It’s been decelerating all year with a year end move up that’s likely to be reversed as personal income growth continues to be very low: Highlights Consumer borrowing increased in December, up .4 billion vs an upwardly revised .0 billion in November which is the largest monthly increase since a break in the series 7 years ago. Revolving credit, a component that tracks credit-card debt, rose a sizable .1 billion following a November spike of .0 billion. On an annualized basis, revolving credit rose at a 6.0 percent pace in December. Non-revolving credit rose at a 5.7 percent pace in the month and in month-to-month dollar terms rose .3 billion. Gains in this component, which is nearly triple the size of the revolving component, were split between student

Topics:

WARREN MOSLER considers the following as important: Economic Releases

This could be interesting, too:

WARREN MOSLER writes Consumer sentiment, real retail sales, industrial production, wages

WARREN MOSLER writes New manufacturers orders, vehicle sales, unemployment claims, rents, oil prices

WARREN MOSLER writes Saudi price hike, private payrolls, new hires, corporate profits

WARREN MOSLER writes Pending home sales, Durable goods orders, oil rigs and production

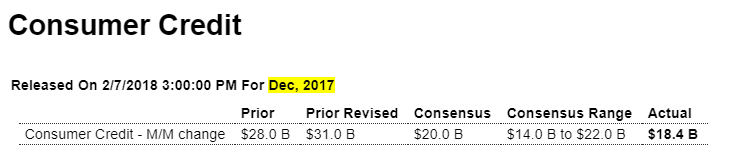

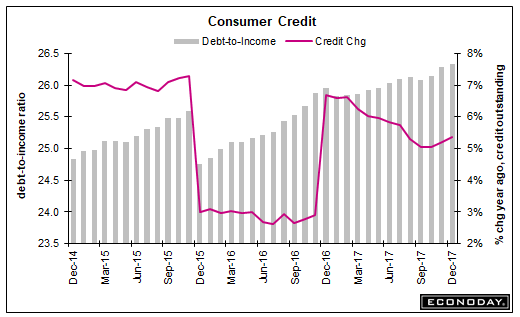

It’s been decelerating all year with a year end move up that’s likely to be reversed as personal income growth continues to be very low:

Highlights

Consumer borrowing increased in December, up $18.4 billion vs an upwardly revised $31.0 billion in November which is the largest monthly increase since a break in the series 7 years ago. Revolving credit, a component that tracks credit-card debt, rose a sizable $5.1 billion following a November spike of $11.0 billion. On an annualized basis, revolving credit rose at a 6.0 percent pace in December.

Non-revolving credit rose at a 5.7 percent pace in the month and in month-to-month dollar terms rose $13.3 billion. Gains in this component, which is nearly triple the size of the revolving component, were split between student loans and especially vehicle financing.

The gain for revolving credit does suggest that those shoppers who are cash strapped turned to their credit cards to do their share to fund the holiday shopping season.

To my point about a general ‘mania’ that seems to be fading:

Bitcoin becomes just like everything else on Wall Street as correlation with stocks jumps to 2-year high

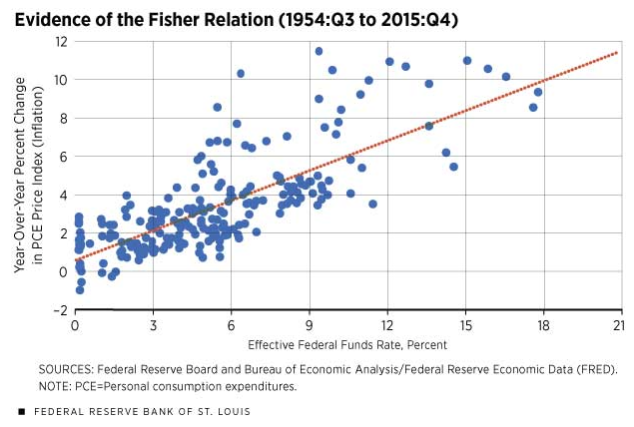

The notion that higher rates from the Fed cause higher inflation seems to be getting a bit of a hearing;

Neo-Fisherism: A Radical Idea, or the Most Obvious Solution to the Low-Inflation Problem?