Analyst Opinion of Container Movements Simply looking at this month versus last month – this was a terrible month. The three month rolling averages significantly declined. This is the first dataset I have seen which could be a self-inflicted wound from the trade wars. The three month rolling average for exports is barely positive year-over-year. This data set is based on the Ports of LA and Long Beach which account for much (approximately 40%) of the container movement into and out of the United States – and these two ports report their data significantly earlier than other USA ports. Most of the manufactured goods move between countries in sea containers (except larger rolling items such as automobiles). This pulse point is an early indicator of the health of the

Topics:

WARREN MOSLER considers the following as important: Economic Releases

This could be interesting, too:

WARREN MOSLER writes Consumer sentiment, real retail sales, industrial production, wages

WARREN MOSLER writes New manufacturers orders, vehicle sales, unemployment claims, rents, oil prices

WARREN MOSLER writes Saudi price hike, private payrolls, new hires, corporate profits

WARREN MOSLER writes Pending home sales, Durable goods orders, oil rigs and production

Analyst Opinion of Container Movements

Simply looking at this month versus last month – this was a terrible month. The three month rolling averages significantly declined. This is the first dataset I have seen which could be a self-inflicted wound from the trade wars. The three month rolling average for exports is barely positive year-over-year.

This data set is based on the Ports of LA and Long Beach which account for much (approximately 40%) of the container movement into and out of the United States – and these two ports report their data significantly earlier than other USA ports. Most of the manufactured goods move between countries in sea containers (except larger rolling items such as automobiles). This pulse point is an early indicator of the health of the economy.

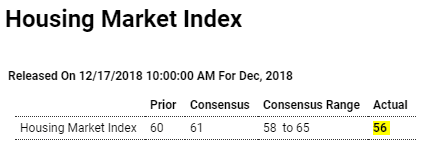

More housing weakness:

California Bay Area Home Sales Decline 17% YoY in November, Inventory up 27% YoY

From Pacific Union chief economist Selma Hepp: Bay Area Housing Inventory Again Posted a Solid Increase in November

Overall Bay Area home sales (single-family homes and condominiums) declined by 17 percent year over year in November, with all counties and price ranges posting decreases.