The second article reveals the year over year situation, which takes out seasonal factors: Highlights Existing home sales have been struggling to move higher but today’s pending home sales index will raise expectations for improvement. Pending home sales rose a sharp 3.1 percent in data for February though they follow an even sharper 5.0 percent revised decline in January. The Northeast has been showing life in recent housing data with February pending sales jumping 10.3 percent in the month. Pending sales in the South rose 3.0 percent with the Midwest up 0.7 percent and the West up 0.4 percent. United States Pending Home Sales Contracts to buy previously owned homes in the United States shrank 4.1 percent year-on-year in February of 2018, following an upwardly revised

Topics:

WARREN MOSLER considers the following as important: Economic Releases

This could be interesting, too:

WARREN MOSLER writes Consumer sentiment, real retail sales, industrial production, wages

WARREN MOSLER writes New manufacturers orders, vehicle sales, unemployment claims, rents, oil prices

WARREN MOSLER writes Saudi price hike, private payrolls, new hires, corporate profits

WARREN MOSLER writes Pending home sales, Durable goods orders, oil rigs and production

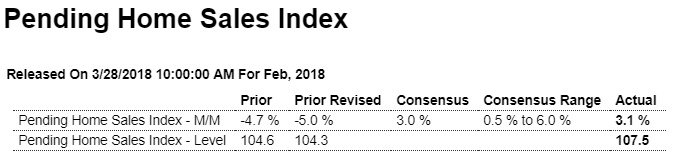

The second article reveals the year over year situation, which takes out seasonal factors:

Highlights

Existing home sales have been struggling to move higher but today’s pending home sales index will raise expectations for improvement. Pending home sales rose a sharp 3.1 percent in data for February though they follow an even sharper 5.0 percent revised decline in January. The Northeast has been showing life in recent housing data with February pending sales jumping 10.3 percent in the month. Pending sales in the South rose 3.0 percent with the Midwest up 0.7 percent and the West up 0.4 percent.

United States Pending Home Sales

Contracts to buy previously owned homes in the United States shrank 4.1 percent year-on-year in February of 2018, following an upwardly revised 4 percent drop in January. It is the biggest decline since June of 2014 as contracts fell in all main regions: Northeast (-5.1 percent), Midwest (-9.5 percent), South (-1.5 percent) and the West (-2.2 percent). Compared to the previous month, pending home sales increased 3.1 percent, rebounding from an upwardly revised 5 percent fall in January and beating forecasts of a 2.1 percent gain.

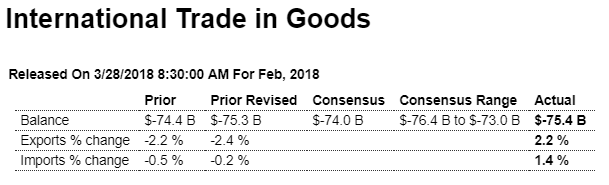

Worse than expected, nor are rising inventories a good sign:

Highlights

The nation’s trade deficit in goods failed to improve in February, at a very steep $75.4 billion which is nearly $1.5 billion deeper than Econoday’s consensus and little changed from January’s revised $75.3 billion. Imports rose 1.4 percent in the month with foods rising sharply along with imports of capital goods and industrial supplies as well. Imports of vehicles rose sizably but not consumer goods which posted only a small gain.

Exports are actually strong in this report, up 2.2 percent with gains centered in vehicles, which are usually a weak category, and also capital goods which is the nation’s strength. Exports of consumer goods, a major weakness, declined sharply after bouncing higher in January.

Based on two months of data, net exports won’t be helping first-quarter GDP though the negative pull may be offset by a rising inventory build, data for which were also released this morning.

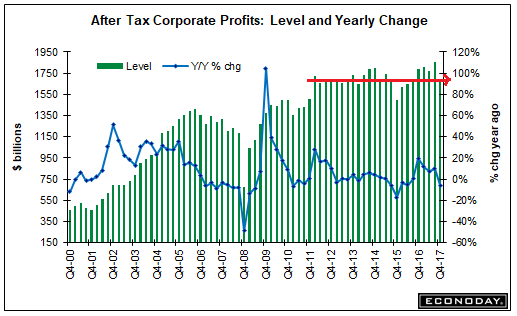

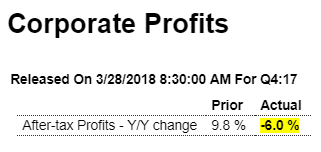

The mainstream had been measuring profit growth from the 2015 dip, but now seems they’ve settled in at about prior year levels and are showing now growth:

Highlights

Going into 2018, corporate profits weren’t getting any tax-related boost. After-tax corporate profits fell a year-on-year 6.0 percent in the fourth quarter to $1.68 trillion compared to a 5.8 percent decline on a pre-tax basis to $2.13 trillion. Profits are after tax without inventory valuation or capital consumption adjustments.