As previously discussed, trade looks to be more negative in q1 than it was in q4: Highlights January’s trade deficit came in very deep but at least right on expectations, at .5 billion and reflecting a surge in foreign consumer and vehicle imports and higher prices for imported oil. January imports rose 2.3 percent from December to 7.6 billion with imports of consumer goods jumping 2.4 percent to .1 billion and with vehicle imports up 1.3 percent to .6 billion. Petroleum imports totaled .3 billion in the month, up 19 percent and reflecting both higher prices, at .94 per barrel vs December’s .45, and a rise in volumes, at 8.4 million barrels per day vs 7.7 million. Though dwarfed by imports, exports did rise 0.6 percent to 8.0 billion led by industrial supplies (where higher oil prices are at play) and also a 1.3 percent gain for vehicle exports to .6 billion as well as a %excerpt%.6 billion gain for foods. Exports of capital goods fell a sharp 1.9 percent to .5 billion in a decline that only partially reflected aircraft. Exports of services, usually the strength for the U.S., were unchanged in the month at .1 billion. Unadjusted country data show a monthly widening with China, to a monthly deficit of .3 billion, and a widening with Canada, at .6 billion. Deficits narrowed with the EU, to .5 billion, with Japan, to .

Topics:

WARREN MOSLER considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

As previously discussed, trade looks to be more negative in q1 than it was in q4:

Highlights

January’s trade deficit came in very deep but at least right on expectations, at $48.5 billion and reflecting a surge in foreign consumer and vehicle imports and higher prices for imported oil.

January imports rose 2.3 percent from December to $197.6 billion with imports of consumer goods jumping 2.4 percent to $52.1 billion and with vehicle imports up 1.3 percent to $13.6 billion. Petroleum imports totaled $15.3 billion in the month, up 19 percent and reflecting both higher prices, at $43.94 per barrel vs December’s $41.45, and a rise in volumes, at 8.4 million barrels per day vs 7.7 million.

Though dwarfed by imports, exports did rise 0.6 percent to $128.0 billion led by industrial supplies (where higher oil prices are at play) and also a 1.3 percent gain for vehicle exports to $13.6 billion as well as a $0.6 billion gain for foods. Exports of capital goods fell a sharp 1.9 percent to $43.5 billion in a decline that only partially reflected aircraft. Exports of services, usually the strength for the U.S., were unchanged in the month at $64.1 billion.

Unadjusted country data show a monthly widening with China, to a monthly deficit of $31.3 billion, and a widening with Canada, at $3.6 billion. Deficits narrowed with the EU, to $11.5 billion, with Japan, to $5.5 billion, and with Mexico, to $4.0 billion.

Strong demand for foreign goods and light demand for U.S. services and capital goods is not a favorable mix for GDP. This report puts first-quarter GDP on the defensive.

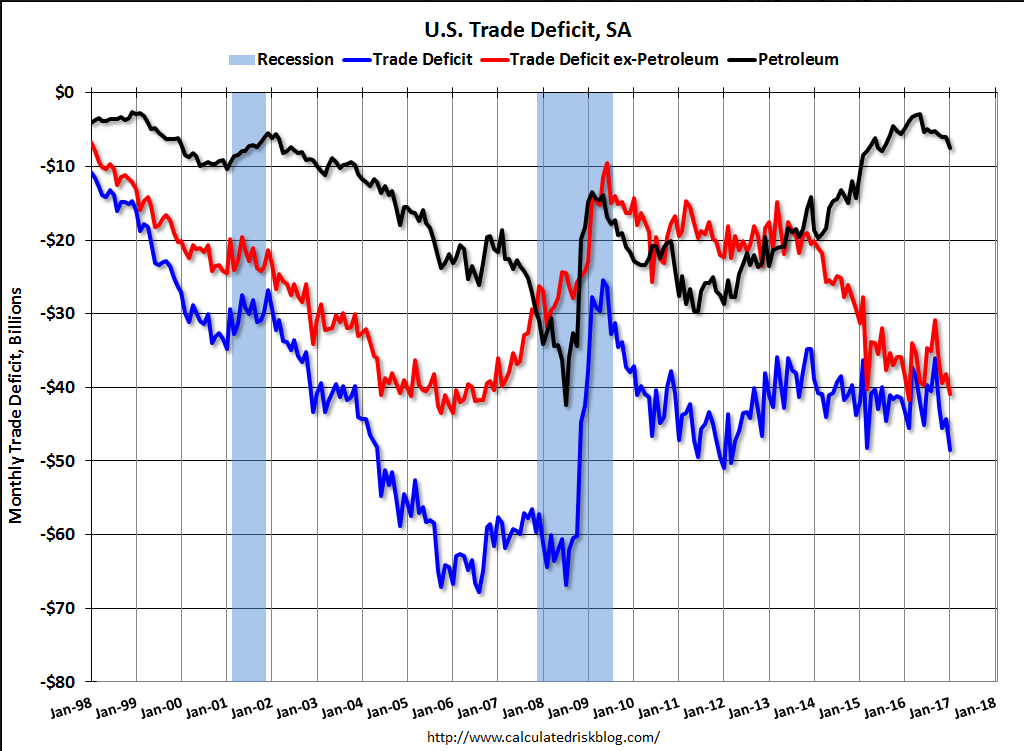

Higher oil prices and the end of the one time surge in soybean exports, etc:

A lot worse than expected:

Highlights

Consumers held back on credit-card borrowing in January as nonrevolving credit fell $3.8 billion for the first monthly decline since February last year and the largest since December 2012. But nonrevolving credit, where vehicle financing and student loans are tracked, rose a respectable $12.6 billion and offers a reminder that overall credit growth, including revolving credit, has been steady. Yet, at least for January, nonrevolving credit couldn’t offset the weakness in revolving credit as total credit increased only $8.8 billion for the smallest rise since July 2012.