Highlights A solid rise in residential spending offset a mixed showing for non-housing components and made for a 0.1 percent July rise in overall construction spending to barely come within Econoday’s consensus range. Residential spending rose 0.6 percent but July’s gain was entirely centered in home improvements which jumped 2.1 percent to offset outright declines of 0.3 percent in single-family homes and 0.4 percent for multi-families. Private non-residential spending fell 1.0 percent in the month, pulled down by a sharp fall in commercial projects, where spending has been uneven in recent months, that offset a fourth straight sharp gain in transportation. Public spending on educational building and highways & streets posted gains following declines in June.

Topics:

WARREN MOSLER considers the following as important: Economic Releases

This could be interesting, too:

WARREN MOSLER writes Consumer sentiment, real retail sales, industrial production, wages

WARREN MOSLER writes New manufacturers orders, vehicle sales, unemployment claims, rents, oil prices

WARREN MOSLER writes Saudi price hike, private payrolls, new hires, corporate profits

WARREN MOSLER writes Pending home sales, Durable goods orders, oil rigs and production

Highlights

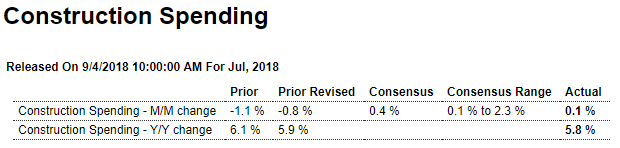

A solid rise in residential spending offset a mixed showing for non-housing components and made for a 0.1 percent July rise in overall construction spending to barely come within Econoday’s consensus range. Residential spending rose 0.6 percent but July’s gain was entirely centered in home improvements which jumped 2.1 percent to offset outright declines of 0.3 percent in single-family homes and 0.4 percent for multi-families.

Private non-residential spending fell 1.0 percent in the month, pulled down by a sharp fall in commercial projects, where spending has been uneven in recent months, that offset a fourth straight sharp gain in transportation. Public spending on educational building and highways & streets posted gains following declines in June.

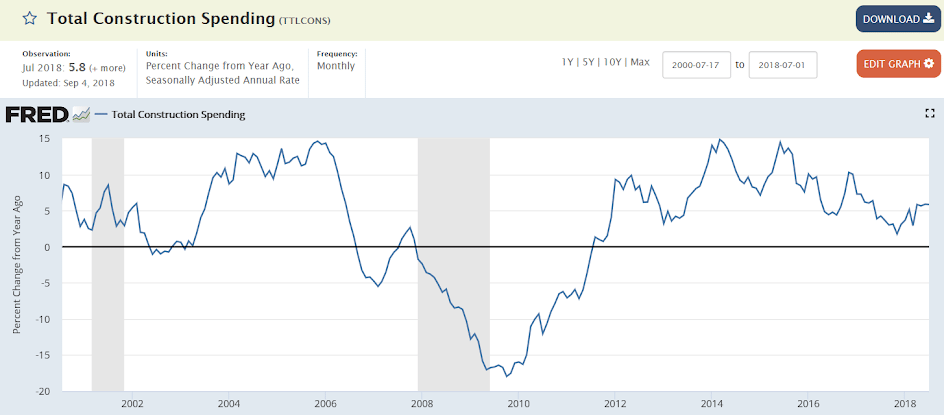

Year-on-year rates help underline what is a healthy rate of growth in construction spending, up 5.8 percent overall with residential spending up 6.7 percent and both private nonresidential and public categories showing low to mid single digit gains. Nevertheless, reports out of housing have been uneven and are clouded further by the declines in single- and multi-family homes in this report.

Highlights

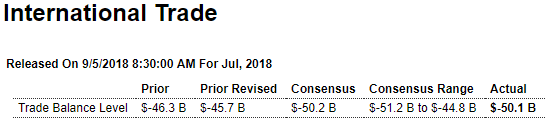

The nation’s trade deficit deepened sharply in July, to $50.1 billion vs a revised $45.7 billion in June. The deficit in goods jumped to $73.1 billion from $68.9 billion in June while the surplus in services slipped slightly to $23.1 billion.

Exports of capital goods fell $1.0 billion to $46.3 billion with civilian aircraft down $1.6 billion to $3.5 billion in the month. Exports of foods & feeds fell $0.9 billion to $13.2 billion with exports of consumer goods down $0.4 billion to $16.0 billion.

The import side shows a $0.8 billion decline in consumer goods to $52.6 billion with other components, however, on the rise including capital goods up $0.7 billion to $58.2 billion and autos up $0.5 billion to $30.7 billion.

The bilateral deficit with China deepened to $36.8 billion in unadjusted country data with the EU at a deficit of $17.6 billion. The deficit with both Japan and Mexico came in at $5.5 billion in July and Canada at $3.2 billion.

July’s deficit is much deeper than the $45.6 billion monthly average for the second quarter and points to a major uphill battle for net exports in the third-quarter GDP report.

Also, as you may know, I’ve been busy running for Governor of the USVI.

To see what that’s all about visit mosler4governor.com

And if you want to make a contribution click here:

Many thanks!

warren