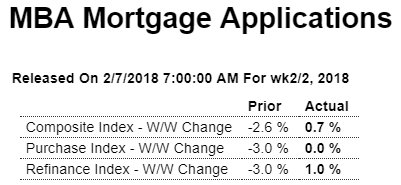

Still going nowhere: Highlights The volume of purchase applications for home mortgages remained unchanged on a seasonally adjusted basis in the February 2 week, while refinancing applications rose 1.0 percent from the previous week despite the headwind of rising interest rates. Unadjusted, purchase applications increased 7 percent from the previous week, though the year-on-year gain shed 2.0 percentage points to 8 percent. The refinancing share of mortgage activity fell 1.4 percentage points to 46.4 percent, the lowest level since July 2017. Mortgage rates continued to rise and accelerated their climb in the week, with the average interest rate on 30-year fixed rate conforming mortgages (3,100 or less) up 9 basis points to 4.50 percent, the highest level since April

Topics:

WARREN MOSLER considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

Still going nowhere:

Highlights

The volume of purchase applications for home mortgages remained unchanged on a seasonally adjusted basis in the February 2 week, while refinancing applications rose 1.0 percent from the previous week despite the headwind of rising interest rates. Unadjusted, purchase applications increased 7 percent from the previous week, though the year-on-year gain shed 2.0 percentage points to 8 percent. The refinancing share of mortgage activity fell 1.4 percentage points to 46.4 percent, the lowest level since July 2017. Mortgage rates continued to rise and accelerated their climb in the week, with the average interest rate on 30-year fixed rate conforming mortgages ($453,100 or less) up 9 basis points to 4.50 percent, the highest level since April 2014.

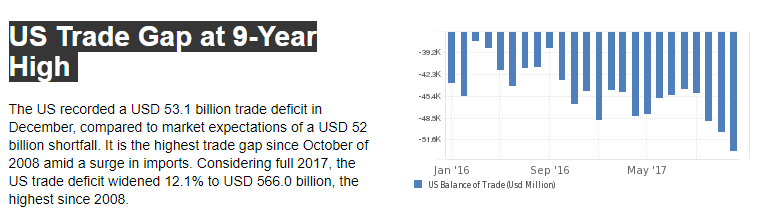

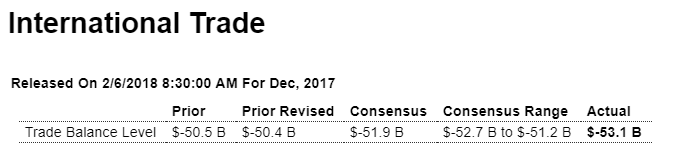

Worse than expected, but prior month revised higher, and still looking like a top to me:

Highlights

In bad news for fourth-quarter GDP revisions, the nation’s trade gap widened more sharply than expected in December, totaling $53.1 billion which just tops Econoday’s low estimate. Imports swelled by a steep 2.5 percent in the month to $256.5 billion which is a direct subtraction from GDP. The good news in the report is a solid 1.8 percent rise in exports to $203.4 billion which will add to GDP.

Imports of goods rose 2.9 percent to $210.8 billion with imports of services up 0.6 percent to $45.7 billion. Imports of consumer goods is the Achilles heel, at $55.5 billion for a 6.1 percent rise in the month.

Exports of goods, led by a strong rise in capital goods to $47.4 billion, rose 2.5 percent to $137.5 billion while growth in export of services remains slow, up only 0.2 percent to what is however a very positive $65.9 billion that does its share to hold down the total deficit.

Petroleum imports fell sharply to $15.8 billion as a decline in volume more than offset a rise in price. Exports of petroleum continue to catch up, at $12.5 billion for what is a modest petroleum deficit of $3.3 billion.

Country totals are in for full-year 2017 goods deficits and they are sizable: China up 8.1 percent on the year at $375.2 billion; EU up 3.2 percent at $151.4 billion; Mexico up 12.2 percent at $71.1 billion; Japan up fractionally at $68.9 billion; and Canada up the most by far in percentage terms, 63 percent higher to $17.6 billion.

Demand for foreign goods is bad for GDP but it does point to a very strong national appetite. Exports are on the rise which reflects the strength of global demand and also the decline in the dollar which, on the varying measures, fell about 10 percent during last year. For GDP which came in at an initial 2.6 percent annualized rate in the fourth quarter and was held down heavily by net exports, today’s data look to be an even bigger negative for the second estimate later this month.