Interest-Rate Policy Is Backward, Modern Monetary Theory Pioneer Mosler Says Under consumption identity: for ever agent that spent less than his income, another must have spent more, or the output would not have been sold. In other words, deficit spending, private or public, is the ‘offset’ to unspent income (savings). The chart shows one of the components of private sector deficit spending which appears to align with economic growth: Tariffs (levied on the grounds that China and others weren’t charging us enough…) causing the collapse in exports globally, and import weakness most often is a sign of domestic demand weakness: Highlights Sharp declines in exports are unwelcome headlines in April’s advance data on goods trade. The monthly deficit remains very deep, at

Topics:

WARREN MOSLER considers the following as important: Economic Releases

This could be interesting, too:

WARREN MOSLER writes Consumer sentiment, real retail sales, industrial production, wages

WARREN MOSLER writes New manufacturers orders, vehicle sales, unemployment claims, rents, oil prices

WARREN MOSLER writes Saudi price hike, private payrolls, new hires, corporate profits

WARREN MOSLER writes Pending home sales, Durable goods orders, oil rigs and production

Interest-Rate Policy Is Backward, Modern Monetary Theory Pioneer Mosler Says

Under consumption identity: for ever agent that spent less than his income, another must have spent more, or the output would not have been sold.

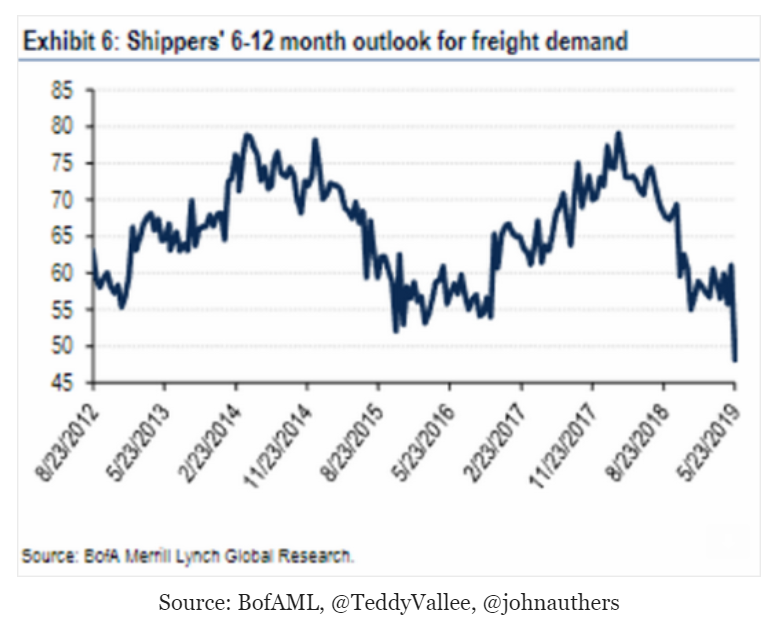

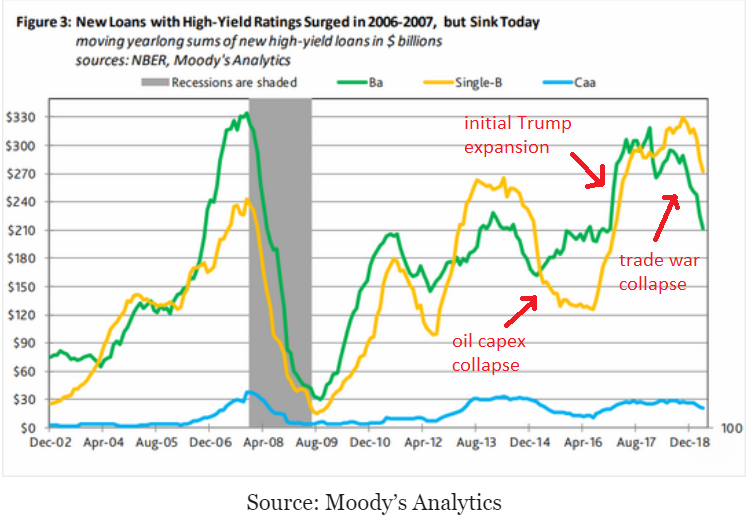

In other words, deficit spending, private or public, is the ‘offset’ to unspent income (savings). The chart shows one of the components of private sector deficit spending which appears to align with economic growth:

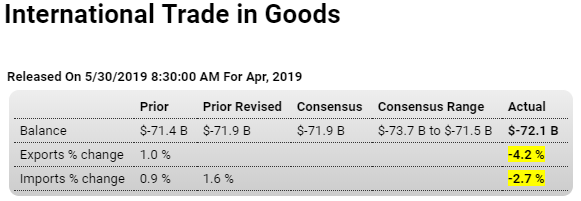

Tariffs (levied on the grounds that China and others weren’t charging us enough…) causing the collapse in exports globally, and import weakness most often is a sign of domestic demand weakness:

Highlights

Sharp declines in exports are unwelcome headlines in April’s advance data on goods trade. The monthly deficit remains very deep, at $72.1 billion with exports falling 4.2 percent year-on-year and with imports also down, 2.7 percent lower. The deficit compares unfavorably with a $71.3 billion monthly average in the first quarter that marks a weak opening for net exports in the second quarter.

Capital goods are the US’s largest exports and these fell 6.5 percent in the month to $44.3 billion. Compared with April last year, capital goods exports are down 3.7 percent. Auto exports are also down, 7.2 percent lower to $12.9 billion and 6.7 percent below last year. The only export component showing a gain is food & feeds which rose 0.5 percent to $11.2 billion but which is nevertheless 6.2 percent below April last year.

The decline on the import side is also led by a 3.5 percent decline for capital goods ($55.4 billion) but also includes 3.1 percent and 2.3 percent monthly declines in autos ($30.9 billion) and consumer goods ($54.2 billion) as well as a 1.1 percent drop in foods ($12.8 billion).

Global trade figures have been contracting and the latest US numbers are part of that picture. Today’s report gets second-quarter GDP, already held down by contractions for April retail sales and industrial production, off to a slow start.

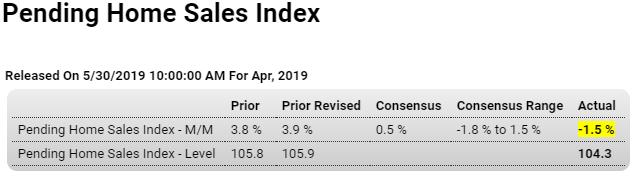

Weakness in housing continues:

Highlights

The forecasters were optimistic but pending home sales couldn’t deliver. The index fell 1.5 percent in April vs a consensus for a 0.5 percent gain, yet the monthly drop does follow an outsized 3.9 percent revised gain in March which makes for a hard comparison. Nevertheless a decline in April is not a good indication for momentum in the spring sales season. Existing home sales have been moving higher this year but today’s report will hold down expectations for May and June.