No houses built without a permit: Highlights Strength in single-family permits leads a mostly favorable housing starts report for February where however the headlines are mixed, at a 1.288 million annualized rate for starts and a 1.213 million rate for total permits. The results compare with Econoday expectations of 1.270 million for both. Permits for single-family homes, where building costs and sale prices are the highest, rose 3.1 percent in February to an 832,000 rate that, in good news for a thinly supplied new home market, is up 13.5 percent year-on-year. This is offset, however, by a downturn in multi-family units where permits fell 22 percent in the month to a 381,000 rate that is down a yearly 11.2 percent. Starts for single-family homes, like permits, are also favorable, up 6.5 percent to an 872,000 rate and a 3.2 percent on-year gain. Multi-family starts fell 3.7 percent in the month to 416,000 but are still up 13.0 percent on the year. Regional data for total permits show special strength in the Midwest, a region where starts have been on a sharp decline. Starts in the Northeast are especially strong with the South also showing strength. Yet supply relief for single-family homes is still in the offing as completions, in a detail that home builders will note, fell 6.5 percent to a 754,000 rate.

Topics:

WARREN MOSLER considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

No houses built without a permit:

Highlights

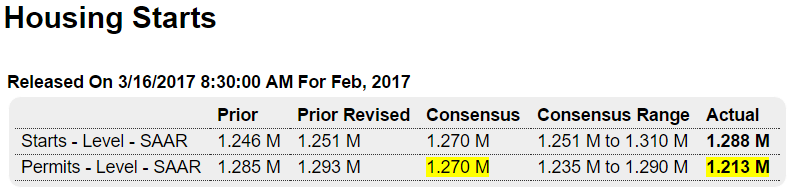

Strength in single-family permits leads a mostly favorable housing starts report for February where however the headlines are mixed, at a 1.288 million annualized rate for starts and a 1.213 million rate for total permits. The results compare with Econoday expectations of 1.270 million for both.

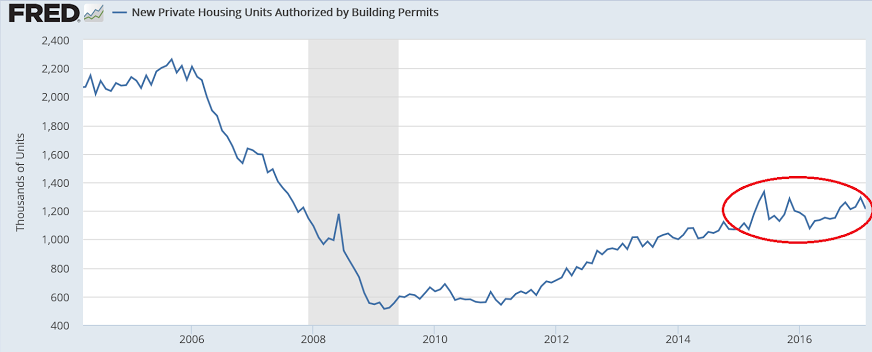

Permits for single-family homes, where building costs and sale prices are the highest, rose 3.1 percent in February to an 832,000 rate that, in good news for a thinly supplied new home market, is up 13.5 percent year-on-year. This is offset, however, by a downturn in multi-family units where permits fell 22 percent in the month to a 381,000 rate that is down a yearly 11.2 percent.

Starts for single-family homes, like permits, are also favorable, up 6.5 percent to an 872,000 rate and a 3.2 percent on-year gain. Multi-family starts fell 3.7 percent in the month to 416,000 but are still up 13.0 percent on the year.

Regional data for total permits show special strength in the Midwest, a region where starts have been on a sharp decline. Starts in the Northeast are especially strong with the South also showing strength.

Yet supply relief for single-family homes is still in the offing as completions, in a detail that home builders will note, fell 6.5 percent to a 754,000 rate. Nevertheless, new supply is coming as homes under construction rose 1.3 percent to 1.091 million for the highest reading since the great bubble in October 2007.

Permits still seriously depressed vs last cycle and going nowhere for over a year now:

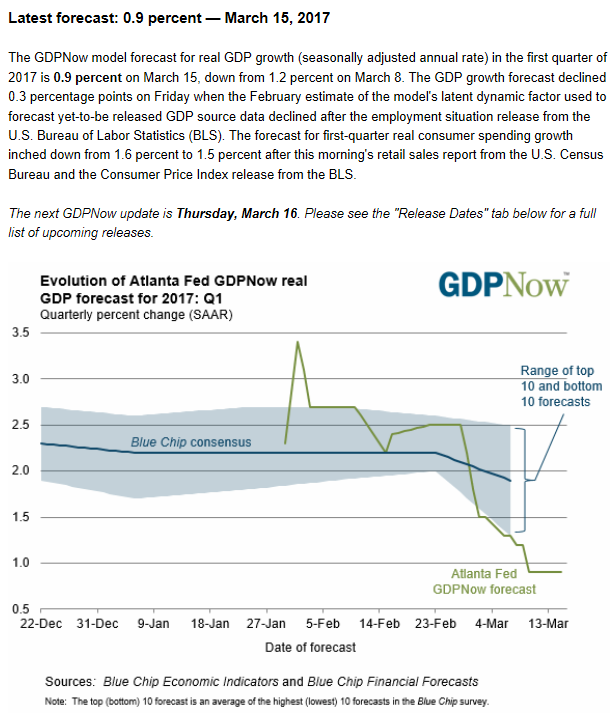

Down again, as is the ‘blue chip consensus’: