Home prices may be softening, but too soon to tell: Highlights The FHFA house price index came in at a very soft 0.1 percent increase in June, well short of Econoday’s consensus for 0.5 percent and low estimate of 0.3 percent. This is both good news and bad news, as slowing price appreciation should help affordability for home sales but will also limit growth in household wealth. Despite June’s weakness, year-on-year prices remain very strong, at plus 6.5 percent which is nearly a percentage point above Case-Shiller’s data. Watch on next week’s calendar for June data from Case-Shiller. This has definitely come back from the lows, though there are likely fewer stores reporting, and this series is not adjusted for inflation: U.S. workers have low hopes for higher pay Aug

Topics:

WARREN MOSLER considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

Home prices may be softening, but too soon to tell:

Highlights

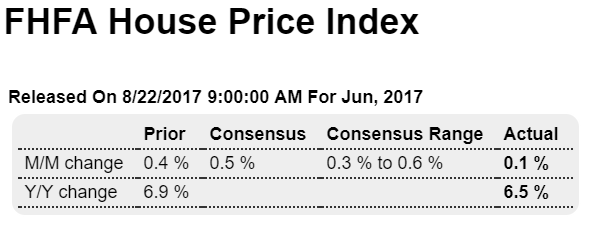

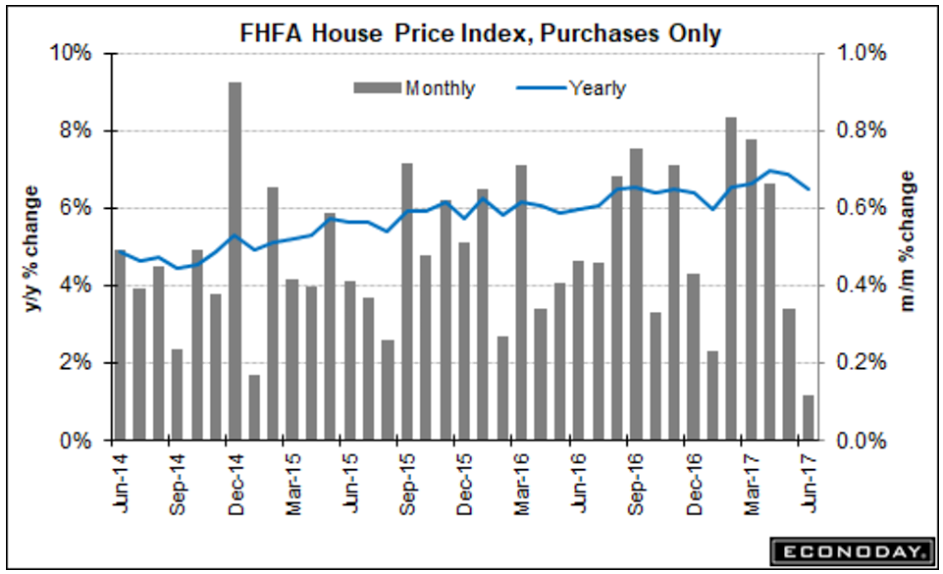

The FHFA house price index came in at a very soft 0.1 percent increase in June, well short of Econoday’s consensus for 0.5 percent and low estimate of 0.3 percent. This is both good news and bad news, as slowing price appreciation should help affordability for home sales but will also limit growth in household wealth. Despite June’s weakness, year-on-year prices remain very strong, at plus 6.5 percent which is nearly a percentage point above Case-Shiller’s data. Watch on next week’s calendar for June data from Case-Shiller.

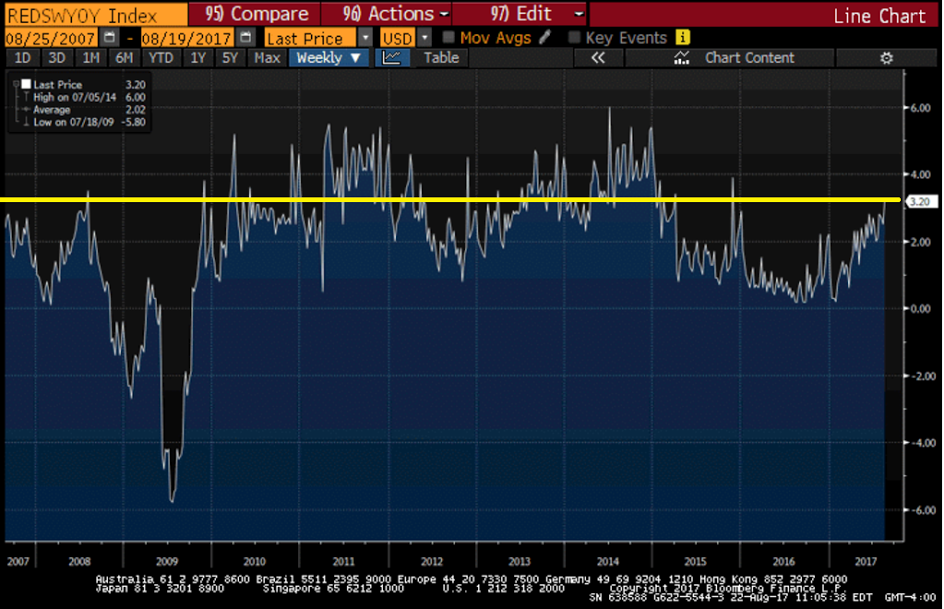

This has definitely come back from the lows, though there are likely fewer stores reporting, and this series is not adjusted for inflation:

U.S. workers have low hopes for higher pay

Aug 21 (Reuters) — A New York Fed survey found that on average respondents said in July that the lowest annual salary they would accept in a new job would be $57,960, down from $59,660 only four months earlier. Asked what salary they expected in job offers over the next four months, the average response declined to $50,790 from $54,590 when the last survey was taken in March. The survey also showed 22.7 percent of respondents searched for a job in the last four wees, up from 19.4 percent in the previous report. The respondents saw a 22 percent likelihood of receiving at least one job offer in the next four months, down from an average response of 25 percent eight months ago.