As per the chart still not looking so good: Highlights Good news on US manufacturing is now much less scarce following a much better-than-expected 2.7 percent jump in durable goods orders for March. The gain is skewed higher by a very welcome 60 percent monthly gain in commercial aircraft orders and also by an equally welcome 2.1 percent rise in motor vehicle orders. Excluding these orders as well as orders for all other transportation equipment, March orders rose a respectable 0.4 percent. Now the really good news! Orders for core capital goods (nondefense ex-aircraft) surged 1.3 percent to easily exceed expectations. This reading had been flat until today’s data for March which now point to a sizable pickup in business investment. Yet the pickup as tracked in GDP will

Topics:

WARREN MOSLER considers the following as important: Economic Releases

This could be interesting, too:

WARREN MOSLER writes Consumer sentiment, real retail sales, industrial production, wages

WARREN MOSLER writes New manufacturers orders, vehicle sales, unemployment claims, rents, oil prices

WARREN MOSLER writes Saudi price hike, private payrolls, new hires, corporate profits

WARREN MOSLER writes Pending home sales, Durable goods orders, oil rigs and production

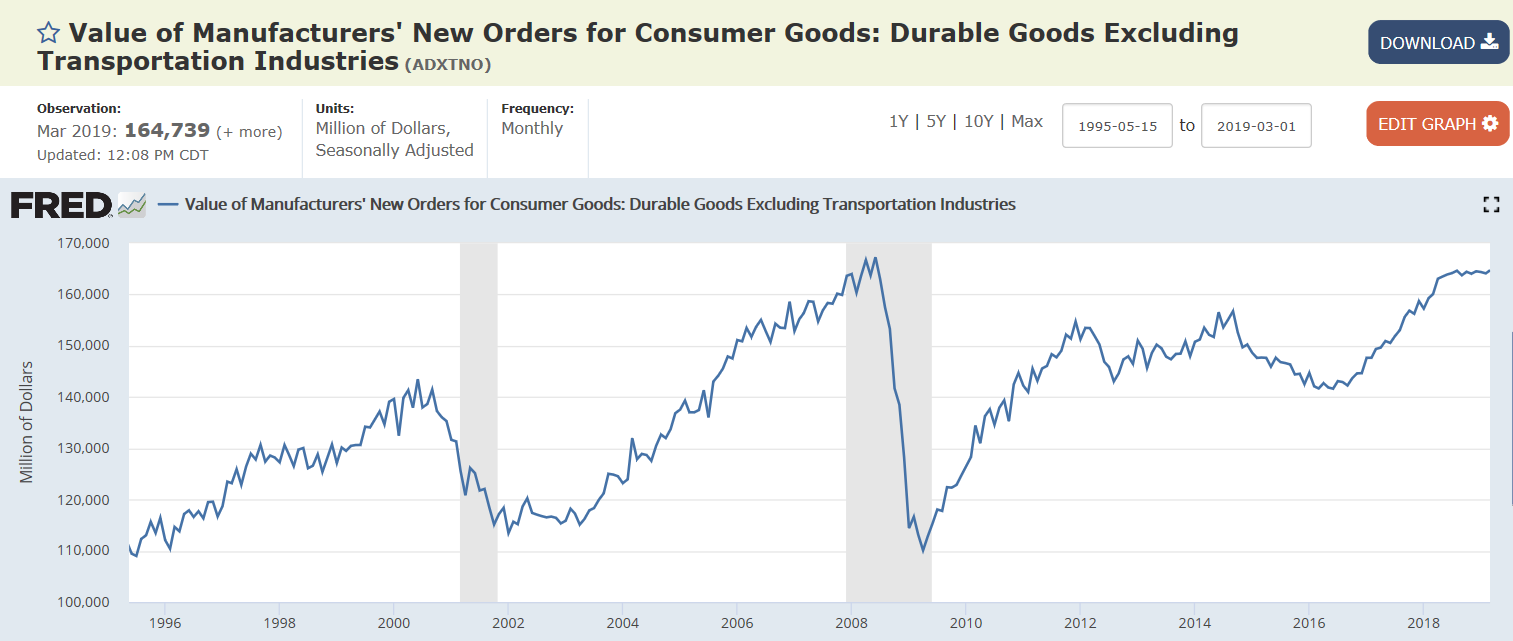

As per the chart still not looking so good:

Highlights

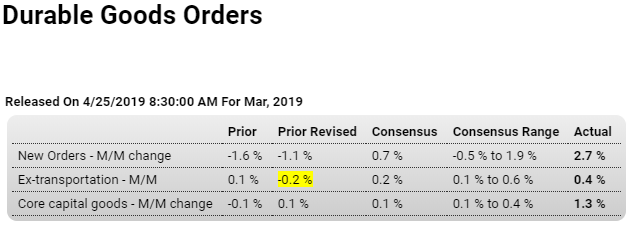

Good news on US manufacturing is now much less scarce following a much better-than-expected 2.7 percent jump in durable goods orders for March. The gain is skewed higher by a very welcome 60 percent monthly gain in commercial aircraft orders and also by an equally welcome 2.1 percent rise in motor vehicle orders. Excluding these orders as well as orders for all other transportation equipment, March orders rose a respectable 0.4 percent.

Now the really good news! Orders for core capital goods (nondefense ex-aircraft) surged 1.3 percent to easily exceed expectations. This reading had been flat until today’s data for March which now point to a sizable pickup in business investment. Yet the pickup as tracked in GDP will have to wait for the second quarter as shipments of core capital goods actually slipped 0.2 percent in the month. The dip in shipments, however, provided a lift for unfilled orders of core capital goods which rose 0.2 percent to end an unwanted run of declines.

Total shipments rose 0.3 percent for a second straight month and are right in line with total inventories which also rose 0.3 percent. Together they keep the inventory-to-shipments ratio unchanged at a constructive and lean 1.62.

Today’s report won’t be raising expectations for business investment in tomorrow’s first-quarter GDP report but will be raising general expectations for manufacturing which, until this report, had been stumbling along. And strength in commercial aircraft, which also includes a 0.2 percent rise in related unfilled orders, should cool worries over 737 Max cancellations. Still, cross-border trade has been depressed and remains a key obstacle that looks to contain this year’s manufacturing growth.

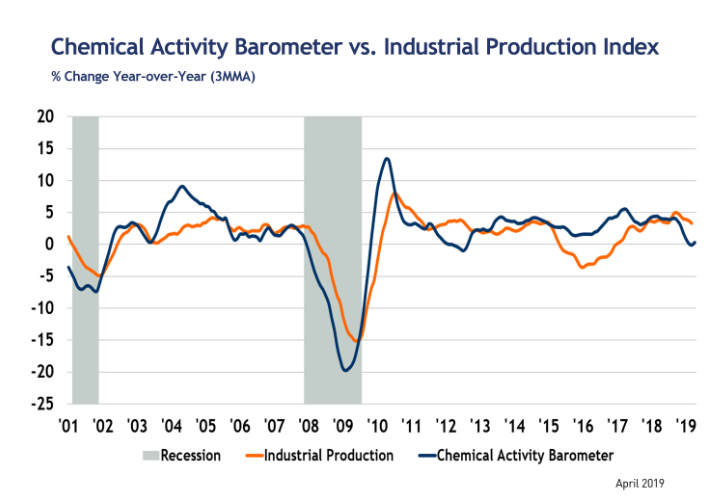

This has gone flat: