Seems to me the highlighted proposals will reduce spending more than the cut in tax rates will increase spending: Trump’s team and lawmakers making strides on tax reform plan Aug 22 (Politico) — President Trump’s top aides and congressional leaders have made significant strides in shaping a tax overhaul. There is broad consensus on some of the best ways to pay for cutting both the individual and corporate tax rates. The options include capping the mortgage interest deduction for homeowners; scrapping people’s ability to deduct state and local taxes; and eliminating businesses’ ability to deduct interest, while also phasing in so-called full expensing for small businesses that allows them to immediately deduct investments like new equipment or facilities. One idea would be

Topics:

WARREN MOSLER considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

Seems to me the highlighted proposals will reduce spending more than the cut in tax rates will increase spending:

Trump’s team and lawmakers making strides on tax reform plan

Aug 22 (Politico) — President Trump’s top aides and congressional leaders have made significant strides in shaping a tax overhaul. There is broad consensus on some of the best ways to pay for cutting both the individual and corporate tax rates. The options include capping the mortgage interest deduction for homeowners; scrapping people’s ability to deduct state and local taxes; and eliminating businesses’ ability to deduct interest, while also phasing in so-called full expensing for small businesses that allows them to immediately deduct investments like new equipment or facilities. One idea would be taxing the money that workers place into their 401(k) savings plans up front.

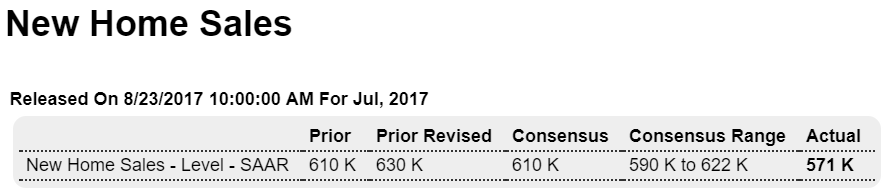

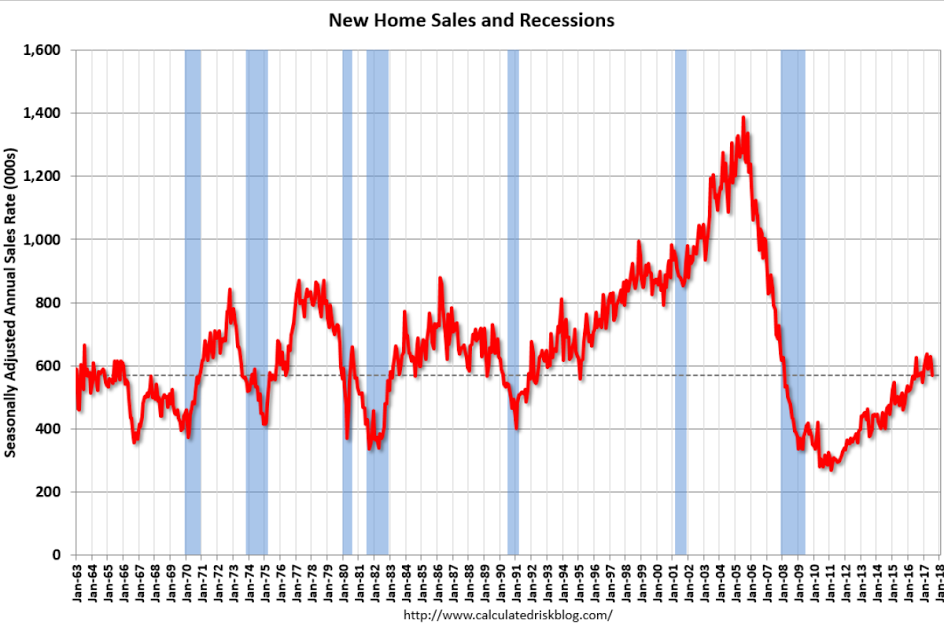

Weak, inline with permits and decelerating mortgage credit growth:

Highlights

Overstating weakness, July’s headline for new home sales fell to a far lower-than-expected annualized rate of 571,000. This is offset, however, by upward revisions totaling 33,000 in the two prior months which now stand at 630,000 and 618,000. This series, where sample sizes are low, is often volatile month-to-month with the 3-month average, still over 600,000 and just off expansion highs, telling the more reliable story.

The best news in July’s report is an increase in supply, up 4,000 to 276,000 new homes on the market. Relative to sales, supply moves from 5.2 months to 5.8 months which is nearly at the 6 month mark which is widely considered to be balanced for new homes.

Prices are showing increasing traction, up 0.7 percent in the month to a median $313,700. This is up 6.3 percent year-on-year which is roughly in line with prices of existing homes.

The strength in pricing is good news for residential investment but not for first-time buyers who are being priced out of the new home market. The downdraft in July’s data aside, new homes are probably still a positive for the housing sector which has been trending higher in fits and starts all year. Watch tomorrow for existing home sales where strength is the expectation.

Today’s survey information:

Highlights

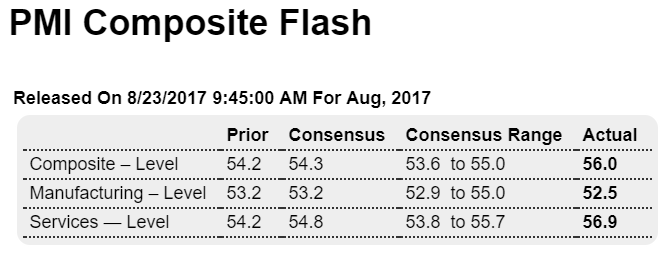

Weakness in manufacturing, at 52.5, is being offset this month by strength in services, at a very strong score of 56.9. The two make for a PMI composite of 56.0. New orders for the services sample are at a 2-year high with hiring also very strong. Input costs for service providers are up as are, in especially positive news, selling prices which are at a nearly 3-year high.

Selling prices for manufacturers are also higher this month with input costs also up. Order growth, however, is slowing as is production. Inventory build is also slowing.

These results are mixed with the slowdown in manufacturing a concern especially following last week’s surprise dip in manufacturing production.

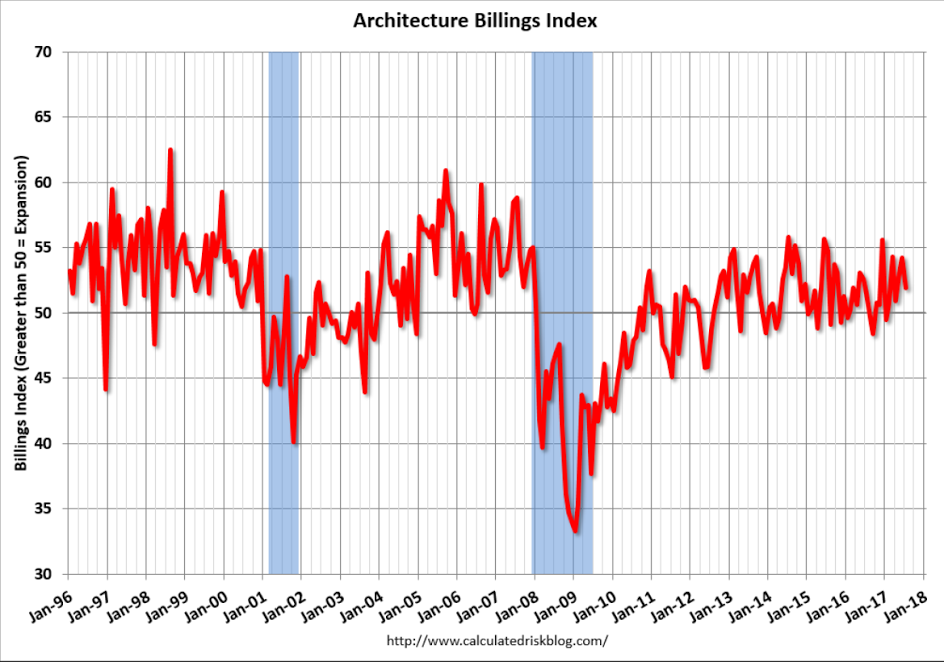

Down a bit, low and going nowhere: