So the question is regarding dividends vs stock buy backs- do stock buy backs cause stocks to be over valued or do dividends cause them to be undervalued?;) A Surprising Connection Between the Bull Market and Stock Buybacks (WSJ) A study published last year in the Financial Analysts Journal, “Net Buybacks and the Seven Dwarfs,” found that net buybacks—the number of shares that companies repurchased across the entire stock market, less the number of new shares issued—explain the bulk of the intermediate- and longer-term differences in stock-market returns around the world. In an analysis of 43 countries’ stock markets between 1997 and 2017, the researchers found that net buybacks explain 80% of the difference in countries’ returns. Maybe core inflation does start rising

Topics:

WARREN MOSLER considers the following as important: Economic Releases

This could be interesting, too:

WARREN MOSLER writes Consumer sentiment, real retail sales, industrial production, wages

WARREN MOSLER writes New manufacturers orders, vehicle sales, unemployment claims, rents, oil prices

WARREN MOSLER writes Saudi price hike, private payrolls, new hires, corporate profits

WARREN MOSLER writes Pending home sales, Durable goods orders, oil rigs and production

So the question is regarding dividends vs stock buy backs- do stock buy backs cause stocks to be over valued or do dividends cause them to be undervalued?

;)

A Surprising Connection Between the Bull Market and Stock Buybacks

(WSJ) A study published last year in the Financial Analysts Journal, “Net Buybacks and the Seven Dwarfs,” found that net buybacks—the number of shares that companies repurchased across the entire stock market, less the number of new shares issued—explain the bulk of the intermediate- and longer-term differences in stock-market returns around the world. In an analysis of 43 countries’ stock markets between 1997 and 2017, the researchers found that net buybacks explain 80% of the difference in countries’ returns.

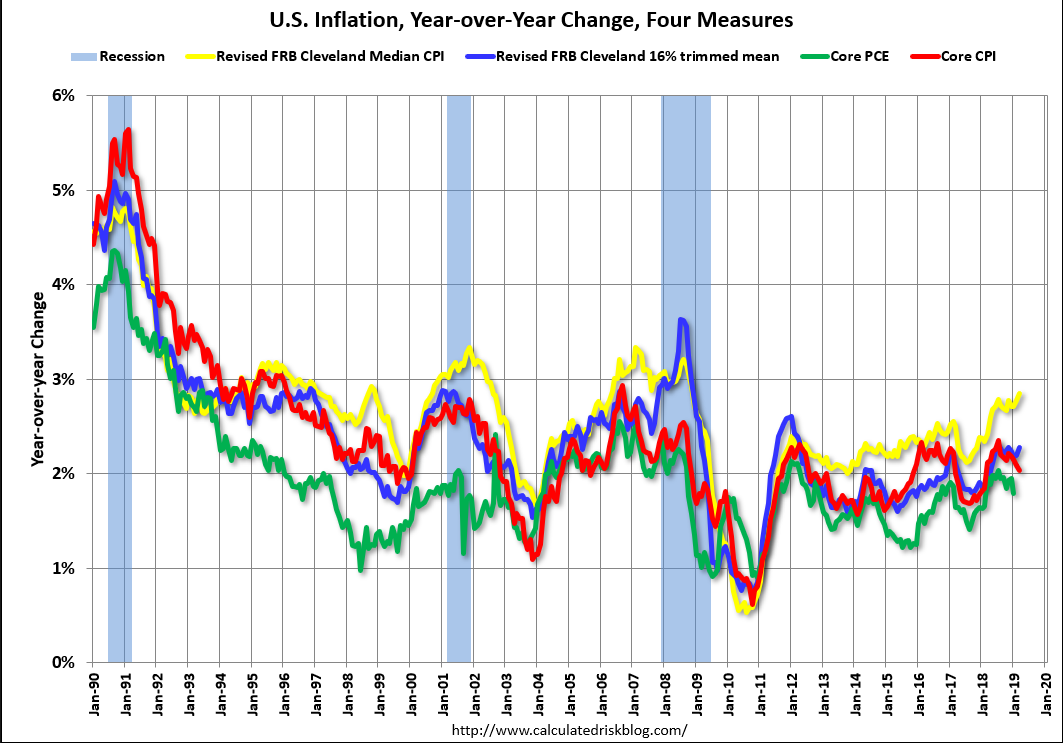

Maybe core inflation does start rising after rates are hiked?

Note the 2018 deceleration:

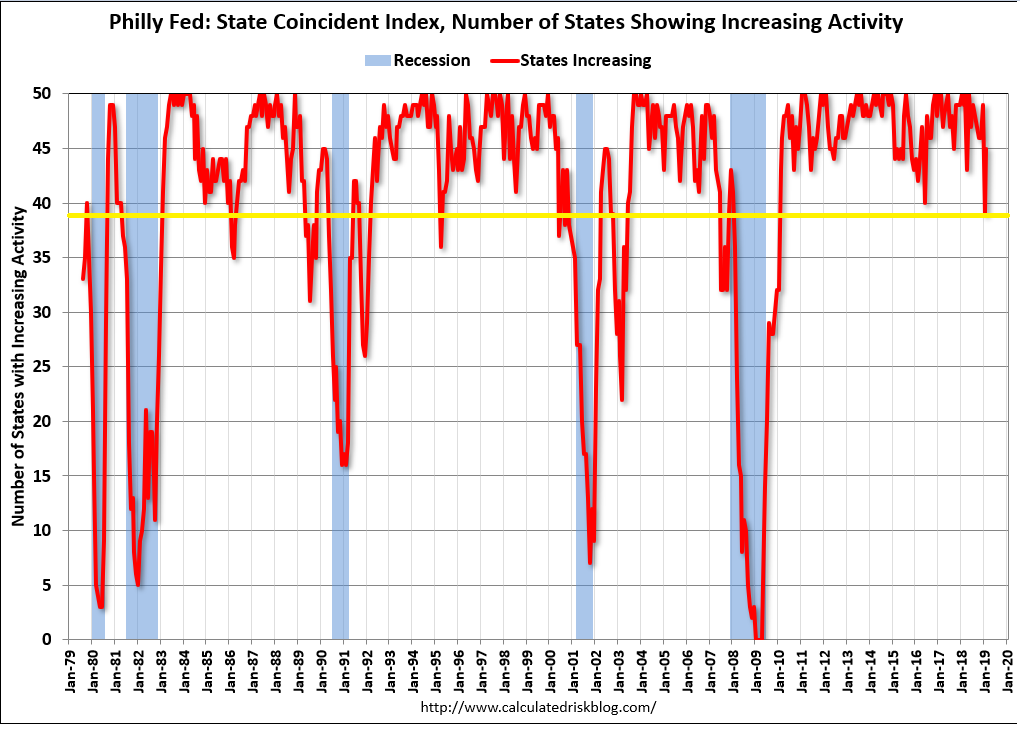

Signs of elevated recession risk here: