December 2018 CBO Monthly Budget Review: Total Receipts Up by 1% And Spending Up 9% in the First Quarter of Fiscal Year 2019 The federal budget deficit was 7 billion for the first quarter of fiscal year 2019, CBO estimates, billion more than the deficit recorded during the same period last year. Revenues were about the same and outlays were billion (9 percent) higher than during the first quarter of 2018. Asian airfreight traffic drops for first time in 2.5 years (Nikkei0 Asia-Pacific carriers carried 2.3% less freight in November than they did a year earlier, according to data collected by the International Air Transport Association. This was the first monthly drop posted since March 2016. Global freight traffic was flat for the month. “Weaker manufacturing

Topics:

WARREN MOSLER considers the following as important: Economic Releases

This could be interesting, too:

WARREN MOSLER writes Consumer sentiment, real retail sales, industrial production, wages

WARREN MOSLER writes New manufacturers orders, vehicle sales, unemployment claims, rents, oil prices

WARREN MOSLER writes Saudi price hike, private payrolls, new hires, corporate profits

WARREN MOSLER writes Pending home sales, Durable goods orders, oil rigs and production

December 2018 CBO Monthly Budget Review: Total Receipts Up by 1% And Spending Up 9% in the First Quarter of Fiscal Year 2019

The federal budget deficit was $317 billion for the first quarter of fiscal year 2019, CBO estimates, $92 billion more than the deficit recorded during the same period last year. Revenues were about the same and outlays were $93 billion (9 percent) higher than during the first quarter of 2018.

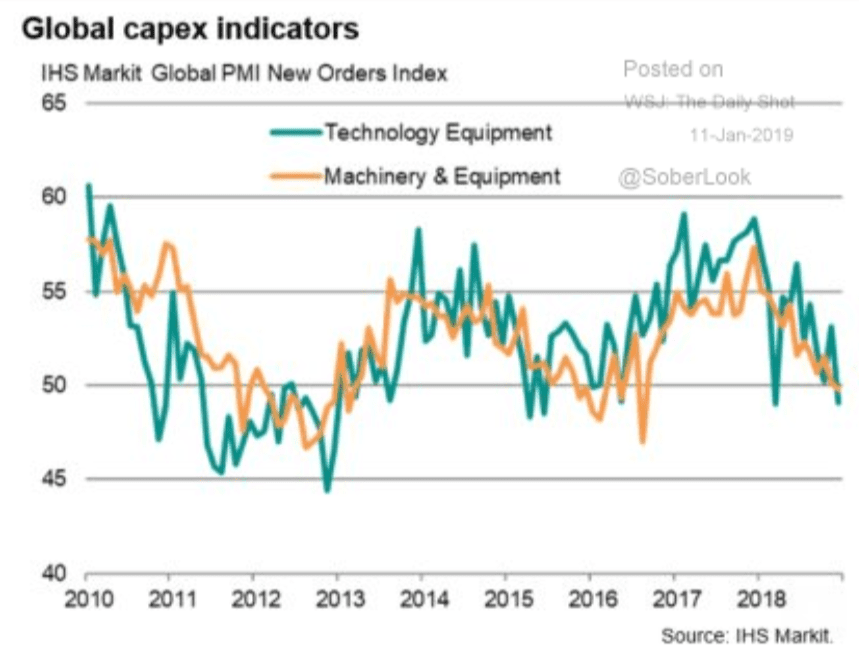

Asian airfreight traffic drops for first time in 2.5 years

(Nikkei0 Asia-Pacific carriers carried 2.3% less freight in November than they did a year earlier, according to data collected by the International Air Transport Association. This was the first monthly drop posted since March 2016. Global freight traffic was flat for the month. “Weaker manufacturing conditions for exporters and shorter supplier delivery times particularly in China impacted the demand,” the Transport Association said. In October, freight traffic had risen 2.1%. The Association of Asia-Pacific Airlines, which separately tracks data for 36 regional airlines, reported 0.1% growth in regional freight traffic for November.

Prospect of U.S. profit drop rises for investors

(Reuters) For 2019, analysts now see profits growing by 6.8 percent, down sharply from an Oct. 1 estimate of 10.2 percent earnings growth. The last profits recession occurred from July 2015 through June of 2016. S&P 500 tech earnings are expected to decline year-over-year for the first three quarters of 2019, based on Refinitiv’s data, and deliver growth of just 2.6 percent this year, the lowest of any sector. Since 1968, as far back as Refinitiv’s data goes, the S&P 500 has had 10 earnings recessions. Seven of the 10 profit recessions since 1968 have coincided with a formal economic recession.

Not particularly reliable but another data point:

And this:

Remember, these buybacks per se act as a ‘reverse split’ does to increase nominal share prices for the benefit of management compensation that’s tied to nominal share price. A ‘scam’ when not specifically disclosed to shareholders?

U.S. buyback market support may wane in 2019

(Reuters) Through the first three quarters of the year companies bought $583.4 billion of their own stock according to S&P Dow Jones Indices data. $295 billion of foreign profits were repatriated in the first quarter of 2018. In the third quarter that was down to about $93 billion. About $190 billion of repatriated funds were used on buybacks in the first three quarters of 2018, JPMorgan says. S&P 500 companies bought roughly $4.5 trillion worth of their own shares, equal to about a third of the benchmark’s $15 trillion gain in value over that time, according to Wells Fargo.