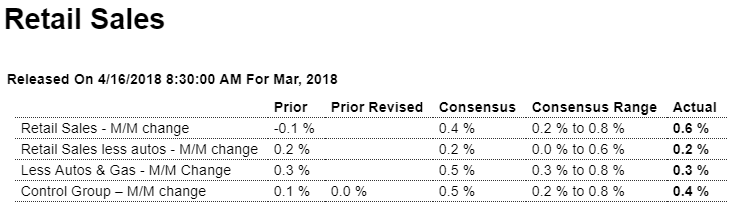

Propped up by autos, as the rest continues weak, and autos aren’t looking so good longer term either: Highlights In a slight reversal of expectations, retail sales proved stronger at the headline level, up 0.6 percent in March, than the core readings which did however still post respectable gains at 0.3 percent less autos and gas and 0.4 percent for the control group. Autos are the big story in March, jumping 2.0 percent and finally shaking off the long lull following the replacement surge of September’s hurricanes. Excluding autos, retail sales managed only a 0.2 percent gain following only 0.2 percent and 0.1 percent gains in the prior two months in results that do not point to much consumer strength. Department stores are having a very hard time, falling 0.3 percent

Topics:

WARREN MOSLER considers the following as important: Economic Releases

This could be interesting, too:

WARREN MOSLER writes Consumer sentiment, real retail sales, industrial production, wages

WARREN MOSLER writes New manufacturers orders, vehicle sales, unemployment claims, rents, oil prices

WARREN MOSLER writes Saudi price hike, private payrolls, new hires, corporate profits

WARREN MOSLER writes Pending home sales, Durable goods orders, oil rigs and production

Propped up by autos, as the rest continues weak, and autos aren’t looking so good longer term either:

Highlights

In a slight reversal of expectations, retail sales proved stronger at the headline level, up 0.6 percent in March, than the core readings which did however still post respectable gains at 0.3 percent less autos and gas and 0.4 percent for the control group.

Autos are the big story in March, jumping 2.0 percent and finally shaking off the long lull following the replacement surge of September’s hurricanes. Excluding autos, retail sales managed only a 0.2 percent gain following only 0.2 percent and 0.1 percent gains in the prior two months in results that do not point to much consumer strength.

Department stores are having a very hard time, falling 0.3 percent after February’s 0.9 percent plunge. Clothing stores also posted a big decline in the month, at 0.8 percent, as did building materials at minus 0.6 percent and sporting goods at 1.8 percent. Gasoline proved a bit of a wildcard in this report, falling only 0.3 percent which is less severe than many expected.

But there are positives in the report including a second straight 0.4 percent gain for restaurants and a second straight solid rise, at 0.7 percent, for furniture stores. And nonstore retailers are once again at the top of the data, at a 0.8 percent gain following February’s 0.9 percent jump.

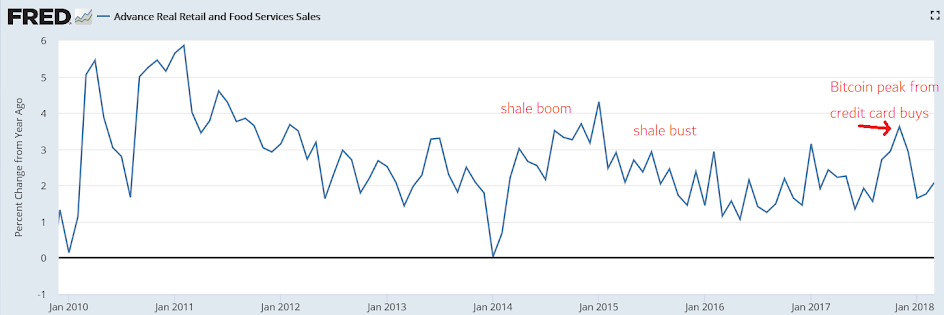

But this report, after two soft showings in January and February, doesn’t show the fundamental acceleration that was expected for March, evident in the year-on-year growth rates for the core readings: down 2 tenths to 3.9 percent ex-gas ex-auto and down 3 tenths for the control group at 3.8 percent. Though service spending may very well bail out the first quarter, consumer spending doesn’t look to be much of a contributor to first-quarter GDP.

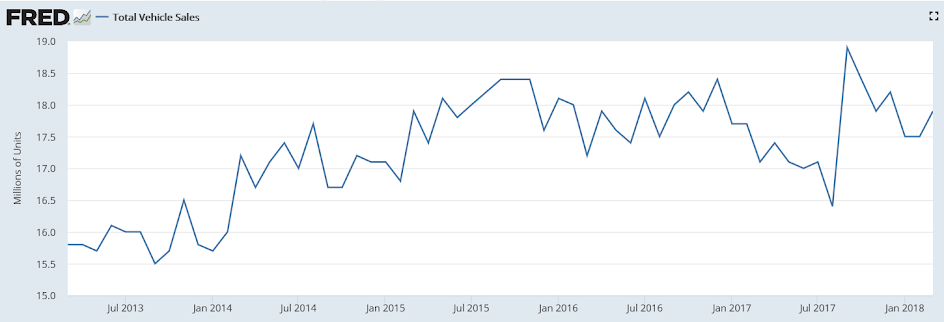

Last months small move up in vehicle sales was what caused retail sales to be better than expected:

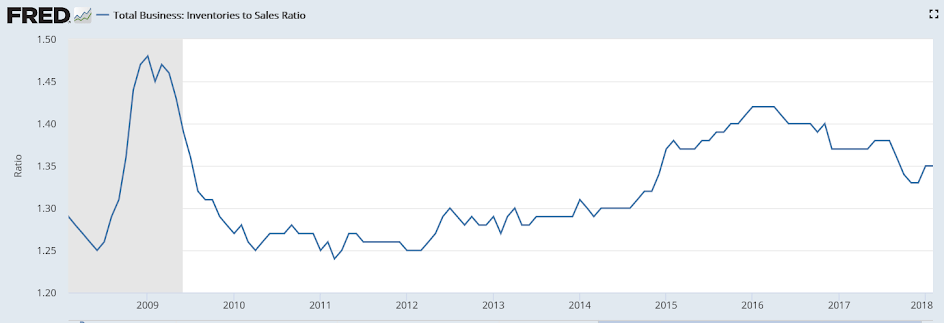

Inventories are still elevated relative to sales: