Bad. All sectors decelerating and residential looking down year over year: U.S. auto sales tumbled 2.8 percent in February (Detroit News) Overall sales for the month tumbled 2.8 percent from the same month a year ago, according to Edmunds.com. Sales came in at 1.26 million for an annualized industry sales rate slowed to 16.6 million. The estimated average transaction price for a new vehicle in February climbed to ,590, according to Kelley Blue Book. That was 3 higher (2.8 percent) from the previous February. The average interest rate on a new-car loan was 6.26 percent in February, compared to 5.19 percent last year and 4.56 percent five years ago. The average monthly payment was 6, up from 7 a year ago. U.S. personal income falls; spending weakest since

Topics:

WARREN MOSLER considers the following as important: Economic Releases

This could be interesting, too:

WARREN MOSLER writes Consumer sentiment, real retail sales, industrial production, wages

WARREN MOSLER writes New manufacturers orders, vehicle sales, unemployment claims, rents, oil prices

WARREN MOSLER writes Saudi price hike, private payrolls, new hires, corporate profits

WARREN MOSLER writes Pending home sales, Durable goods orders, oil rigs and production

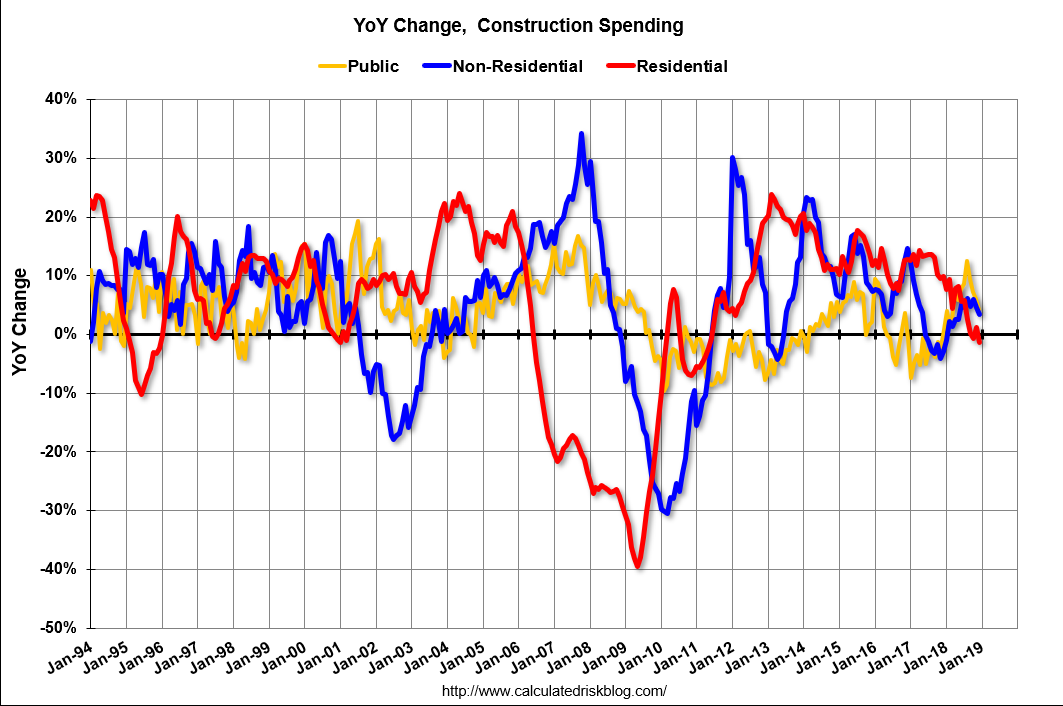

Bad. All sectors decelerating and residential looking down year over year:

U.S. auto sales tumbled 2.8 percent in February

(Detroit News) Overall sales for the month tumbled 2.8 percent from the same month a year ago, according to Edmunds.com. Sales came in at 1.26 million for an annualized industry sales rate slowed to 16.6 million. The estimated average transaction price for a new vehicle in February climbed to $36,590, according to Kelley Blue Book. That was $993 higher (2.8 percent) from the previous February. The average interest rate on a new-car loan was 6.26 percent in February, compared to 5.19 percent last year and 4.56 percent five years ago. The average monthly payment was $556, up from $527 a year ago.

U.S. personal income falls; spending weakest since 2009

(Reuters) Personal income slipped 0.1 percent in January after jumping 1.0 percent in December. Wages increased by a moderate 0.3 percent in January after rising 0.5 percent in December. Consumer spending dropped 0.5 percent in December after a 0.6 percent increase in November. When adjusted for inflation, consumer spending fell 0.6 percent in December. The saving rate jumped to a three-year high of 7.6 percent. The PCE price index excluding the volatile food and energy components rose 0.2 percent after a similar gain in November. That left the year-on-year increase at 1.9 percent.

When the understanding of trade dynamics is backwards and confused, you get one counterproductive policy after another:

Trump Says Dollar Too Strong in Renewed Criticism of Powell

(Bloomberg) President Donald Trump said Saturday that the U.S. dollar is too strong and took a swipe at Federal Reserve Chairman Jerome Powell as someone who “likes raising interest rates.” The dollar was quoted lower against the euro and the yen in early Asia-Pacific trading hours on Monday after Trump’s comments. The U.S. economy is doing well despite the actions of the central bank, Trump said during a wide-ranging speech at the Conservative Political Action Conference in National Harbor, Maryland. “I want a strong dollar but I want a dollar that does great for our country, not a dollar that’s so strong that it makes it prohibitive for us to do business with other nations and take their business,” Trump said Saturday. He didn’t mention Powell by name, but referenced “a gentleman that likes raising interest rates in the Fed, we have a gentleman that loves quantitative tightening in the Fed, we have a gentleman that likes a very strong dollar in the Fed.” “Essentially there’s no inflation,” Trump said. “Can you imagine if we left interest rates where they were, if we didn’t do quantitative tightening. Taking money out of the market if we didn’t do quantitative talk, and this would lead to a little bit lower dollar,” he said. Trump said the U.S. “is booming like never before,” while other countries are “doing very poorly, and that makes it even harder for us to be successful.”