Bank lending began to decelerate after oil related capital spending collapsed late in 2014, and then collapsed further about the time of the presidential election: Note the consumer ‘dipping into savings’ some to sustain consumption via borrowing into year end as personal income flattened: Real disposable personal income flattened and consumer spending slowed but not as much as income, and was instead supported by consumers ‘dipping into savings’: This is now impossibly low, given the deceleration in credit: Employment gains continue to decelerate: Total vehicle sales were lower in 2017 vs 2016, with domestic autos particularly weak. This is through November: Slowing growth here as well: With income and employment decelerating I can’t see the upside?

Topics:

WARREN MOSLER considers the following as important: Economic Releases

This could be interesting, too:

WARREN MOSLER writes Consumer sentiment, real retail sales, industrial production, wages

WARREN MOSLER writes New manufacturers orders, vehicle sales, unemployment claims, rents, oil prices

WARREN MOSLER writes Saudi price hike, private payrolls, new hires, corporate profits

WARREN MOSLER writes Pending home sales, Durable goods orders, oil rigs and production

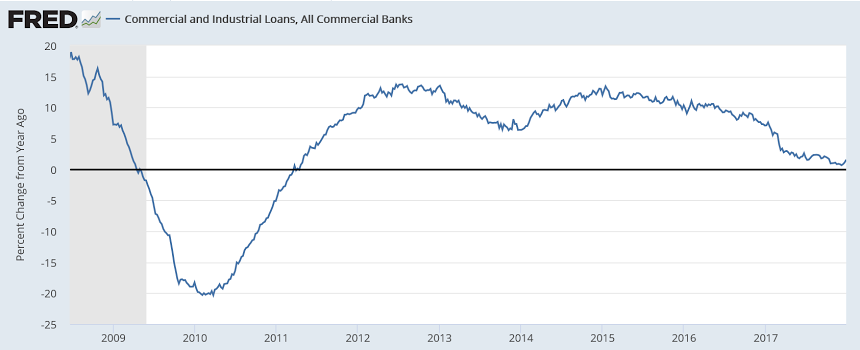

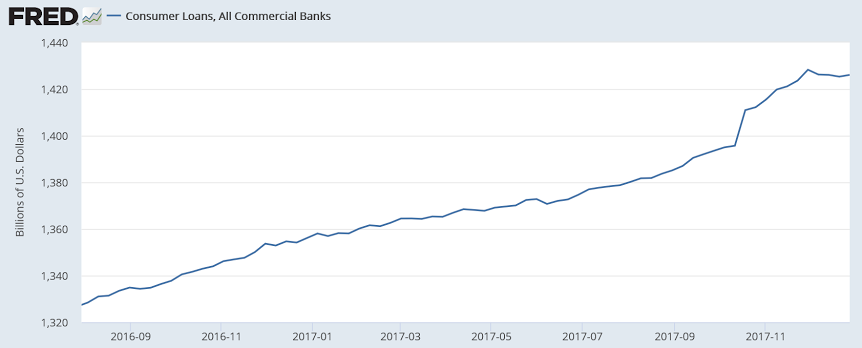

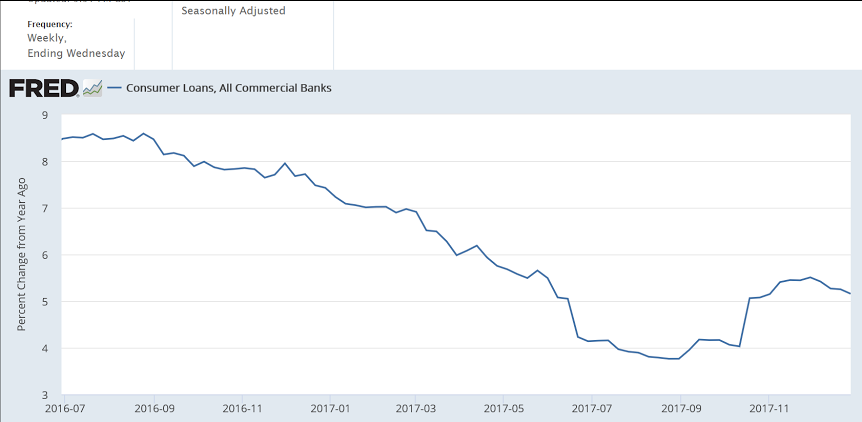

Bank lending began to decelerate after oil related capital spending collapsed late in 2014, and then collapsed further about the time of the presidential election:

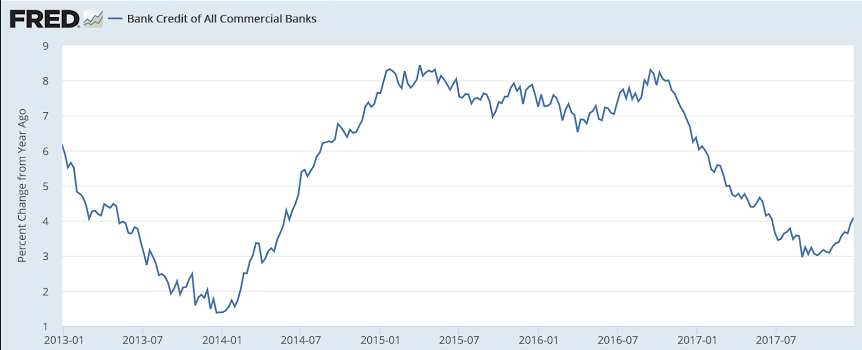

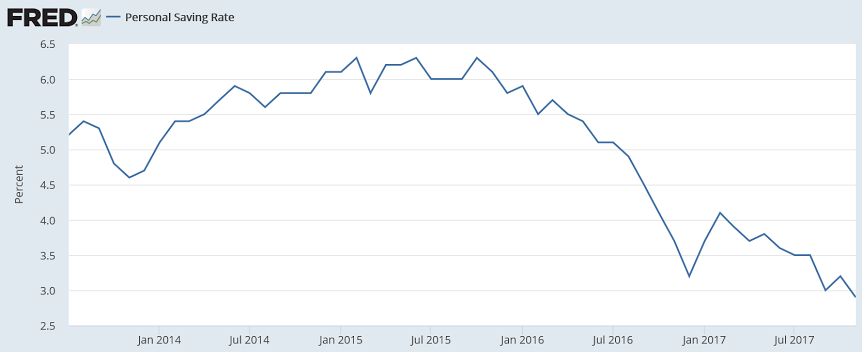

Note the consumer ‘dipping into savings’ some to sustain consumption via borrowing into year end as personal income flattened:

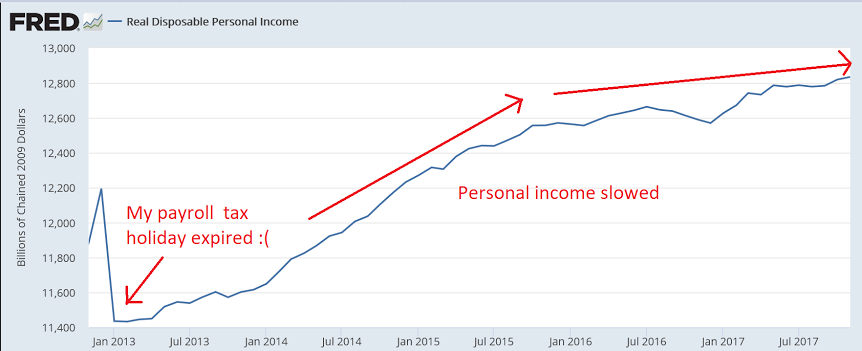

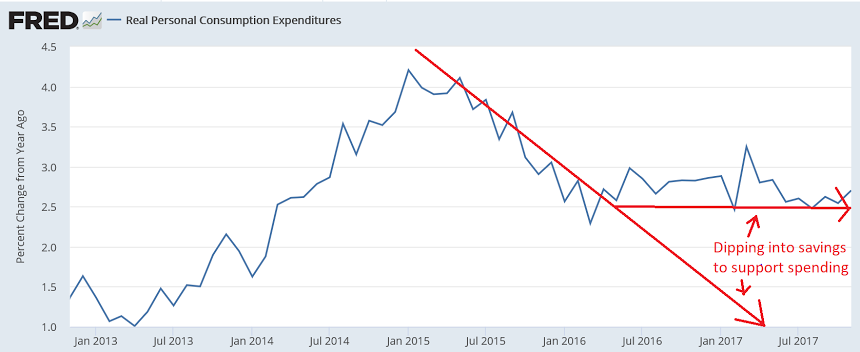

Real disposable personal income flattened and consumer spending slowed but not as much as income, and was instead supported by consumers ‘dipping into savings’:

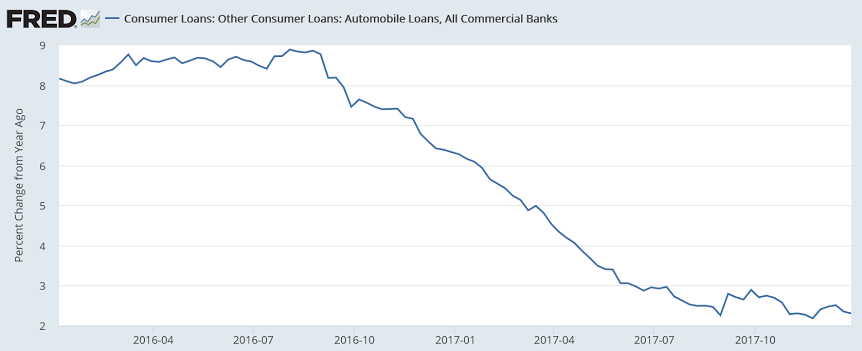

This is now impossibly low, given the deceleration in credit:

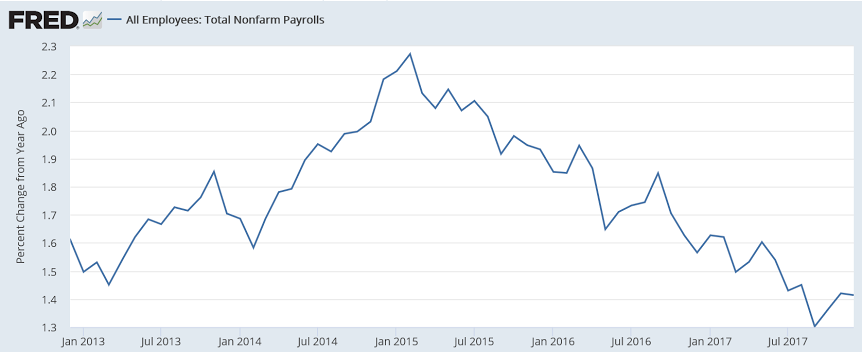

Employment gains continue to decelerate:

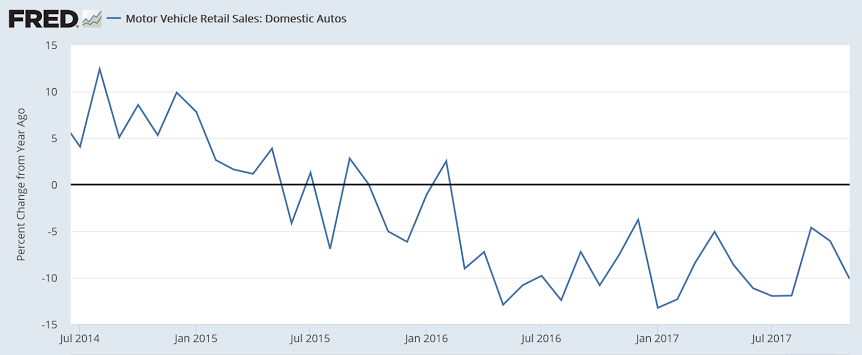

Total vehicle sales were lower in 2017 vs 2016, with domestic autos particularly weak. This is through November:

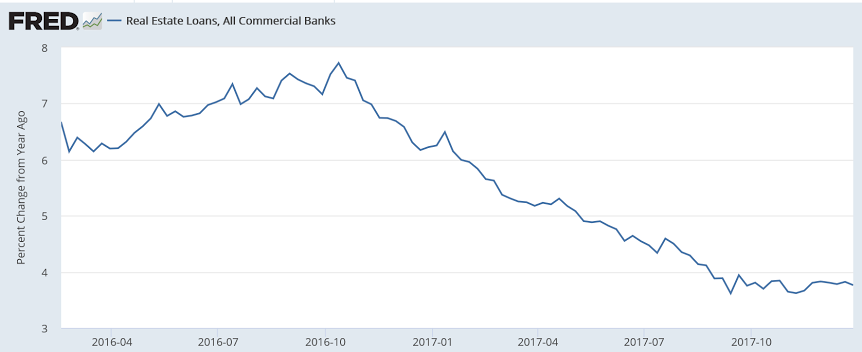

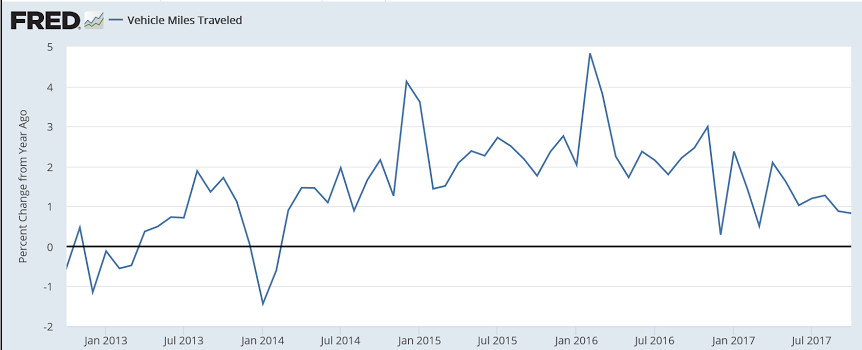

Slowing growth here as well:

With income and employment decelerating I can’t see the upside?