As expected with prior month’s spending revised up .2. Annual growth rates still not looking so good, as per the charts: Highlights April was mostly a favorable month for the consumer who benefited from strong wage gains, kept money in the bank, and was an active shopper at least compared to the first quarter. Consumer spending opened the second quarter with an as-expected 0.4 percent gain with strength in durables spending, including vehicles, offsetting another subpar increase, however, for services at only 0.3 percent. Personal income rose 0.4 percent in April with the wages & salaries component posting an outsized 0.7 percent gain and offsetting weakness in proprietor income and interest income. The savings rate held at 5.3 percent for a third straight month.

Topics:

WARREN MOSLER considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

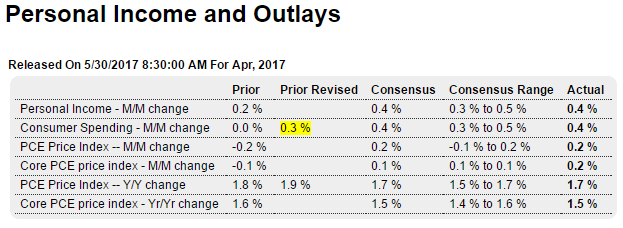

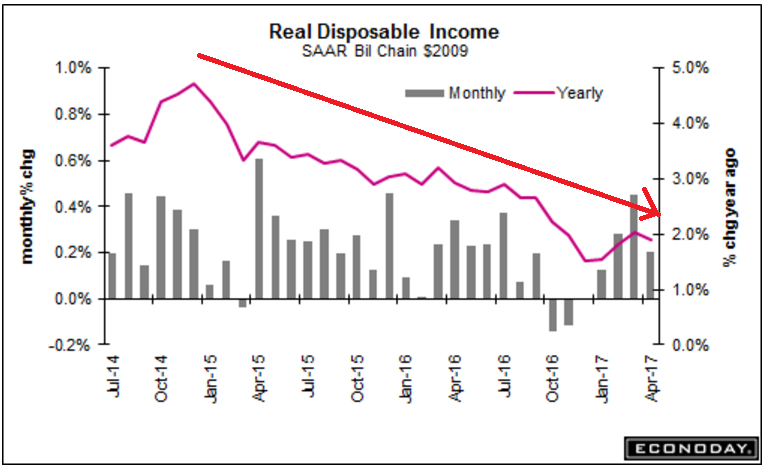

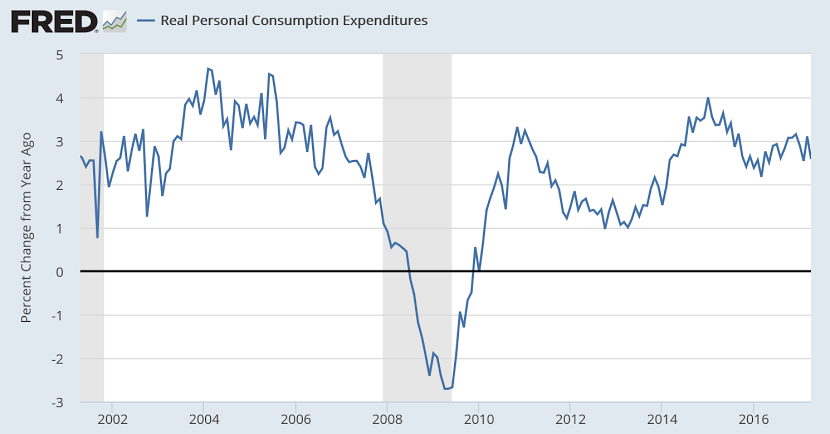

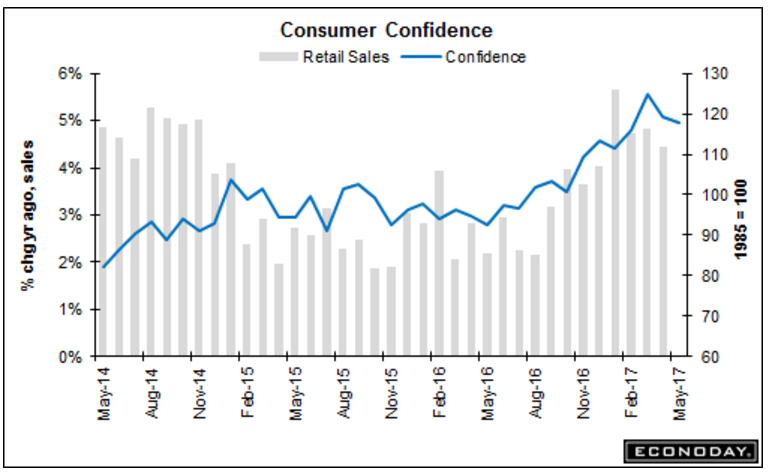

As expected with prior month’s spending revised up .2. Annual growth rates still not looking so good, as per the charts:

Highlights

April was mostly a favorable month for the consumer who benefited from strong wage gains, kept money in the bank, and was an active shopper at least compared to the first quarter. Consumer spending opened the second quarter with an as-expected 0.4 percent gain with strength in durables spending, including vehicles, offsetting another subpar increase, however, for services at only 0.3 percent. Personal income rose 0.4 percent in April with the wages & salaries component posting an outsized 0.7 percent gain and offsetting weakness in proprietor income and interest income. The savings rate held at 5.3 percent for a third straight month.

Inflation data in this report, which are the FOMC’s key inflation gauges, are more subdued than the spending readings. The core PCE (less food & energy) managed a 0.2 percent monthly gain but the year-on-year rate slipped another 1 tenth to 1.5 percent. This is the lowest rate since December 2015 with this year’s weak pressures having erased a full year of improvement. Overall prices also rose 0.2 percent with this year-on-year rate also lower, down 2 tenths to 1.7 percent.

A small positive in the report is an upward revision to March spending from no change to plus 0.3 percent. That’s a positive, however, that falls into the first quarter, not the second which is the focus right now. Consumer spending put in a respectable April but nothing spectacular which some had been expecting given positive seasonal factors including the inclusion of Easter. But the inflation readings are very quiet and won’t be raising expectations much further for a rate hike at the June FOMC.

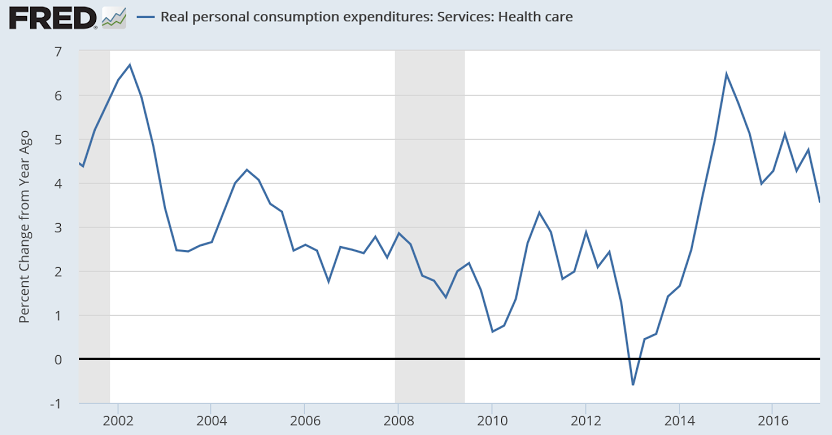

Health care premiums count as personal consumption expenditures and you can see how they have influenced total pce which is now weakening again:

Trumped up expectations coming down:

Small business hires fall in May, but employees got raises, Paycheck survey shows

By Berkeley Lovelace Jr.

May 30 (CNBC) —

Small business hiring fell in May, but wages continued to rise, Paychex says. The Small Business Jobs Index now has its weakest three-month change since July 2009. “Small business owners now seem to be taking a more wait-and-see approach to hiring,” Paychex President and CEO Martin Mucci says.

Looks like I’m now officially mainstream with the latest paper I wrote with Professor Silipo published in a mainstream economics journal:

Dear Warren Mosler,

Your paper “Maximizing price stability in a monetary economy” that has just been published today on “Journal of Policy Modeling” has been found by Peerus.

Peerus is an App that monitors your scientific field – Journals, Authors (colleagues / competitors), Keywords – and identifies new papers as soon as there are published.