Nice surprise on the upside, though there’s discussion it’s weather-related, as highlighted below. The growth rate moved up some as per the chart shows, but remains in a multi-year downtrend, with the low growth in hourly earnings an indication that demand remains very weak; Highlights There’s still no wage inflation underway but the flashpoint may be sooner than later based on unusual strength in the February employment report. Nonfarm payrolls rose an outsized 313,000 which is more than 80,000 above Econoday’s high estimate. Revisions add to the strength, at a net 54,000 for January which is now 239,000 and December which is 175,000. Strength in construction is a standout in the report as payrolls in the sector surged 61,000 in February following gains in the three

Topics:

WARREN MOSLER considers the following as important: Economic Releases

This could be interesting, too:

WARREN MOSLER writes Consumer sentiment, real retail sales, industrial production, wages

WARREN MOSLER writes New manufacturers orders, vehicle sales, unemployment claims, rents, oil prices

WARREN MOSLER writes Saudi price hike, private payrolls, new hires, corporate profits

WARREN MOSLER writes Pending home sales, Durable goods orders, oil rigs and production

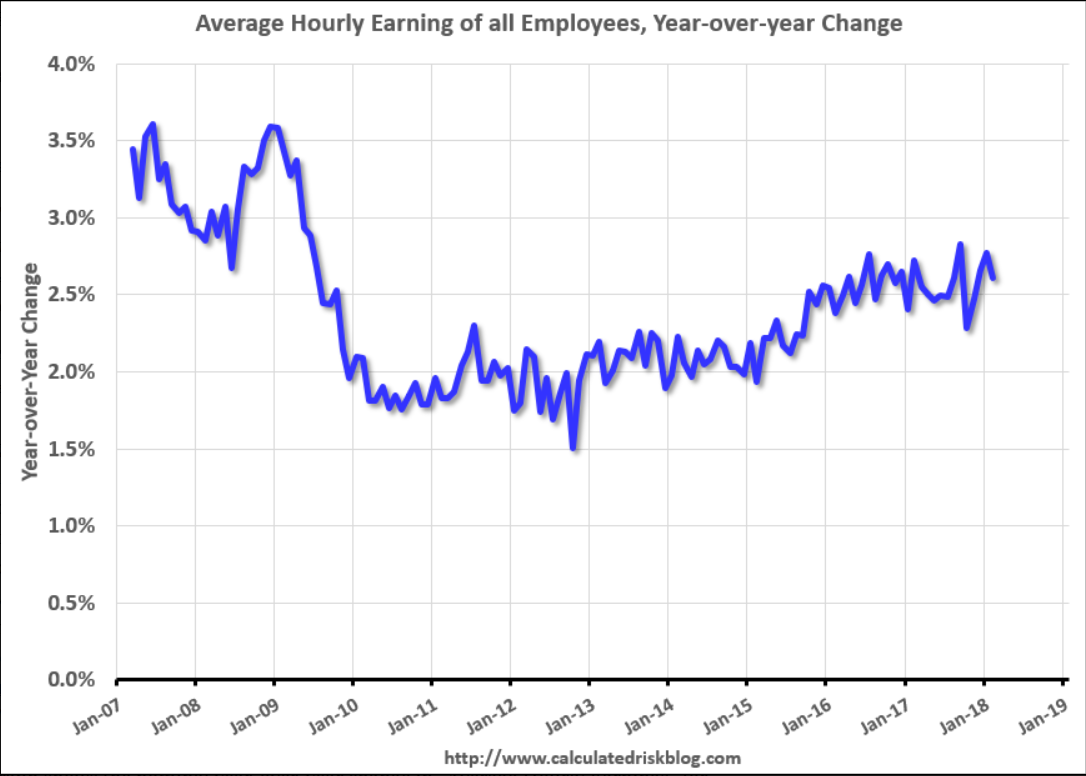

Nice surprise on the upside, though there’s discussion it’s weather-related, as highlighted below. The growth rate moved up some as per the chart shows, but remains in a multi-year downtrend, with the low growth in hourly earnings an indication that demand remains very weak;

Highlights

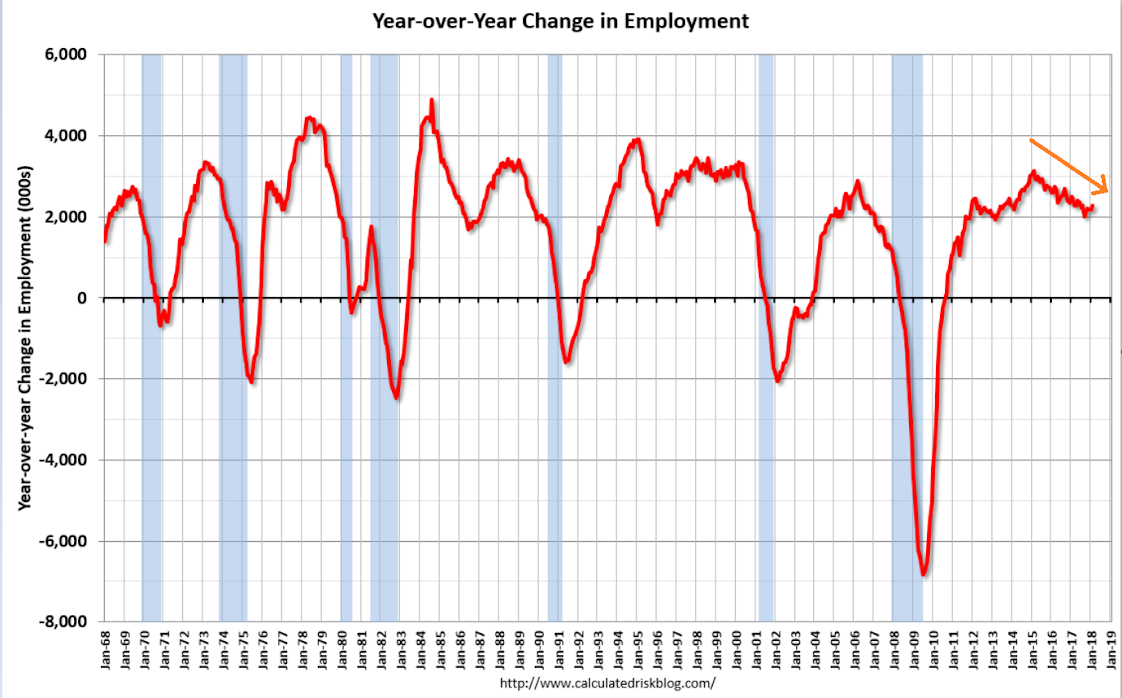

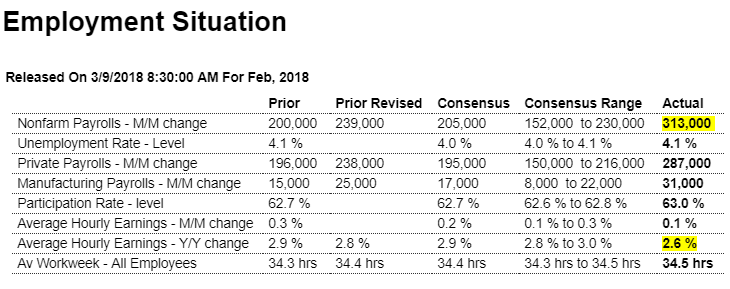

There’s still no wage inflation underway but the flashpoint may be sooner than later based on unusual strength in the February employment report. Nonfarm payrolls rose an outsized 313,000 which is more than 80,000 above Econoday’s high estimate. Revisions add to the strength, at a net 54,000 for January which is now 239,000 and December which is 175,000.

Strength in construction is a standout in the report as payrolls in the sector surged 61,000 in February following gains in the three prior gains that are all 40,000 and over. Manufacturing is also very strong, up 31,000 for a fifth straight strong gain. Retail, which has been uneven, added 50,000 as did professional & business services where the closely watched temporary help subcomponent spiked 27,000 in a tangible indication that employers are scrambling to fill positions. Government payrolls, which have been weak, added 26,000 to February’s nonfarm total.

Despite all this strength average hourly earnings actually came in below expectations, at only plus 0.1 percent with the year-on-year 3 tenths under the consensus at 2.6 percent. But given how strong demand is for labor, policy makers at the Federal Reserve may not want to risk runaway wage gains as employers try increasingly to attract candidates.

The workweek further points to strength, up 1 tenth to an average 34.5 hours for all employees with the prior month revised 1 tenth higher to 34.4 hours (the private sector workweek rose 2 tenths to 38.8 hours with manufacturing also up 2 tenths to 41.0 hours in a gain that points to strength for next week’s industrial production report).

The unemployment rate held at a very low 4.1 percent as discouraged workers flocked into the jobs market. The labor participation rate is another major headline, up 3 tenths to 63.0 percent and again well beyond high-end expectations.

The sheer strength of the hiring in this report would appear certain to raise expectations for four rate hikes this year as Fed policy makers may begin to grow impatient with their efforts to cool demand.

There was probably a boost from weather in February. According to Chicago Fed economist Francois Gourio: “February was significantly warmer than usual – positive weather effect in today’s NFP of about 80k according to our state model”. Even if weather boosted the NFP report by 80,000 jobs, this was still a strong report. If weather was a factor, we might see some payback in the March report.

Read more at http://www.calculatedriskblog.com/#fjXLw7chlFPWdFbv.99