Continuing to be negative year over year: Highlights Rising interest rates continue to dampen mortgage activity, with purchase applications for home mortgages falling a seasonally adjusted 2.3 percent in the November 9 week to the lowest level since February 2017 while refinancing applications decreased by 4.3 percent to the lowest level since December 2000. Unadjusted, purchase applications fell further into negative year-on-year territory and were 3 percent below their level in the same week last year. The refinance share of mortgage activity rose 0.3 percentage points from the prior week to 39.4 percent. Climbing to the highest level since 2010, the average interest rate on 30-year fixed rate conforming mortgages (3,100 or less) was up 2 basis points from the prior

Topics:

WARREN MOSLER considers the following as important: Economic Releases

This could be interesting, too:

WARREN MOSLER writes Consumer sentiment, real retail sales, industrial production, wages

WARREN MOSLER writes New manufacturers orders, vehicle sales, unemployment claims, rents, oil prices

WARREN MOSLER writes Saudi price hike, private payrolls, new hires, corporate profits

WARREN MOSLER writes Pending home sales, Durable goods orders, oil rigs and production

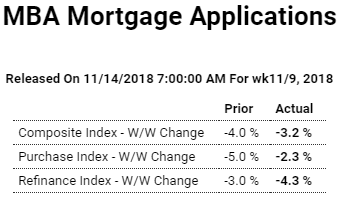

Continuing to be negative year over year:

Highlights

Rising interest rates continue to dampen mortgage activity, with purchase applications for home mortgages falling a seasonally adjusted 2.3 percent in the November 9 week to the lowest level since February 2017 while refinancing applications decreased by 4.3 percent to the lowest level since December 2000. Unadjusted, purchase applications fell further into negative year-on-year territory and were 3 percent below their level in the same week last year. The refinance share of mortgage activity rose 0.3 percentage points from the prior week to 39.4 percent. Climbing to the highest level since 2010, the average interest rate on 30-year fixed rate conforming mortgages ($453,100 or less) was up 2 basis points from the prior week to 5.17 percent.

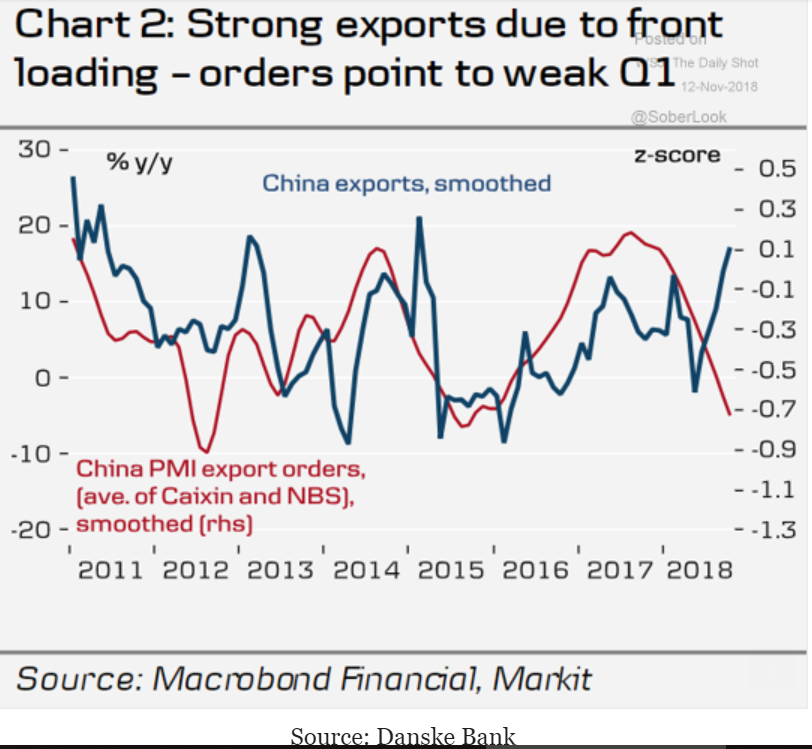

Trade issues taking their toll and bringing down the entire global economy:

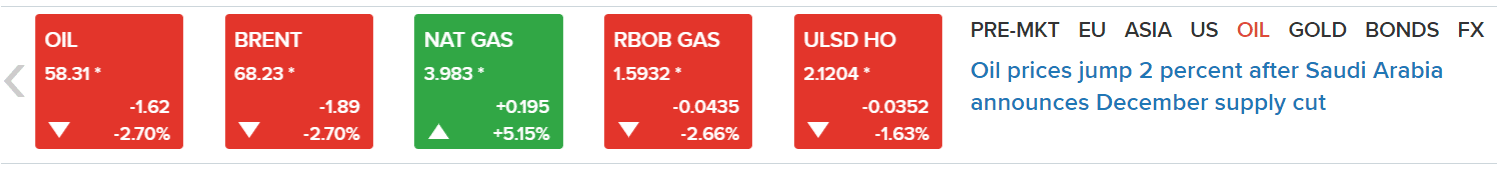

Sometimes the headlines make no sense to me vs the data…