Highlights In mixed results, March payroll growth of 103,000 is well below expectations but wage indications from average hourly earnings do show a little pressure as was expected, up 0.3 percent on the month with the year-on-year rate up 1 tenth to 2.7 percent. The unemployment rate did not move down which was the consensus, instead holding steady at what is still a very low 4.1 percent. Looking first at payroll growth, February and January have been revised with a net of minus 50,000 the result. The first quarter average of 202,000 is a bit below the fourth quarter’s 221,000. The breakdown for March shows another very strong showing for manufacturing, up 22,000 which hits Econoday’s consensus, and with professional & business services, a key component for tracking

Topics:

WARREN MOSLER considers the following as important: Economic Releases

This could be interesting, too:

WARREN MOSLER writes Consumer sentiment, real retail sales, industrial production, wages

WARREN MOSLER writes New manufacturers orders, vehicle sales, unemployment claims, rents, oil prices

WARREN MOSLER writes Saudi price hike, private payrolls, new hires, corporate profits

WARREN MOSLER writes Pending home sales, Durable goods orders, oil rigs and production

Highlights

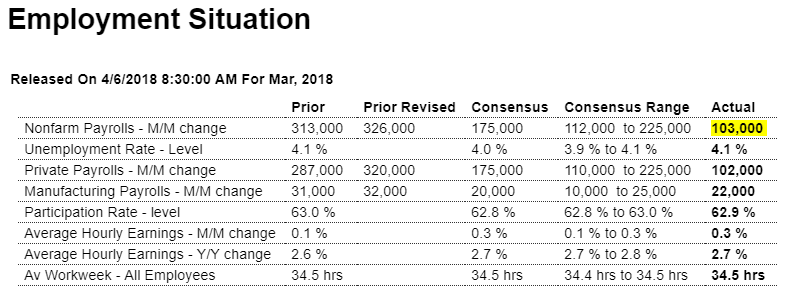

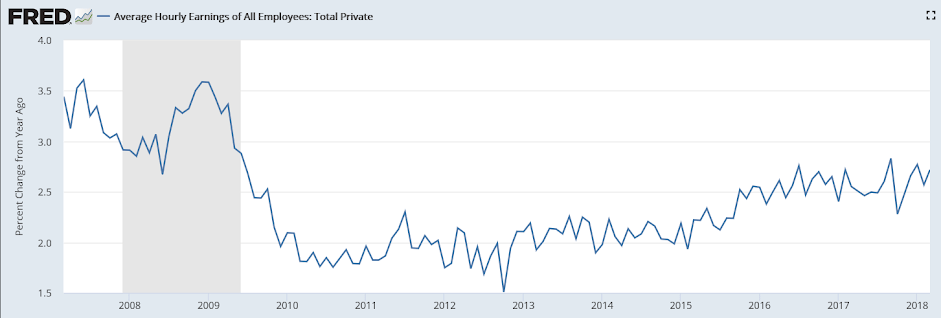

In mixed results, March payroll growth of 103,000 is well below expectations but wage indications from average hourly earnings do show a little pressure as was expected, up 0.3 percent on the month with the year-on-year rate up 1 tenth to 2.7 percent. The unemployment rate did not move down which was the consensus, instead holding steady at what is still a very low 4.1 percent.

Looking first at payroll growth, February and January have been revised with a net of minus 50,000 the result. The first quarter average of 202,000 is a bit below the fourth quarter’s 221,000. The breakdown for March shows another very strong showing for manufacturing, up 22,000 which hits Econoday’s consensus, and with professional & business services, a key component for tracking labor demand, rising a respectable 33,000. Yet the temporary help subcomponent for this reading fell 1,000 after rising 21,000 in February. And construction payrolls, which have been on the rise, fell 15,000. Retail also fell, down 4,000 in the month.

Judging by today’s results, the labor market wasn’t quite as hot as previously expected which turns down concern over wages even though those pressures did rise tangibly in March. On net, the March employment report will not likely turn up the heat on the Federal Reserve to increase its pace of rate tightenings.

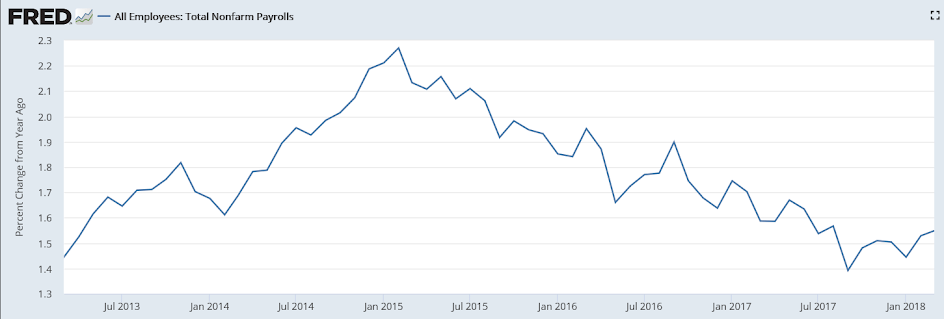

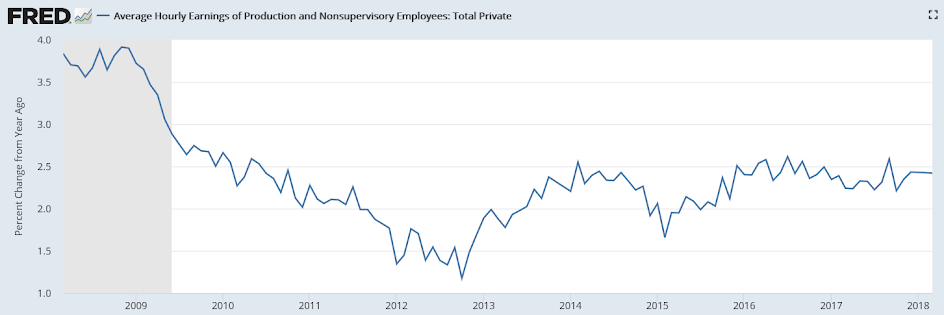

Still looking like it’s been going downhill for over two years:

I don’t see any ‘acceleration’ here:

Highlights

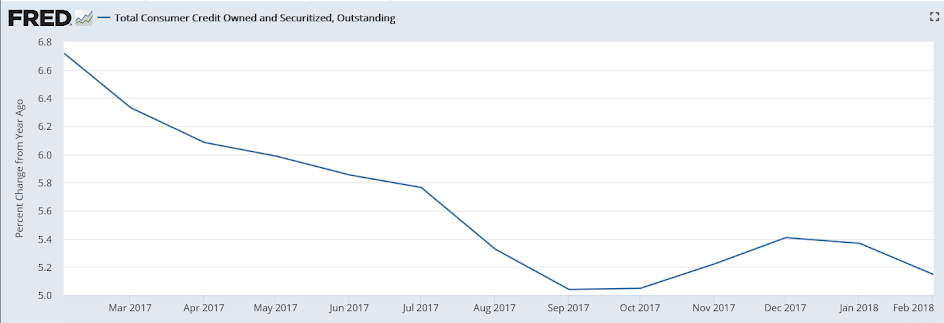

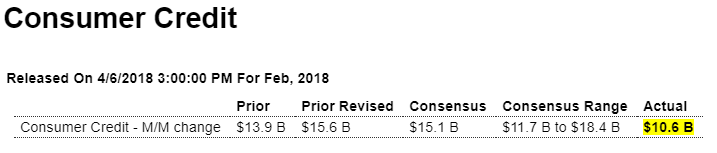

Consumer spending was soft in February and part of the reason was reluctance to run up credit cards. Revolving credit inched only $0.1 billion higher in February for the lowest result in 4-1/2 years. Nonrevolving credit, where student loans and vehicle financing are tracked, did rise $10.5 billion in the month which, however, is soft for this reading. Together they make for a $10.6 rise in total consumer credit which is well under Econoday’s low estimate. These results point to a cautious consumer and hint at trouble for the consumer’s contribution to first-quarter GDP.

Decelerating again after the mini spike in December that may have been used to buy Bitcoin: