Highlights It was a very good holiday shopping season but perhaps not a great one. Retail sales rose a solid 0.4 percent in December which is just shy of Econoday’s consensus though November is revised 1 tenth higher to what is a standout gain of 0.9 percent. Core readings show similar strength with all pointing to a solid consumer contribution to fourth-quarter GDP. Nonstore retailers, a component which e-commerce dominates, did in fact have a great season. Sales here rose 1.2 percent in December on top of November’s 4.2 percent surge. These gains no doubt came at the expense of brick-and-mortar boxes as general merchandise inched only 0.1 percent and 0.3 percent higher in the two months with the sub-component for department stores down a very noticeable 1.1 percent in

Topics:

WARREN MOSLER considers the following as important: Economic Releases

This could be interesting, too:

WARREN MOSLER writes Consumer sentiment, real retail sales, industrial production, wages

WARREN MOSLER writes New manufacturers orders, vehicle sales, unemployment claims, rents, oil prices

WARREN MOSLER writes Saudi price hike, private payrolls, new hires, corporate profits

WARREN MOSLER writes Pending home sales, Durable goods orders, oil rigs and production

Highlights

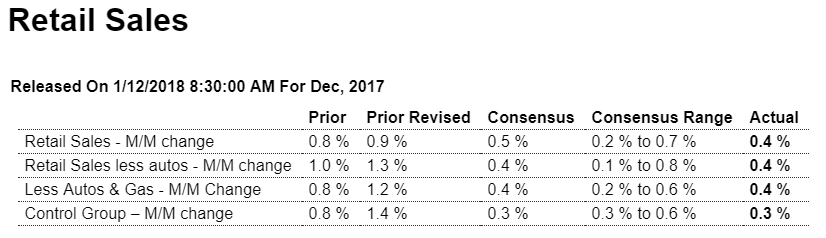

It was a very good holiday shopping season but perhaps not a great one. Retail sales rose a solid 0.4 percent in December which is just shy of Econoday’s consensus though November is revised 1 tenth higher to what is a standout gain of 0.9 percent. Core readings show similar strength with all pointing to a solid consumer contribution to fourth-quarter GDP.

Nonstore retailers, a component which e-commerce dominates, did in fact have a great season. Sales here rose 1.2 percent in December on top of November’s 4.2 percent surge. These gains no doubt came at the expense of brick-and-mortar boxes as general merchandise inched only 0.1 percent and 0.3 percent higher in the two months with the sub-component for department stores down a very noticeable 1.1 percent in December. Clothing stores are another December disappointment, falling 0.3 percent and reflecting price discounting as evidenced in the apparel reading of this morning’s consumer price report.

But furniture stores had a very good season with December and November gains of 0.6 percent and 0.5 percent. And in further evidence of housing strength, building material sales jumped 1.2 percent in December following November’s 0.5 percent gain. Restaurants are also positive with December and November gains of 0.7 and 0.5 percent. Vehicle sales rose 0.2 percent in December with gasoline sales unchanged.

The consumer was alive during the holidays but not unrestrained. Likely gains underway in wages along with the enormous strength in confidence and in the labor market are positives going into the 2018 economy.

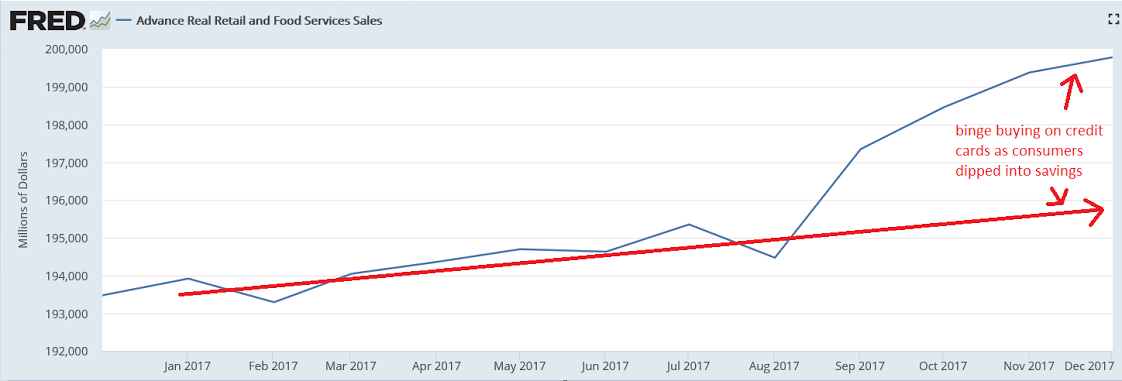

The year end binge buying financed by consumers adding to credit cards as income fell short doesn’t seem at all sustainable:

The $US is down maybe 10% since the election, and looks to be going lower as:

1. The relatively large US trade and current account deficits have been getting larger, exacerbated by higher oil prices

2. The President’s trade initiatives are often ‘weak dollar’ stories

3. Fed rate hikes fundamentally weaken the $US via interest income channels

4. US trade policy is reducing non-resident desires to accumulate $US financial assets

So yes, equity prices are higher, but in terms of foreign currencies, such as the euro, not so much. And a lower $US could translate into higher US inflation should import prices increase. Along those lines, the Saudis could be targeting a non-dollar price for their oil, such as the price in euro, for example, which could mean a higher $US oil price. And higher gasoline price can slow the US consumer should income growth continue to lag: