Bankruptcy-related job losses invoke grim reminders of Great Recession In the first seven months of the year, U.S.-based companies announced 42,937 job cuts due to bankruptcy, up 40% from the same period last year and nearly 20% higher than all bankruptcy-related job losses last year, a report released Tuesday concluded. Despite record-low unemployment, bankruptcy filings have not claimed this many jobs since the Great Recession.“It is the highest seven-month total since 2009 when 50,258 cuts due to bankruptcy were announced,” according to the report by outplacement and business coaching firm Challenger, Gray & Christmas. “In fact, it is higher than the annual totals for bankruptcy cuts every year since 2009.” Not good, sales in contraction: Highlights Inventories in

Topics:

WARREN MOSLER considers the following as important: Economic Releases

This could be interesting, too:

WARREN MOSLER writes Consumer sentiment, real retail sales, industrial production, wages

WARREN MOSLER writes New manufacturers orders, vehicle sales, unemployment claims, rents, oil prices

WARREN MOSLER writes Saudi price hike, private payrolls, new hires, corporate profits

WARREN MOSLER writes Pending home sales, Durable goods orders, oil rigs and production

Bankruptcy-related job losses invoke grim reminders of Great Recession

In the first seven months of the year, U.S.-based companies announced 42,937 job cuts due to bankruptcy, up 40% from the same period last year and nearly 20% higher than all bankruptcy-related job losses last year, a report released Tuesday concluded. Despite record-low unemployment, bankruptcy filings have not claimed this many jobs since the Great Recession.

“It is the highest seven-month total since 2009 when 50,258 cuts due to bankruptcy were announced,” according to the report by outplacement and business coaching firm Challenger, Gray & Christmas. “In fact, it is higher than the annual totals for bankruptcy cuts every year since 2009.”

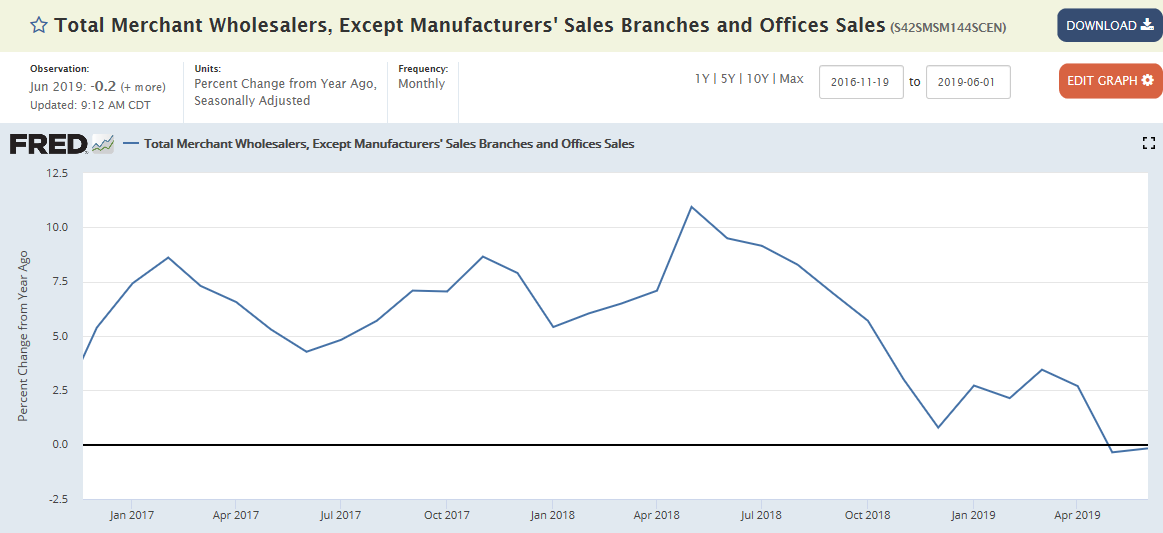

Not good, sales in contraction:

Highlights

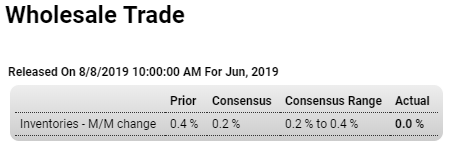

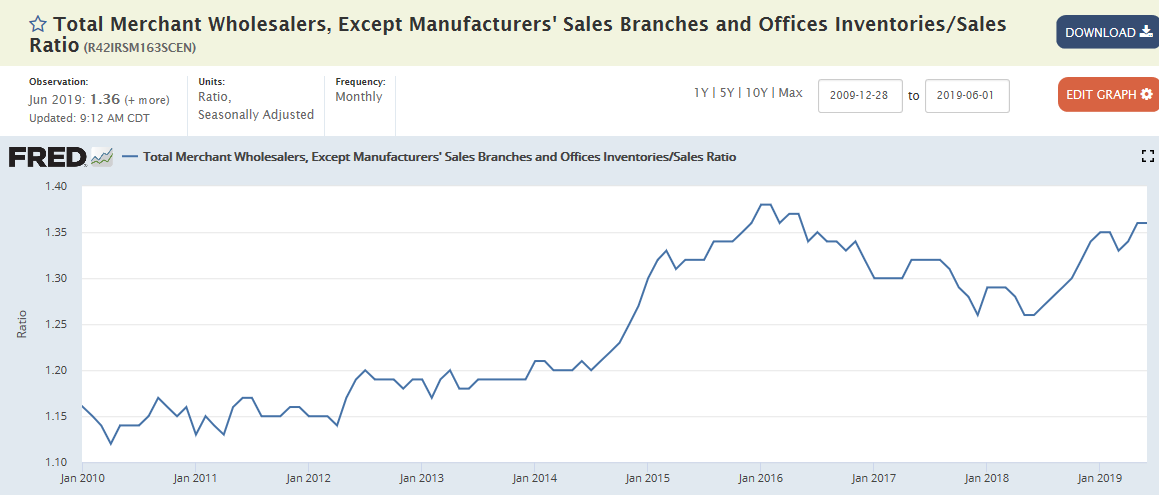

Inventories in the wholesale sector were unchanged in the second estimate, down from a 0.2 percent build in the first estimate (which will be a small negative for second-quarter GDP revisions) and compared to a 0.4 percent build in May. Inventories may be steady but not sales which fell 0.3 percent in the wholesale sector during June after a 0.6 percent decline in May. Year-on-year, sales in June were down 0.2 percent versus a 7.6 percent rise in inventories which hints at a slowing inventory build ahead. Inventories of autos did fall 0.2 percent in June but were still up 17.4 percent on the year. This will likely be a negative for near-term auto production.

Inventories excessive and rising as sales slow:

Now that the ‘counter-intuitive’ rate cut worked in Erdogan’s favor, good chance more to come?

Turkish Lira

The Turkish lira rose to 5.484 against the US dollar on Thursday, the highest since early April