The seasonally adjusted Purchase Index increased 2 percent from one week earlier. The unadjusted Purchase Index increased 3 percent compared with the previous week and was 6 percent higher than the same week one year ago.Read more at http://www.calculatedriskblog.com/#rYAGsCBZRKvRLYa4.99 Depressed and moving sideways for over a year:Prior month revised up, but current month worse than expected, and I suspect the seasonal adjustments a nominally small increase in sales to translate into a much larger seasonally adjusted number, to be reversed later in the year: Highlights February and January have to be averaged but together they confirm strength in the consumer. Retail spending could manage only a 0.1 percent gain in February but January, which was already solid, is now revised 2 tenths higher to 0.6 percent. A surprising point in this report is that these headline gains, though less than astonishing, were made despite weakness in the motor vehicle component which had been strong late last year and makes up about 1/5 of total retail spending. Auto sales fell 0.2 percent in February and 1.3 percent in January. Excluding autos, February retail sales rose 0.2 percent with January showing a standout 1.2 percent surge which is the strongest monthly gain in 5 years, since February 2012. Gasoline pulled down February’s results, falling 0.6 percent after rising 2.

Topics:

WARREN MOSLER considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

The seasonally adjusted Purchase Index increased 2 percent from one week earlier. The unadjusted Purchase Index increased 3 percent compared with the previous week and was 6 percent higher than the same week one year ago.

Read more at http://www.calculatedriskblog.com/#rYAGsCBZRKvRLYa4.99

Depressed and moving sideways for over a year:

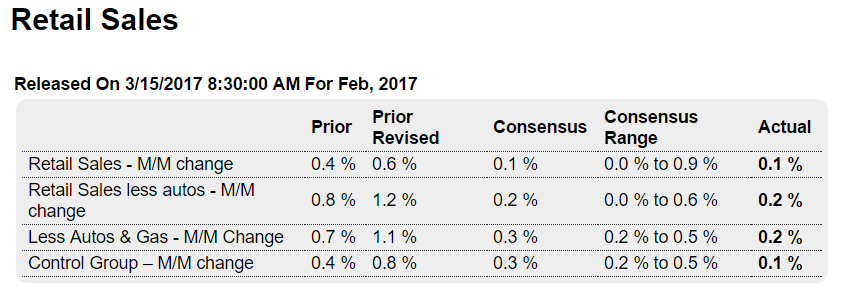

Prior month revised up, but current month worse than expected, and I suspect the seasonal adjustments a nominally small increase in sales to translate into a much larger seasonally adjusted number, to be reversed later in the year:

Highlights

February and January have to be averaged but together they confirm strength in the consumer. Retail spending could manage only a 0.1 percent gain in February but January, which was already solid, is now revised 2 tenths higher to 0.6 percent.

A surprising point in this report is that these headline gains, though less than astonishing, were made despite weakness in the motor vehicle component which had been strong late last year and makes up about 1/5 of total retail spending. Auto sales fell 0.2 percent in February and 1.3 percent in January. Excluding autos, February retail sales rose 0.2 percent with January showing a standout 1.2 percent surge which is the strongest monthly gain in 5 years, since February 2012.

Gasoline pulled down February’s results, falling 0.6 percent after rising 2.1 percent in January. When excluding both autos and gasoline, sales rose 0.2 percent vs January’s very strong 1.1 percent. And control group sales, which are another core measure, inched only 0.1 percent in the month but follow an outstanding 0.8 percent gain in January, one that initially posted at 0.4 percent.

It’s the January revision that is most striking and which points to an upward revision for total consumer spending in the national accounts, one that came in at only 0.2 percent in the initial January report. Yet even the two months together, retail sales, though solid, are far from the astonishingly strong readings underway in consumer confidence, a mismatch that will play out in the months ahead. Another factor to note is that January and February are the two slowest months for retail sales, which makes for an outsized effect from seasonal adjustments.

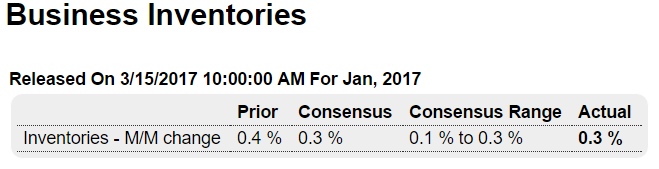

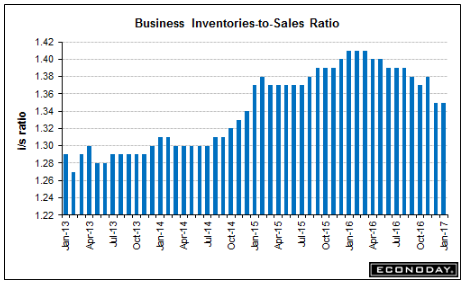

Still high and still coming down and thereby weakening output and gdp. Auto inventories are particularly bloated due to lower sales:

Highlights

Inventory growth looks moderate and stable, at an expected 0.3 percent in January and roughly in line with underlying sales growth which came in at an even more moderate 0.2 percent. The inventory-to-sales ratio is unchanged at 1.35.

Heavy auto inventories at dealerships are key right now in the inventory picture, and weakness in auto sales (posted this morning in the retail sales report) doesn’t point to much of a draw for auto inventories in February. Dealership inventories in January surged 2.4 percent with total retailer inventories at plus 0.8 percent. Excluding autos, however, retail inventories were unchanged. Manufacturer inventories rose a steady 0.2 percent in January with wholesalers reporting a 0.2 percent draw.

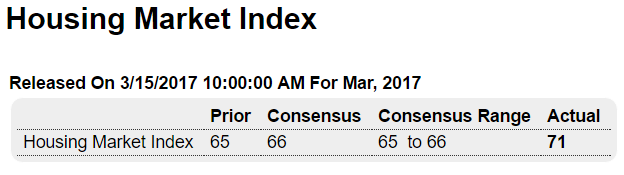

Trumped up expectations:

Highlights

Strong optimism is the theme of so many reports including the housing market index which is up a very sharp 6 points in March to 71 for the best reading of the economic cycle. Home builders peg current sales at an index of 78, up 7 points from February, and see future sales also at 78, for a 5 point gain. And their assessment of traffic is perhaps most telling, at 54 for an 8 point gain. This is the 3rd plus 50 score for this reading in the last 4 months and it suggests that first-time buyers, who have held down the housing sector this cycle, are also optimistic and are looking to buy a new home.

This report points to strength for permit data in tomorrow’s housing starts report and also to strength in next week’s report on new home sales. But optimism doesn’t always translate into immediate strength for hard economic data and it’s important to remember that new home sales have been struggling in recent months.