The trade deficit narrowed but due to a drop in consumer spending on imported cell phones, which doesn’t bode well for retail sales, which are under pressure from the reduced growth of real disposable personal income. And the widening trade gap with the euro area is fundamentally euro friendly even as fears of Italian politics are frightening portfolio managers: Highlights Helped by a dip in cellphone imports, the nation’s trade gap narrowed sharply in April to a much lower-than-expected .2 billion. Cellphone imports fell .2 billion to pull down the consumer-goods deficit which narrowed by .8 billion in the month. Despite the improvement for consumer goods, the bilateral gap with China rose a noticeable .1 billion to an unadjusted .0 billion in results that

Topics:

WARREN MOSLER considers the following as important: Economic Releases

This could be interesting, too:

WARREN MOSLER writes Consumer sentiment, real retail sales, industrial production, wages

WARREN MOSLER writes New manufacturers orders, vehicle sales, unemployment claims, rents, oil prices

WARREN MOSLER writes Saudi price hike, private payrolls, new hires, corporate profits

WARREN MOSLER writes Pending home sales, Durable goods orders, oil rigs and production

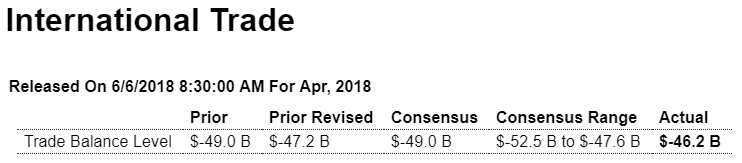

The trade deficit narrowed but due to a drop in consumer spending on imported cell phones, which doesn’t bode well for retail sales, which are under pressure from the reduced growth of real disposable personal income. And the widening trade gap with the euro area is fundamentally euro friendly even as fears of Italian politics are frightening portfolio managers:

Highlights

Helped by a dip in cellphone imports, the nation’s trade gap narrowed sharply in April to a much lower-than-expected $46.2 billion. Cellphone imports fell $2.2 billion to pull down the consumer-goods deficit which narrowed by $2.8 billion in the month.

Despite the improvement for consumer goods, the bilateral gap with China rose a noticeable $2.1 billion to an unadjusted $28.0 billion in results that probably won’t ease ongoing trade friction. Note that country data, unlike other data in this report, are traditionally tracked in unadjusted terms due to small monthly totals yet adjusted data for China are available and tell a different story with the gap at a higher level of $30.8 billion but down in month-to-month terms from an adjusted $34.2 billion in March.

Turning back to unadjusted country data, the gap with Europe also deepened, by $2.5 billion in April to $14.6 billion with the Japanese gap little changed at $6.3 billion. Turning to North America, the gap with Mexico narrowed by $2.4 billion to a deficit of $5.7 billion while a small March surplus with Canada turned into a $785 million deficit in April.

Imports of iron and steel mill products rose $228 million to $2.1 billion with imports of bauxite and aluminum up slightly to $1.5 billion. It will be interesting to watch whether these totals, due to U.S. tariffs on steel and aluminum, begin to slide in the month’s ahead.

Overall, exports rose 0.3 percent in the month to $221.2 billion with goods, led by a gain for industrial supplies and also food, up 0.2 percent at $141.3 billion and despite a 0.1 percent slip in service exports which totaled $70 billion. Imports fell 0.2 percent with goods, again reflecting the weakness in cellphones, down 0.3 percent to $209.5 billion and services up 0.6 percent to $47.9 billion.

April’s deficit is more than $1 billion narrower than March and far under the $53.1 billion monthly average of the first quarter. This points to a big net-export lift for second-quarter GDP.

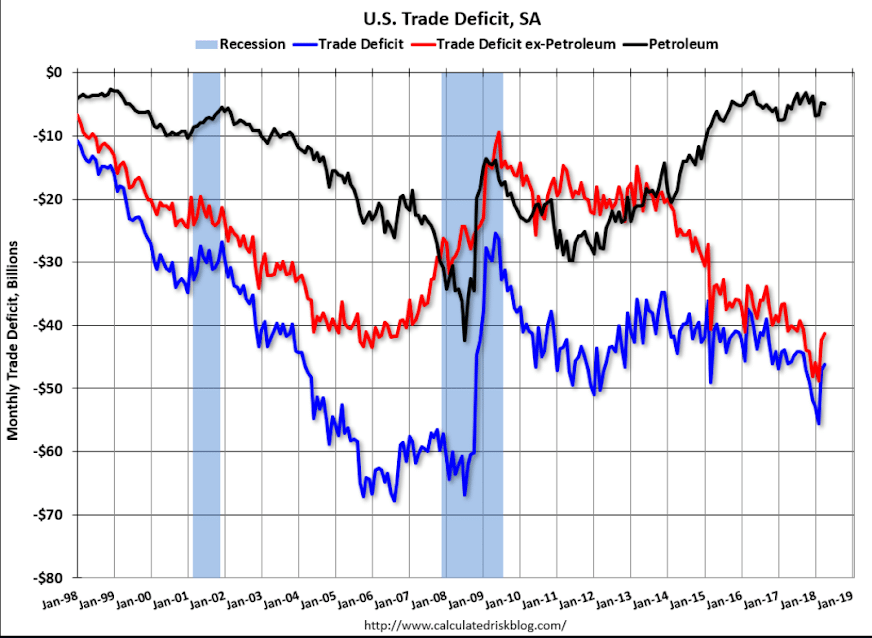

The petroleum deficit appears to have leveled off, while trade overall still looks to be trending further into deficit, recognizing the volatility around year end:

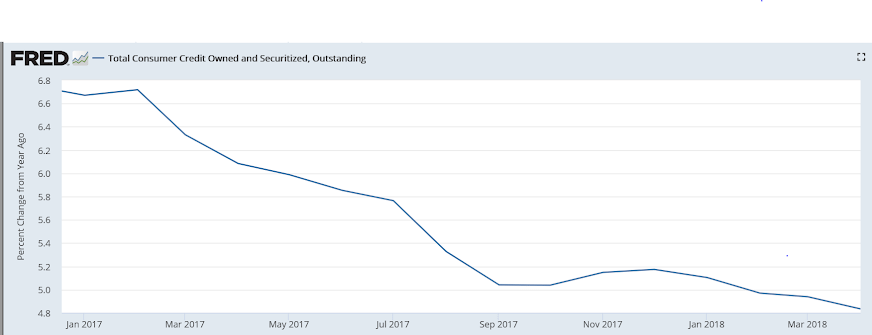

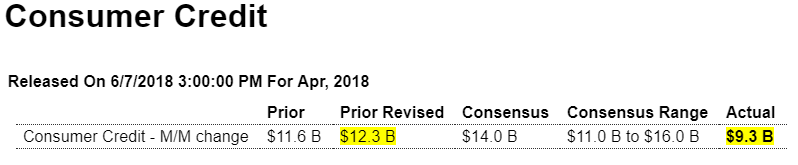

Deceleration continues:

Highlights

Consumer credit rose a lower-than-expected $9.3 billion in April though consumers did run up their credit-card debt slightly as revolving credit, which was in the negative column the last two reports, rose $2.3 billion in the month. Nonrevolving credit, which includes student loans and also vehicle financing and which often posts double-digit gains, rose only $7.0 billion in the month.