Worse than expected and now down for the last three months, not adjusted for inflation. And all in line with the narrative about personal income going flat and the falling savings rate: Highlights The big tax cut isn’t being passed to the nation’s retailers. Retail sales once again missed expectations badly, at minus 0.1 percent in February vs Econoday’s consensus for a 0.4 percent gain and a low estimate for a 0.1 percent gain. The job market may be high and confidence near long-term time highs but the consumer is definitely not on a spending spree. Department stores were especially weak in February, down 0.9 percent with furniture store sales also weak, down 0.8 percent and sales at health & personal care stores down 0.4 percent. What isn’t a surprise is a 4th straight

Topics:

WARREN MOSLER considers the following as important: Economic Releases

This could be interesting, too:

WARREN MOSLER writes Consumer sentiment, real retail sales, industrial production, wages

WARREN MOSLER writes New manufacturers orders, vehicle sales, unemployment claims, rents, oil prices

WARREN MOSLER writes Saudi price hike, private payrolls, new hires, corporate profits

WARREN MOSLER writes Pending home sales, Durable goods orders, oil rigs and production

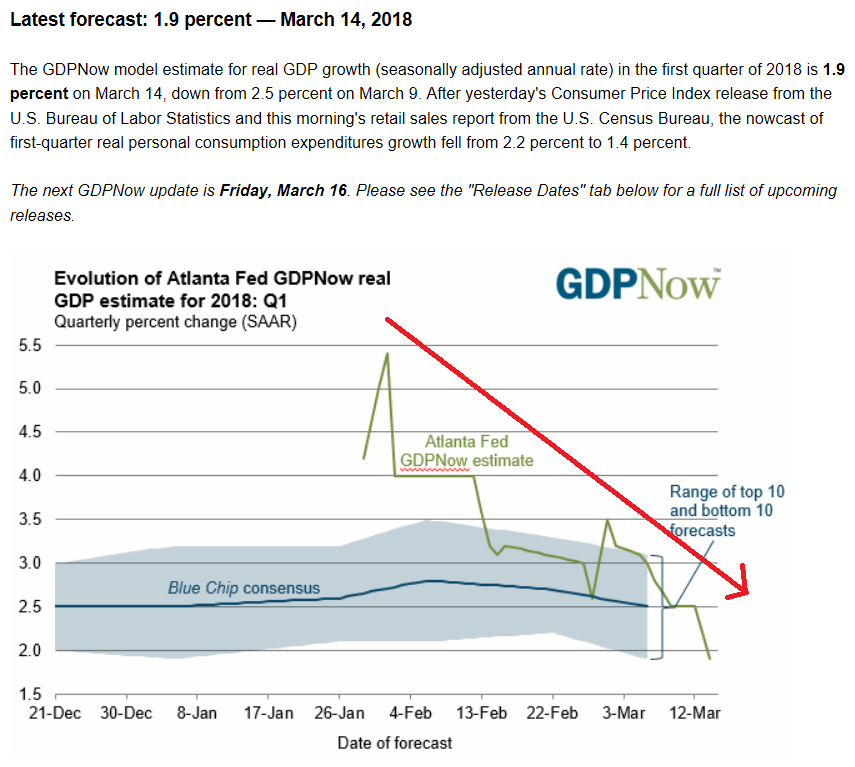

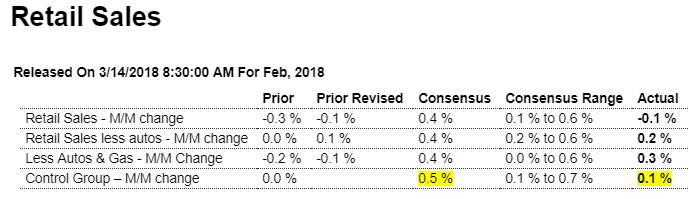

Worse than expected and now down for the last three months, not adjusted for inflation. And all in line with the narrative about personal income going flat and the falling savings rate:

Highlights

The big tax cut isn’t being passed to the nation’s retailers. Retail sales once again missed expectations badly, at minus 0.1 percent in February vs Econoday’s consensus for a 0.4 percent gain and a low estimate for a 0.1 percent gain. The job market may be high and confidence near long-term time highs but the consumer is definitely not on a spending spree.

Department stores were especially weak in February, down 0.9 percent with furniture store sales also weak, down 0.8 percent and sales at health & personal care stores down 0.4 percent. What isn’t a surprise is a 4th straight month of decline at vehicle dealers, down a very sharp 0.9 percent in a drop that re-emphasizes the effect of the spike in the hurricane season which pulled sales forward. Sales at gasoline stores are also a negative, down 1.2 percent with food sales down 0.1 percent.

Now the positives and these are led by nonretailers where sales, after a sharp January fall that followed a positive holiday season, jumped a monthly 1 percent. Building materials are also positive, up 1.9 percent that reverses a 1.7 percent decline in January. Restaurants are another positive but only barely at a 0.2 percent monthly gain which follows January’s marginal 0.1 percent improvement.

But there really should be no alarm on the consumer as retail sales in fact remain positive, evident in the total year-on-year rate which is up 1 tenth to a respectable 4.0 percent with the control group up 3 tenths to 4.2 percent. Should spending on services continue to show strength, consumer spending can still post passable first-quarter results.