China exports falling with tariffs: China’s November export, import growth shrinks, showing weak demand US exports turning south as well? The deceleration that started with the collapse of oil capex in Dec 2014 took a brief zig up late in 2017, and subsequently continued lower: Likewise the ability to generate gross profits has been fading: After tax and depreciation it’s not a whole lot different, with a one time leg up for the 2018 corporate tax cut that just brought it back to the prior highs, not adjusted for inflation: And real hourly compensation flattened out around the same time: This series decelerated with the collapse of oil capex at the end of 2014 and has remained at historically low levels: Japan GDP Growth Rate The Japanese economy shrank 0.6% on quarter

Topics:

WARREN MOSLER considers the following as important: Economic Releases

This could be interesting, too:

WARREN MOSLER writes Consumer sentiment, real retail sales, industrial production, wages

WARREN MOSLER writes New manufacturers orders, vehicle sales, unemployment claims, rents, oil prices

WARREN MOSLER writes Saudi price hike, private payrolls, new hires, corporate profits

WARREN MOSLER writes Pending home sales, Durable goods orders, oil rigs and production

China exports falling with tariffs:

China’s November export, import growth shrinks, showing weak demand

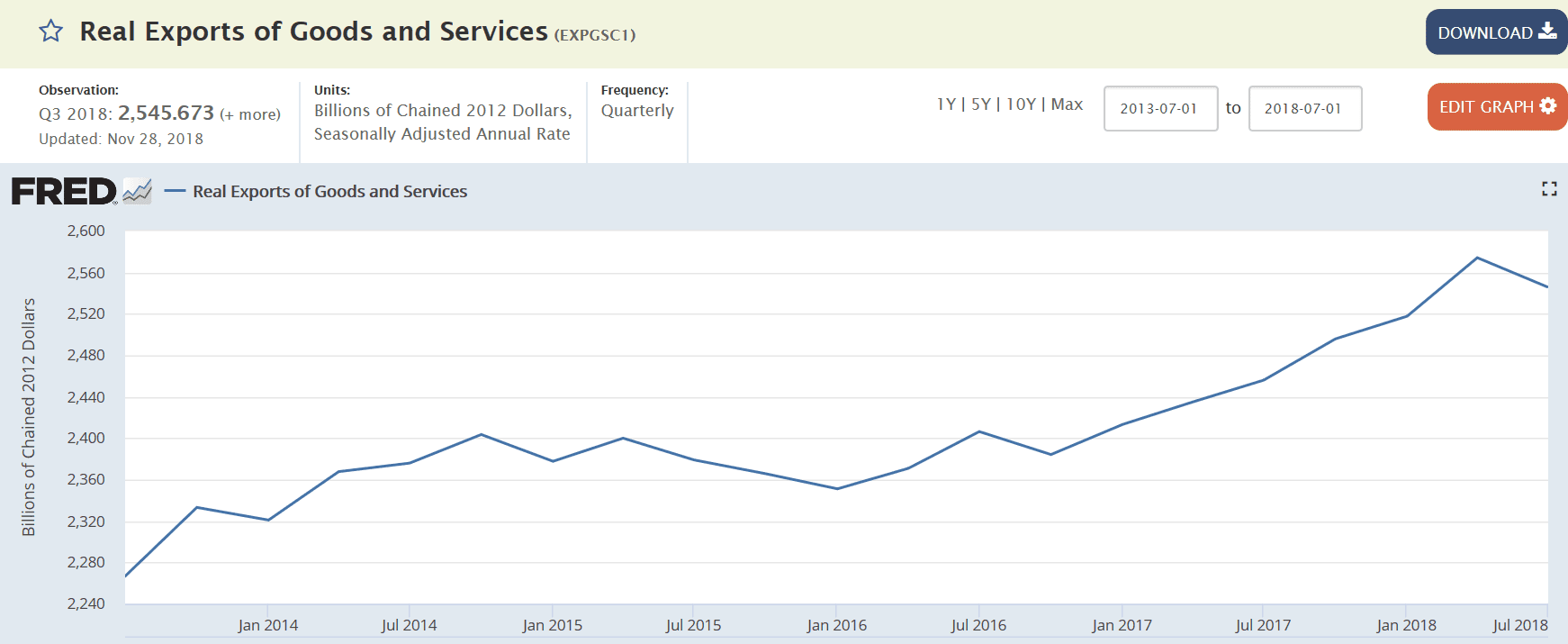

US exports turning south as well?

The deceleration that started with the collapse of oil capex in Dec 2014 took a brief zig up late in 2017, and subsequently continued lower:

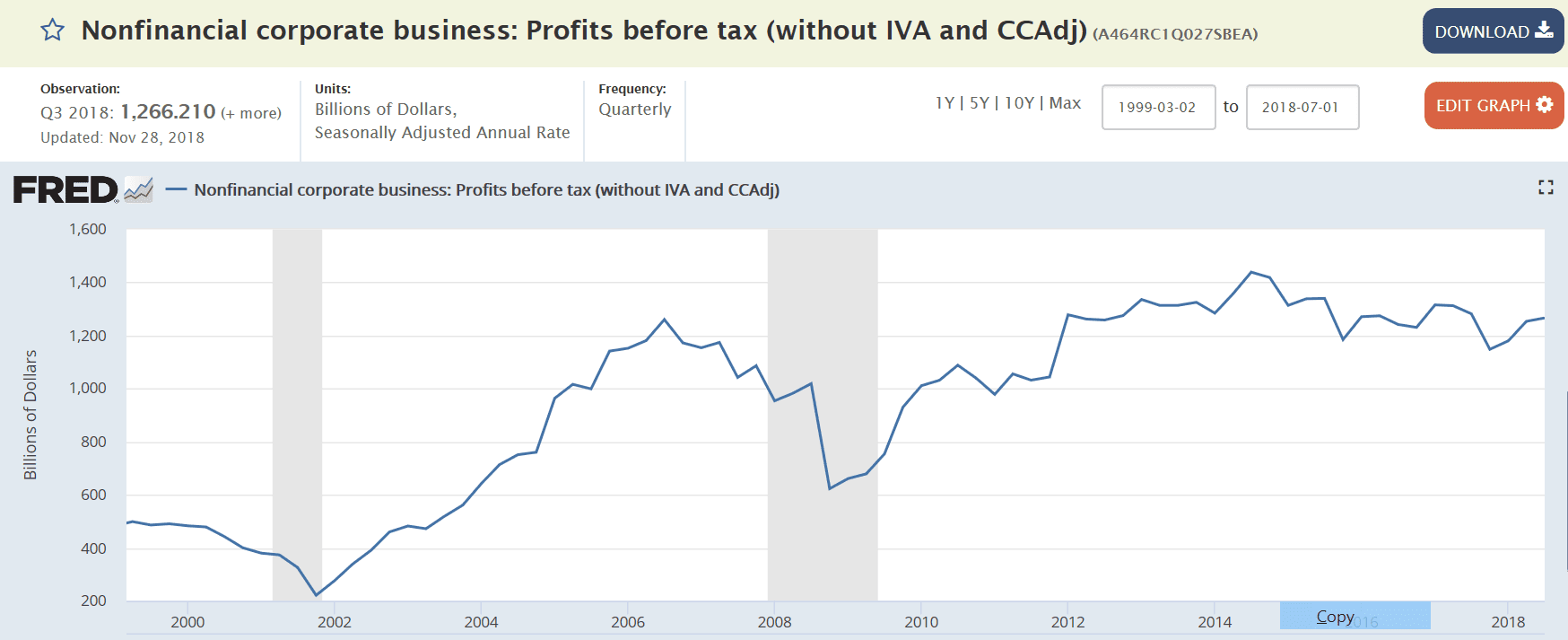

Likewise the ability to generate gross profits has been fading:

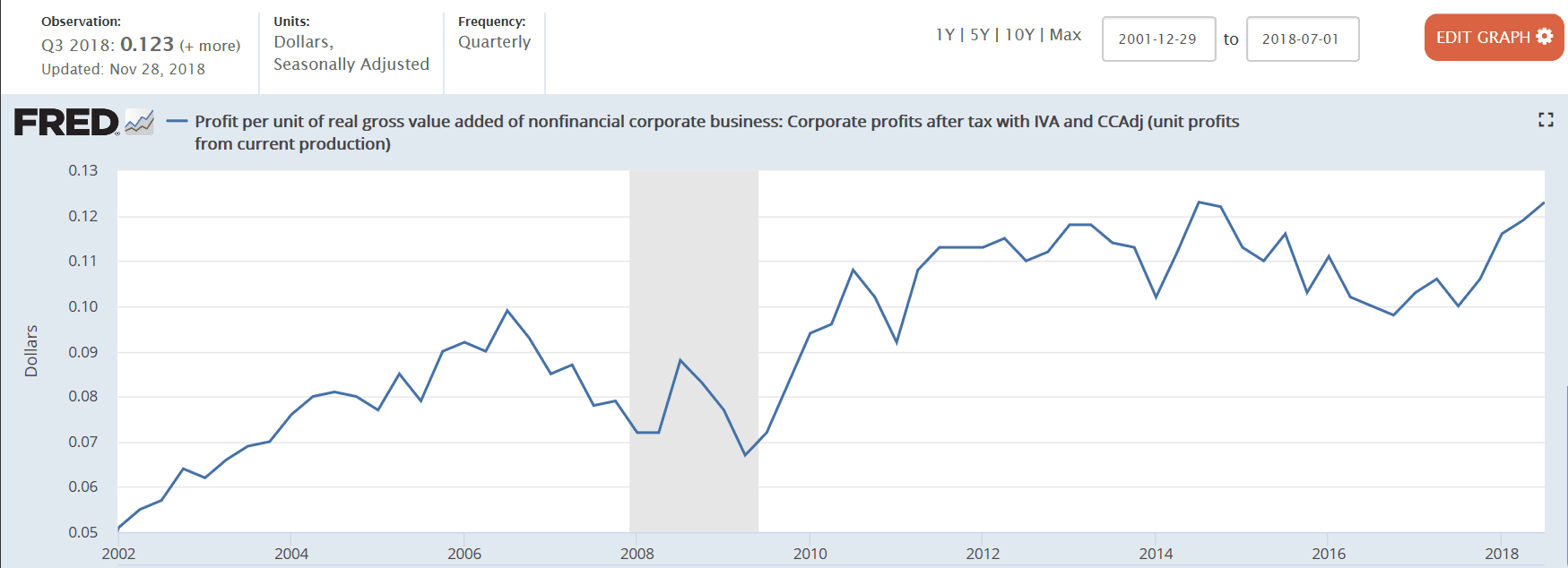

After tax and depreciation it’s not a whole lot different, with a one time leg up for the 2018 corporate tax cut that just brought it back to the prior highs, not adjusted for inflation:

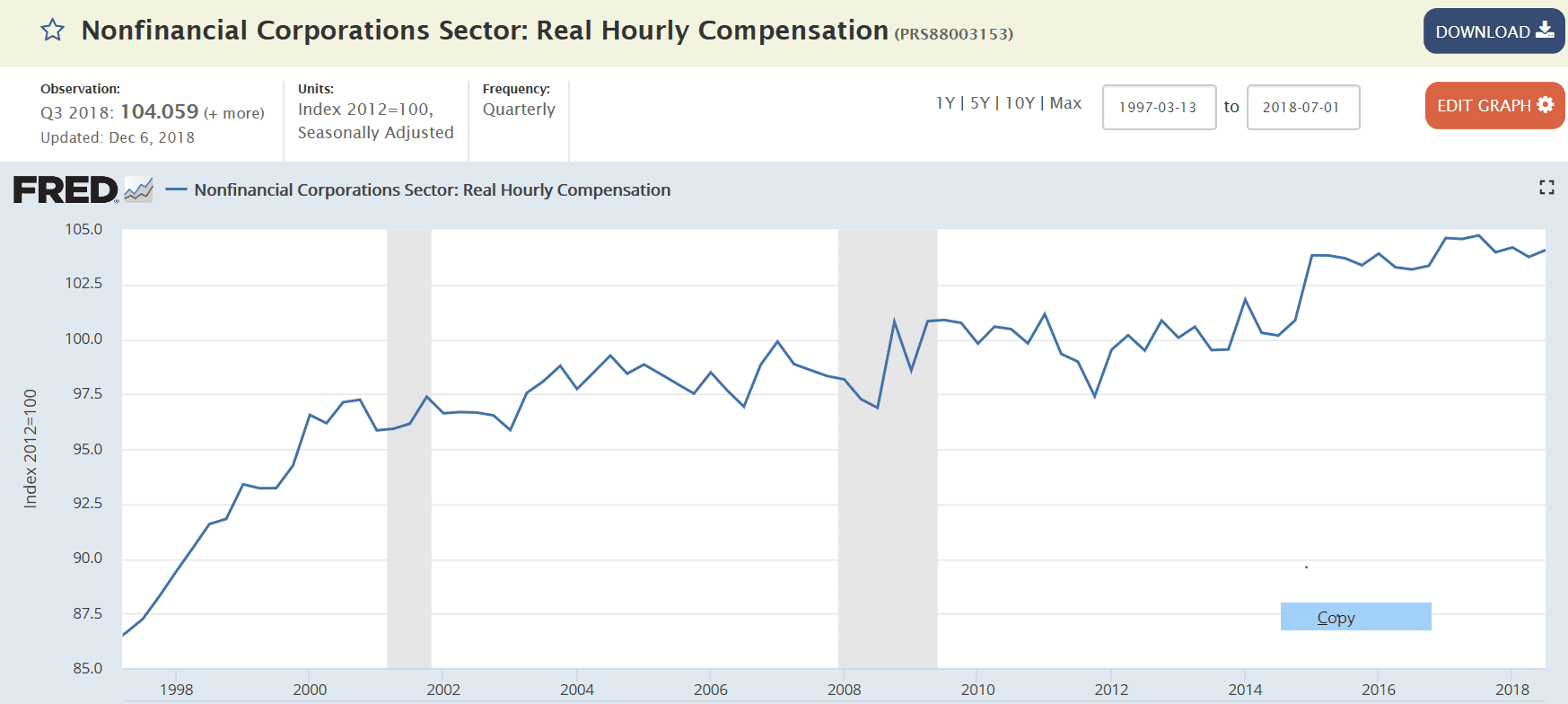

And real hourly compensation flattened out around the same time:

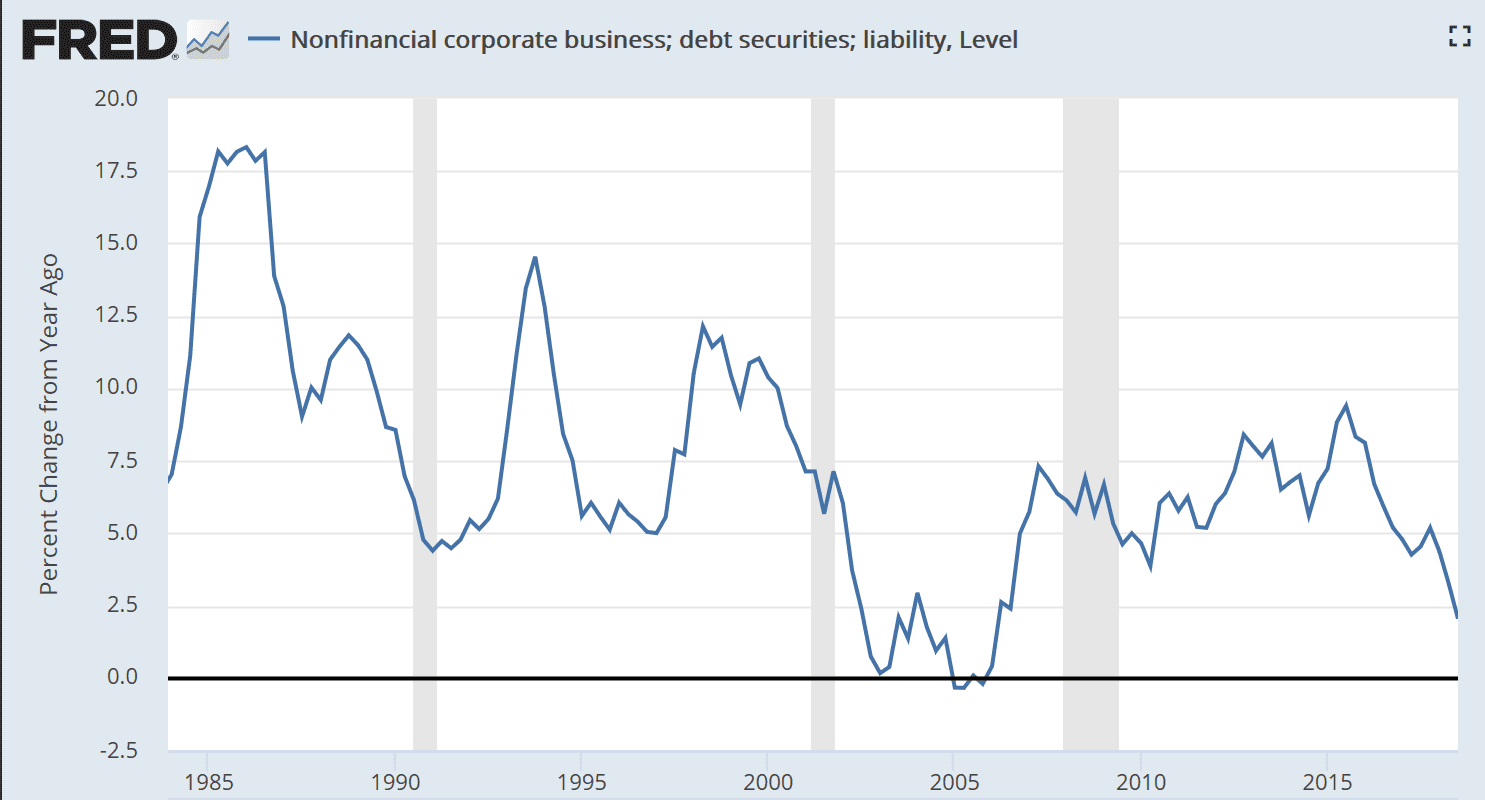

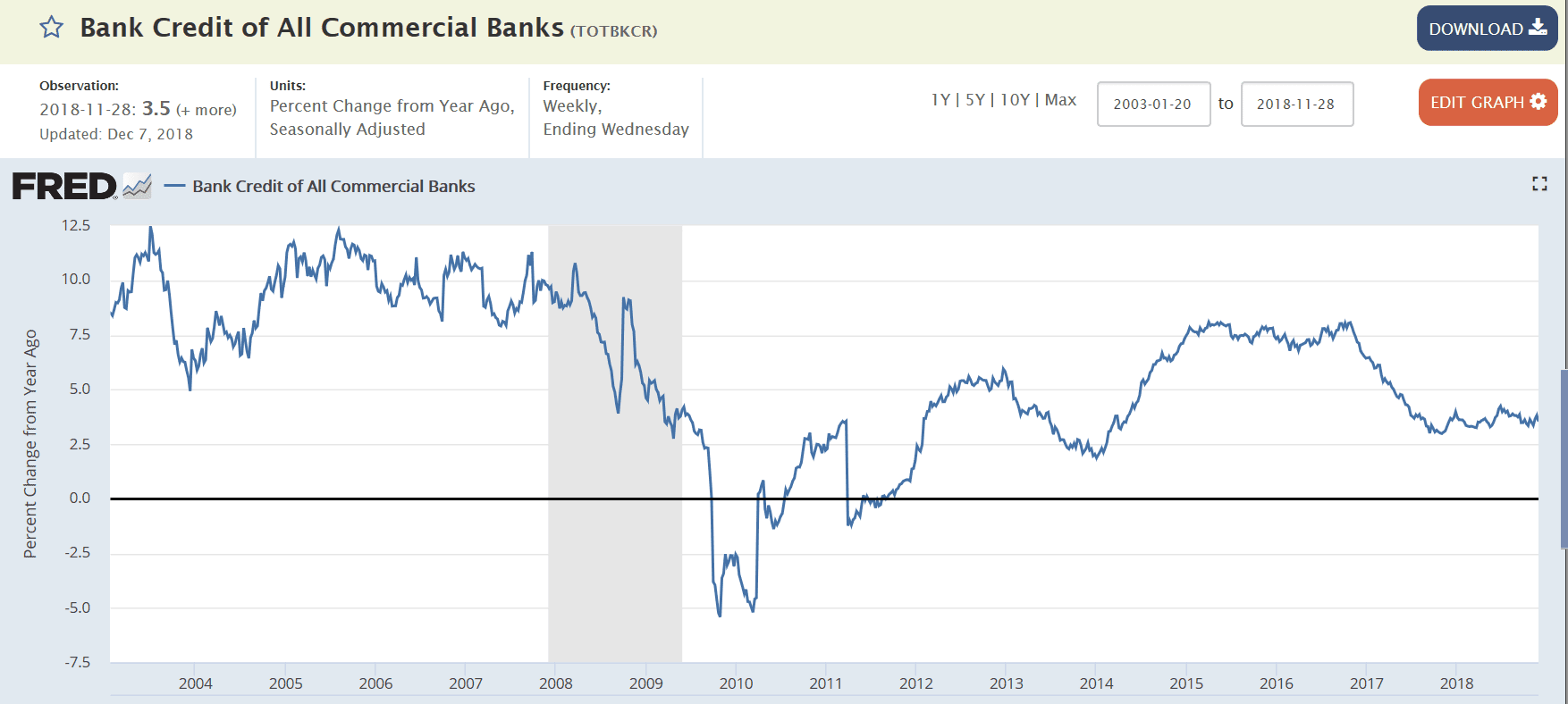

This series decelerated with the collapse of oil capex at the end of 2014 and has remained at historically low levels:

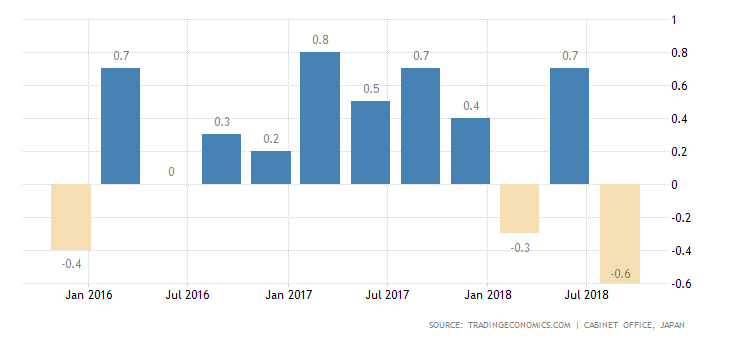

Japan GDP Growth Rate

The Japanese economy shrank 0.6% on quarter in Q3, faster than a preliminary estimate of a 0.3% drop and market expectations of a 0.5% decline. It is the steepest contraction since Q2 2014 as natural disasters like flood and earthquake weighed more on personal consumption and capital investment than initially estimated.

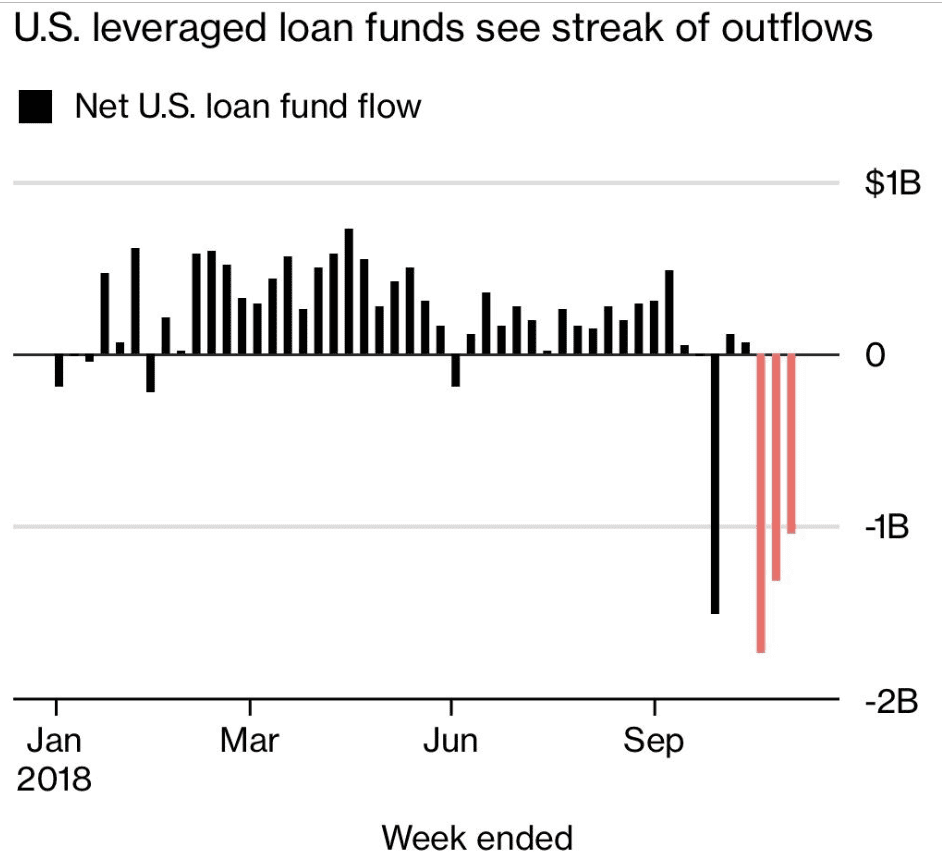

Leveraged loans are now funded by non banks as well as banks, and some of the non banks are funded by banks, so banks are still funding some portion of leveraged loan funding.

However, this credit expansion- including what does not show up as bank lending- does support GDP growth, and a slowdown removes that support for the economy: