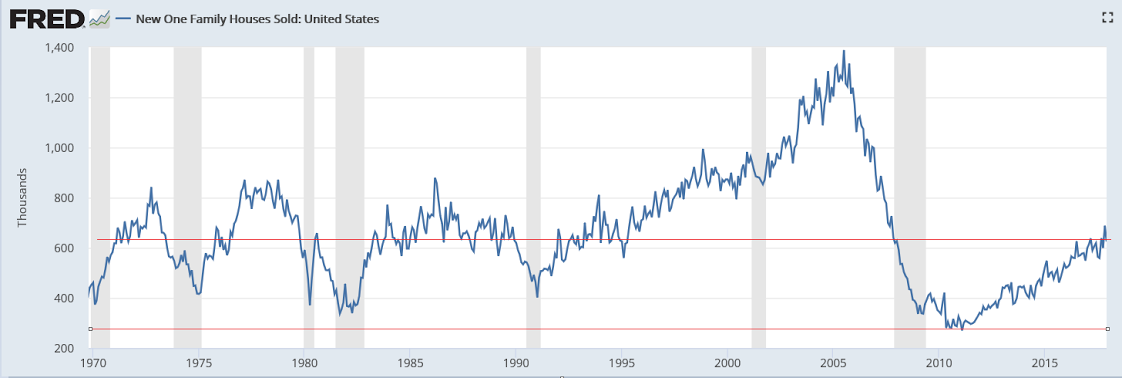

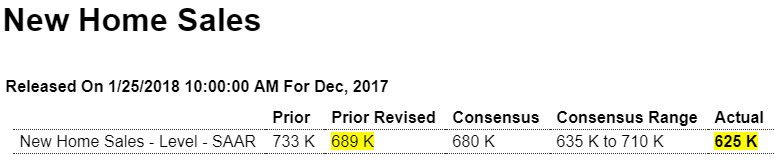

Much lower than expected, and last month’s number, which was touted as the turning point for housing, was revised lower as well. And note from the chart we’re still below the levels of the 1970’s when the population was about 40% lower: Highlights The headline 9.3 percent decline in new home sales for December masks what is actually a solid new home sales report. December’s 625,000 annualized rate is the fourth best of the expansion and follows November’s revised 689,000 rate which is the very best. And importantly supply moved into the market, up 3.9 percent at 295,000 units. On a sales basis, supply improved to 5.7 months from November’s 4.9 months. Prices were steady in the month with the median edging up 0.1 percent to 5,400 for, however, very modest year-on-year

Topics:

WARREN MOSLER considers the following as important: Economic Releases

This could be interesting, too:

WARREN MOSLER writes Consumer sentiment, real retail sales, industrial production, wages

WARREN MOSLER writes New manufacturers orders, vehicle sales, unemployment claims, rents, oil prices

WARREN MOSLER writes Saudi price hike, private payrolls, new hires, corporate profits

WARREN MOSLER writes Pending home sales, Durable goods orders, oil rigs and production

Much lower than expected, and last month’s number, which was touted as the turning point for housing, was revised lower as well. And note from the chart we’re still below the levels of the 1970’s when the population was about 40% lower:

Highlights

The headline 9.3 percent decline in new home sales for December masks what is actually a solid new home sales report. December’s 625,000 annualized rate is the fourth best of the expansion and follows November’s revised 689,000 rate which is the very best. And importantly supply moved into the market, up 3.9 percent at 295,000 units. On a sales basis, supply improved to 5.7 months from November’s 4.9 months.

Prices were steady in the month with the median edging up 0.1 percent to $335,400 for, however, very modest year-on-year improvement of only 2.6 percent. But prices may have room to move higher given that the sales rate is up 14.1 percent on the year with supply up 15.2 percent.

The downward revisions in today’s report are significant, totaling 69,000 going back to October but this is really no surprise given how volatile this report always is. But the bottom line is upward sales momentum, incoming supply and room for prices to move higher. Residential investment has been dragging down GDP in recent quarters but today’s report points to a solid contribution for tomorrow’s fourth-quarter report.