Still depressed and going nowhere: Highlights Amid rising interest rates, purchase applications for home mortgages fell by a seasonally adjusted 6.0 percent in the February 9 week. Unadjusted, the year-on-year gain in the volume of purchase applications fell 4.0 percentage points to 4.0 percent. Applications for refinancing fell just 2.0 percent in the week, putting the refinancing share of mortgage applications up 0.1 percentage points to 46.5 percent. Mortgages rates rose to the highest level since January 2014, with the average interest on 30-year fixed rate conforming mortgages (3,100 or less) up 8 basis points from the prior week to 4.57 percent. Higher than expected which elevates expectations of Fed rate hikes: But the Fed may also be looking at this evidence

Topics:

WARREN MOSLER considers the following as important: Economic Releases

This could be interesting, too:

WARREN MOSLER writes Consumer sentiment, real retail sales, industrial production, wages

WARREN MOSLER writes New manufacturers orders, vehicle sales, unemployment claims, rents, oil prices

WARREN MOSLER writes Saudi price hike, private payrolls, new hires, corporate profits

WARREN MOSLER writes Pending home sales, Durable goods orders, oil rigs and production

Still depressed and going nowhere:

Highlights

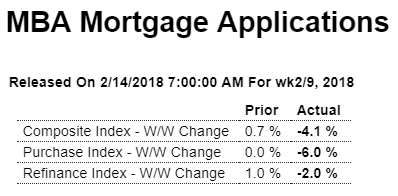

Amid rising interest rates, purchase applications for home mortgages fell by a seasonally adjusted 6.0 percent in the February 9 week. Unadjusted, the year-on-year gain in the volume of purchase applications fell 4.0 percentage points to 4.0 percent. Applications for refinancing fell just 2.0 percent in the week, putting the refinancing share of mortgage applications up 0.1 percentage points to 46.5 percent. Mortgages rates rose to the highest level since January 2014, with the average interest on 30-year fixed rate conforming mortgages ($453,100 or less) up 8 basis points from the prior week to 4.57 percent.

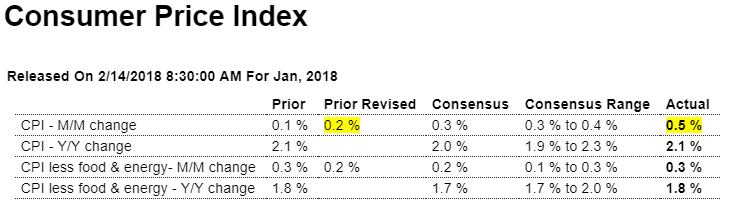

Higher than expected which elevates expectations of Fed rate hikes:

But the Fed may also be looking at this evidence of weakness:

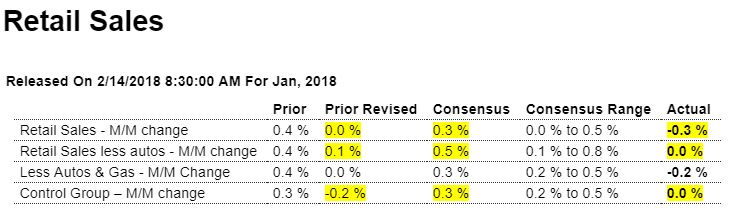

Worse than expected with prior month revised lower as well, ties in with previous discussion about low personal income growth, with this report now indicating personal savings wasn’t quite so low because spending was that much lower than first reported:

Highlights

Retail sales not only proved very soft in January, but a sharp downward revision to December looks certain to pull down what had been outstanding strength for consumer spending in fourth-quarter GDP. Retail sales fell 0.3 percent in January compared to Econoday’s low estimate for no change. December is revised down 4 tenths to unchanged with November, adding insult to injury, also revised down, 1 tenth lower to what is still an outstanding gain of 0.8 percent.

All three months show declines for the leading component which is motor vehicles, falling a very sharp 1.3 percent in January. The weakness here no doubt is the result of replacement demand following the hurricane season which pulled sales forward. Building materials are also weak, down 2.4 percent and in this case possibly reflecting January’s unusually severe weather. But however bad the weather was it didn’t help nonstore retailers, a component that is dominated by e-commerce and which proved dead flat in January with December’s initial surge of 1.2 percent revised down to a much more moderate looking 0.5 percent.

Clothing sales, which had been very soft, rose 1.2 percent in the month, echoing this morning’s consumer price report where apparel prices posted a sudden jump. Restaurant sales, which had been strong, were unchanged while furniture sales wobbled for a second month, down 0.4 percent.

The downward revision to December turns what had been a solid holiday shopping season into a so-so season. Control group sales, which are a direct input into GDP, did rise a very strong 1.2 percent in November but are now down 0.2 percent for December with January limping in at no change. After today’s report, the consumer sector gets a one-notch downgrade from strong to solid.