Prior month revised down, keeping the chart looking very weak for this ‘hard data’ release: Looks like the Saudis mean to keep a bit of upward pressure on prices. Perhaps to offset the weak $US,in which case the higher oil prices work to further weaken the $US: Saudis Seen Keeping Feb. Asia Arab Light Oil Price Unchanged M/m By Serene Cheong and Sharon Cho (Bloomberg) — State-run Saudi Aramco may keep Arab Light crude official selling price unchanged m/m for Feb. sales to Asian customers, according to median estimate in Bloomberg survey of 4 refiners, traders. Feb. Arab Light differential estimated at .65/bbl premium to Oman-Dubai benchmark, stable from Jan. NOTE: Aramco increased Jan. Arab Light OSP to Asia by 40c/bbl m/m, vs +30c expansion expected in Bloomberg

Topics:

WARREN MOSLER considers the following as important: Economic Releases

This could be interesting, too:

WARREN MOSLER writes Consumer sentiment, real retail sales, industrial production, wages

WARREN MOSLER writes New manufacturers orders, vehicle sales, unemployment claims, rents, oil prices

WARREN MOSLER writes Saudi price hike, private payrolls, new hires, corporate profits

WARREN MOSLER writes Pending home sales, Durable goods orders, oil rigs and production

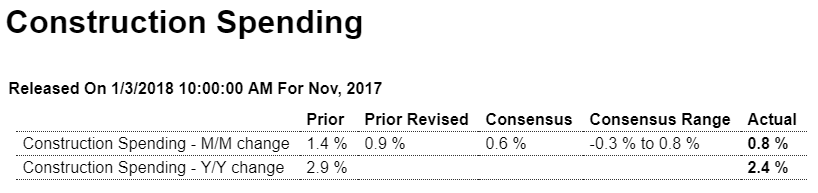

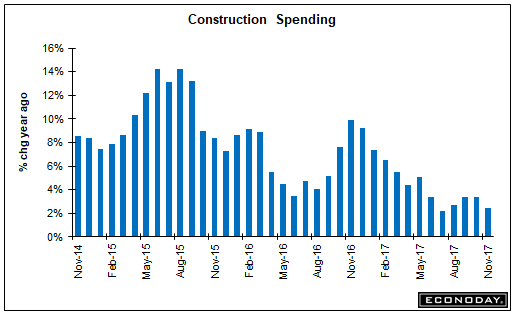

Prior month revised down, keeping the chart looking very weak for this ‘hard data’ release:

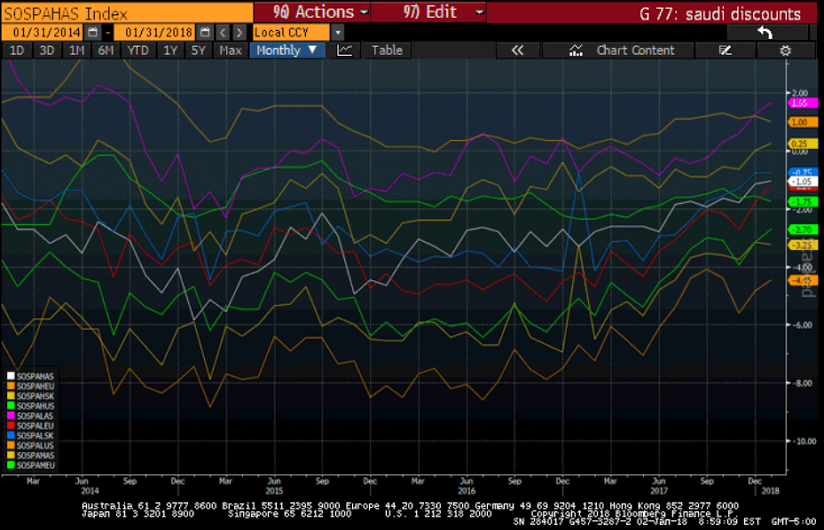

Looks like the Saudis mean to keep a bit of upward pressure on prices. Perhaps to offset the weak $US,

in which case the higher oil prices work to further weaken the $US:

Saudis Seen Keeping Feb. Asia Arab Light Oil Price Unchanged M/m

By Serene Cheong and Sharon Cho

(Bloomberg) — State-run Saudi Aramco may keep Arab Light crude official selling price unchanged m/m for Feb. sales to Asian customers, according to median estimate in Bloomberg survey of 4 refiners, traders.

Feb. Arab Light differential estimated at $1.65/bbl premium to Oman-Dubai benchmark, stable from Jan. NOTE: Aramco increased Jan. Arab Light OSP to Asia by 40c/bbl m/m, vs +30c expansion expected in Bloomberg survey For Feb., 3 respondents forecast no change in Arab Light OSP m/m, while 1 expects +5c Aramco may announce Feb. OSPs next week

New York real estate has its worst quarter in 6 years — and there could be more pain ahead

United States ISM New York Index

The ISM New York Current Business Conditions in the United States fell to 56.3 in December of 2017 from 58.1 in November. Still, it remained above the 12-month average of 54.9. Employment contracted (42.9 from 64.6), purchases slowed (55 from 56.3) and prices paid increased (66.7 from 62.5). Also, both current (55 from 64.3) and expected (63.6 from 71.4) revenues eased. On the other hand, the six-month outlook jumped to 85.7 from 69.7, reaching the highest since July of 2006. Ism New York Index in the United States averaged 55.56 percent from 1993 until 2017, reaching an all time high of 88.80 percent in December of 2003 and a record low of 23.40 percent in October of 2001.