Purchase applications remain negative this year vs last: Highlights The June 15 week was an active one for mortgage bankers as the purchase index rose a solid 4.0 percent and the refinance index 6.0 percent. Despite the jump in the purchase index, its year-on-year rate remains in the negative column for a second straight week, at minus 1.0 percent. Turning back to refinancing, the outsized gain increased the share of mortgage activity to 36.8 percent of total applications vs 35.6 percent in the previous week. The average rate for 30-year fixed mortgages with conforming balances (3,100 or less) was unchanged at 4.83 percent. Higher than expected but last couple of months revised to lower numbers. In any case it’s relatively large, and the US continues to be dependent

Topics:

WARREN MOSLER considers the following as important: Economic Releases

This could be interesting, too:

WARREN MOSLER writes Consumer sentiment, real retail sales, industrial production, wages

WARREN MOSLER writes New manufacturers orders, vehicle sales, unemployment claims, rents, oil prices

WARREN MOSLER writes Saudi price hike, private payrolls, new hires, corporate profits

WARREN MOSLER writes Pending home sales, Durable goods orders, oil rigs and production

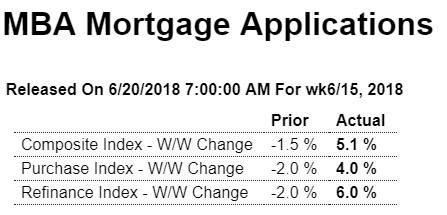

Purchase applications remain negative this year vs last:

Highlights

The June 15 week was an active one for mortgage bankers as the purchase index rose a solid 4.0 percent and the refinance index 6.0 percent. Despite the jump in the purchase index, its year-on-year rate remains in the negative column for a second straight week, at minus 1.0 percent. Turning back to refinancing, the outsized gain increased the share of mortgage activity to 36.8 percent of total applications vs 35.6 percent in the previous week. The average rate for 30-year fixed mortgages with conforming balances ($453,100 or less) was unchanged at 4.83 percent.

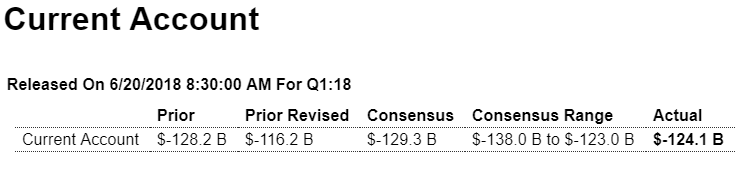

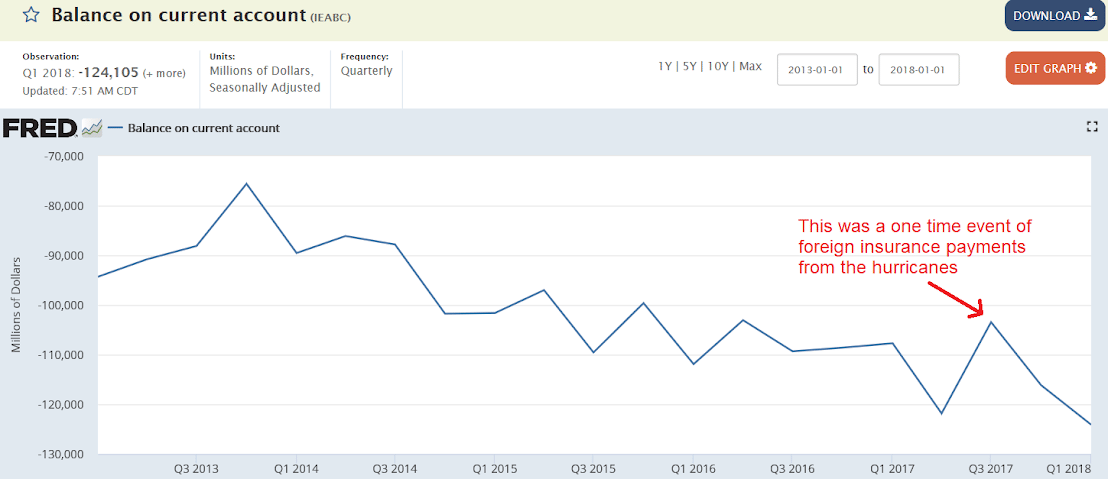

Higher than expected but last couple of months revised to lower numbers. In any case it’s relatively large, and the US continues to be dependent on imported oil, all of which is not $US friendly should the current trade policy result in reduced non resident desires to accumulate $US:

Highlights

A sharp rise in the nation’s deficit in goods trade made for a nearly $8 billion deepening in the first-quarter current deficit to $124.1 billion. Yet the result is much better than expected in what reflects a comparison with the fourth quarter which, when forecasters made their estimates, stood at $128.2 billion but is now revised sharply lower to $116.2 billion. Note that today’s report includes annual revisions.

The goods deficit swelled by $8.1 billion in the first quarter to $220.5 billion and was unable to be offset by other factors which were all flat including the surplus on service trade which did rise but only slightly to $0.3 billion. The main factors for the fourth-quarter revision are the surplus on primary income which was revised $5.2 billion higher, the surplus on services revised $4.2 billion higher, with the deficit on goods revised $1.9 billion lower.

As a percent of GDP, the first-quarter deficit rose to a still moderate 2.5 percent vs 2.4 percent in the prior quarter which was revised from 2.1 percent. This report, amid early skirmishes of trade war, will be taking on closer and closer scrutiny.

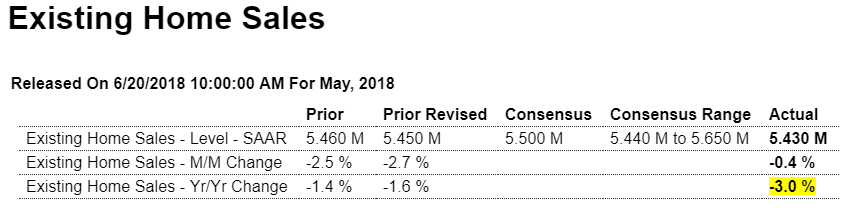

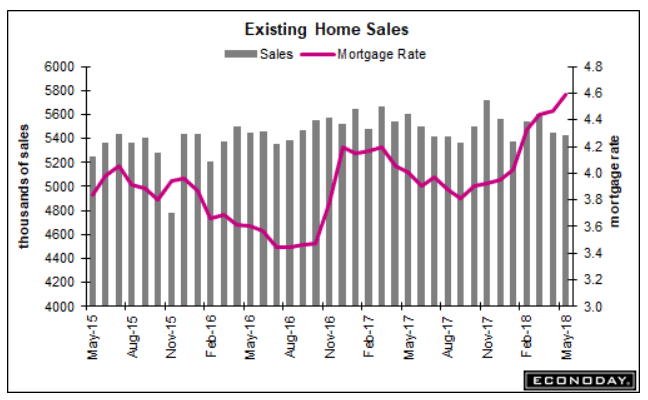

Confirming weakness in housing:

Highlights

The new home market is on the rise in sharp contrast to the resale market which is flat at best. Existing home sales slipped 0.4 percent in May to a lower-than-expected 5.430 million rate and a year-on-year decline of 3.0 percent. Part of the lack of sales traction may be due to prices which, in contrast to the decline in sales, rose 2.7 percent in the month to a record $264,800 for a year-on-year gain of 4.9 percent. Supply improved in the month but remains thin, up 2.8 percent to 1.850 million units on the market with supply relative to sales at 4.1 months vs 4.0 months in April.

The resale market remains a dead weight and is limiting the housing sector’s contribution to overall economic growth. In regional data, the Northeast popped higher in the month but remains the weakest resale region at an 11.7 percent yearly decline with the West at minus 4.1 percent and the Midwest at minus 2.3 percent. Sales in the South, which is by far the largest resale market, are unchanged on the year.

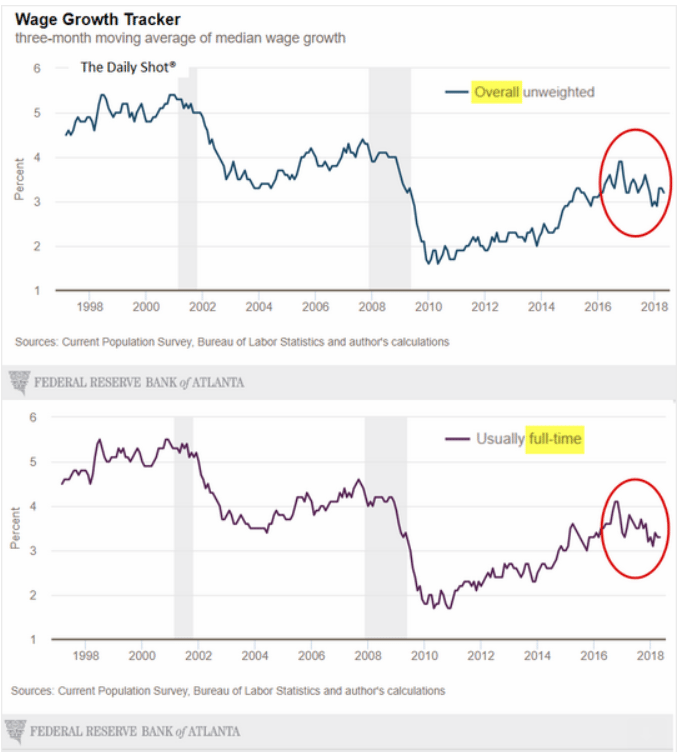

Wage growth continues to be depressed: