods is the general merchandise category where the department store subcomponent, in an echo of company news out of the sector, shows only marginal strength.

Revisions are helpful but again but by much. The overall rate for March is revised 3 tenths higher to plus 0.1 percent but February, at minus 0.2 percent, is unrevised. The upward revision for March will be a modest plus for first-quarter GDP where the first estimate on consumer spending came in barely positive and at an expansion low.

Consumer confidence may be through the roof but retail sales, and consumer spending in general, have been stuck on the ground. Despite a very easy comparison against a very weak first quarter, second quarter consumer spending is off to no better than a moderate start.

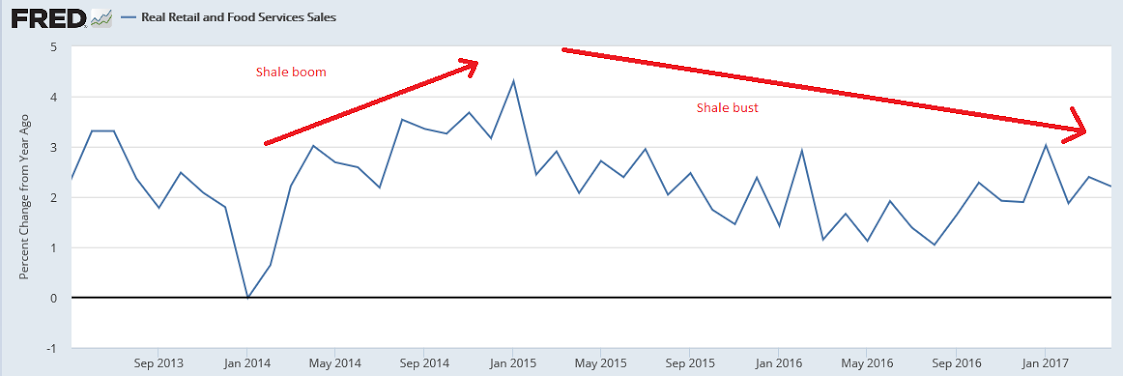

This is not population adjusted:

Business inventories remain elevated:

Business Inventories rise 0.2% in March, above economist’s expectations of a 0.1% gain. Inventories in February were revised lower to a 0.2% rise from the prior estimate of a 0.3% gain. Business sales were flat in March. The inventory-to-sales ratio, an indication of demand, remained steady at 1.35 in March. Inventories were a drag on first quarter growth, subtracting almost 1%.

Business sales have flattened, and this chart is not adjusted for inflation:

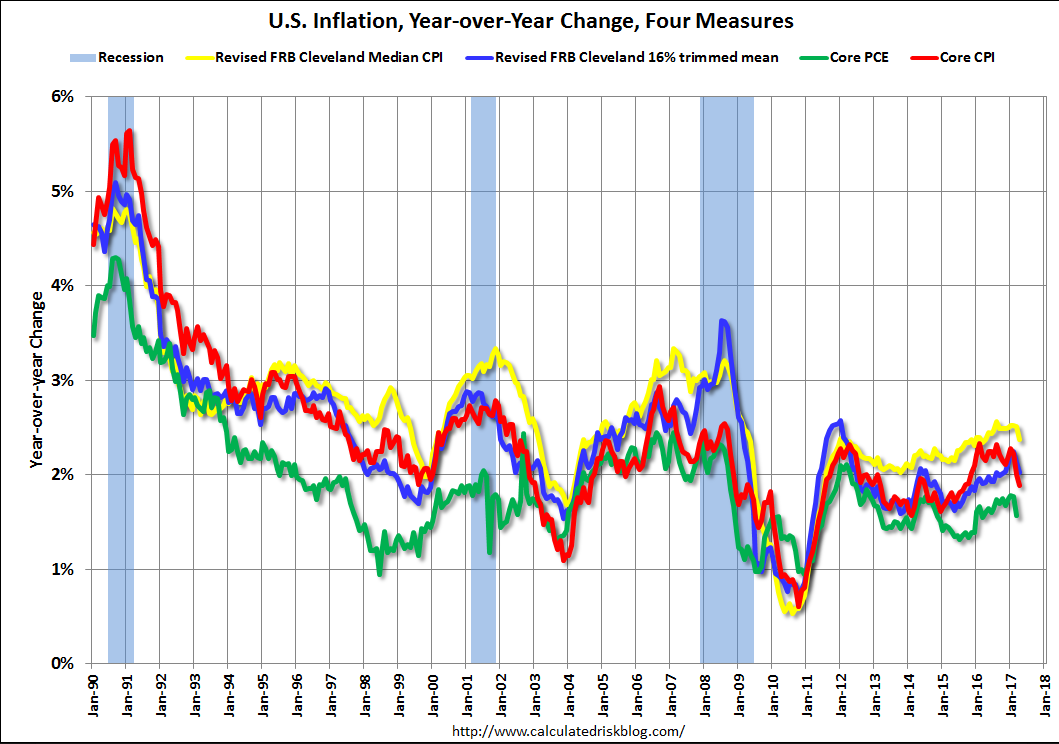

Today’s cpi report took all the indicators down a bit: