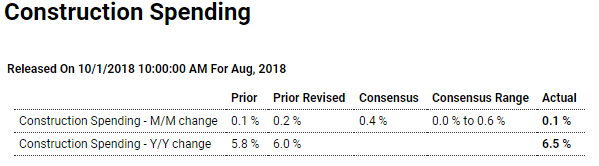

Lots of evidence of slowing; Highlights A marginal headline gain of 0.1 percent in construction spending masks significant declines in residential spending during August. Residential spending fell 0.7 percent in the month to more than offset a 0.2 percent rise in July. Looking at sub-components, single-family spending was also down 0.7 percent in August with multi-unit spending down 1.7 percent. Home improvement spending fell 0.6 percent. Strength in the report is in highways & streets, up 1.7 percent in the month. Educational spending was also strong with a 1.0 percent gain. Government spending was very active in August, up 5.9 percent at the Federal level and up 1.7 percent for state & local. Private nonresidential spending was flat, down 0.2 percent overall with

Topics:

WARREN MOSLER considers the following as important: Economic Releases

This could be interesting, too:

WARREN MOSLER writes Consumer sentiment, real retail sales, industrial production, wages

WARREN MOSLER writes New manufacturers orders, vehicle sales, unemployment claims, rents, oil prices

WARREN MOSLER writes Saudi price hike, private payrolls, new hires, corporate profits

WARREN MOSLER writes Pending home sales, Durable goods orders, oil rigs and production

Lots of evidence of slowing;

Highlights

A marginal headline gain of 0.1 percent in construction spending masks significant declines in residential spending during August. Residential spending fell 0.7 percent in the month to more than offset a 0.2 percent rise in July. Looking at sub-components, single-family spending was also down 0.7 percent in August with multi-unit spending down 1.7 percent. Home improvement spending fell 0.6 percent.

Strength in the report is in highways & streets, up 1.7 percent in the month. Educational spending was also strong with a 1.0 percent gain. Government spending was very active in August, up 5.9 percent at the Federal level and up 1.7 percent for state & local.

Private nonresidential spending was flat, down 0.2 percent overall with commercial, power and manufacturing subcomponents all showing declines to offset gains for transportation and offices.

This report is not pointing to acceleration in business investment and is consistent with another weak quarter for residential investment which remains the economy’s weak spot for 2018.

Investing in the Soaring Popularity of Gaming

(Reuters) Global mergers and acquisitions dropped to $783 billion in the third quarter, down 35 percent from the prior quarter. The first nine months of 2018 saw global M&A reach a new record of $3.2 trillion. M&A activity in Europe has been particularly strong, with deals worth $962.5 billion so far this year, a 72 percent increase compared with a year ago. U.S. M&A, which rose 14 percent year-over-year to $368.1 billion in the quarter. Announced deals in Europe fell 14 percent to $151.4 billion, while M&A in Asia-Pacific was down 38 percent to $185.1 billion, the Thomson Reuters data showed.

Japanese business sentiment logs longest fall since 2009

(Nikkei) The closely watched index of large manufacturer sentiment came to plus 19 for the July-September period, down from 21 in the previous survey in June. The survey showed that big manufacturers expect profits to fall 4.6% for the year ending March 2019, on an assumption that the yen will average 107.40 to the dollar this business year. In the previous survey, the rate was seen at 107.26 yen per dollar. The survey showed that large companies plan to increase their capital investment in the current fiscal year by 13.4%, only a tick lower than the 13.6% increase predicted in the previous June survey.

China’s Economy Losing Steam as Trade Conflict With U.S. Intensifies

(WSJ) An intensifying trade brawl with the U.S. is starting to take a heavier toll on China’s economy, as weakening foreign demand and sluggish domestic consumption cause Chinese manufacturers to significantly scale back production. The new data released Sunday showed that privately owned makers of cars, machinery and other products stopped expanding in September, as export orders dropped the most in more than two years. At the same time, output by large, state-owned manufacturers continued to weaken.

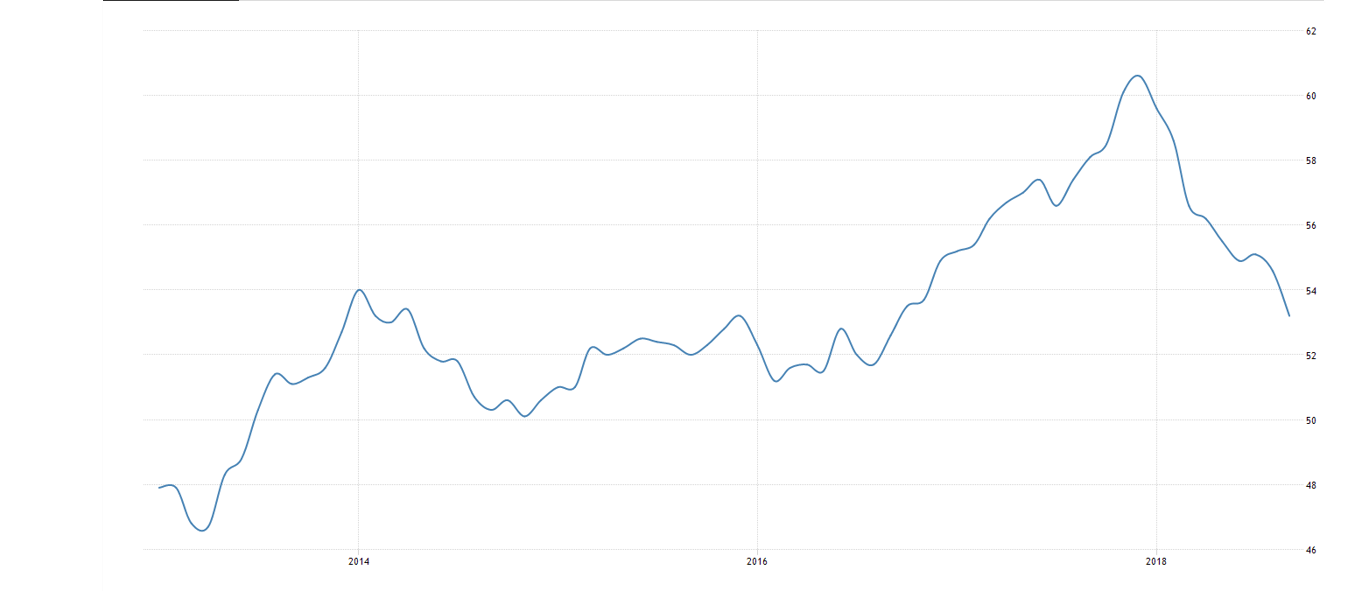

Euro area manufacturing purchasing managers index

This reduces aggregate demand:

The savings bill the House passed Thursday would make it easier for small businesses to offer retirement plans to their employees, create universal savings accounts and allow 529 education savings plans to be used for more purposes.