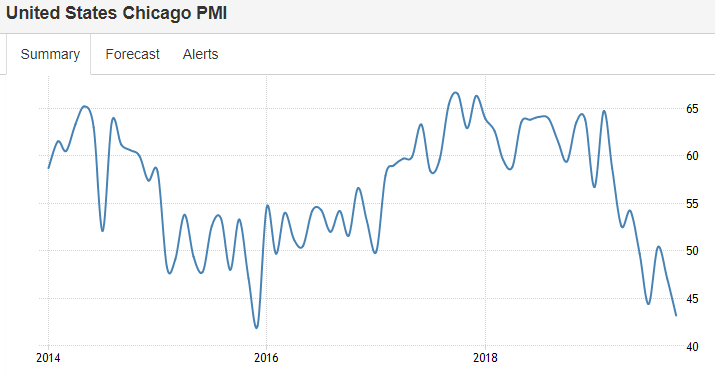

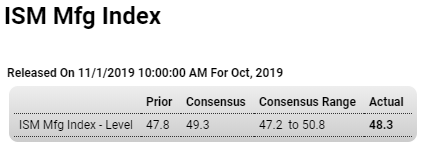

The slow motion train wreck continues unabated and when employment goes bad, it all goes bad: Highlights On the low side of expectations but not at increasing rates of contraction are the results of ISM’s manufacturing report for October. At 48.3, the index missed Econoday’s consensus by 1 point but gained a 1/2 point from September. New orders improved nearly 2 points in October but, at 49.1, are still under breakeven 50. New export orders, however, improved markedly, up more than 9 points and back over 50 at 50.4. Yet total backlogs are a major weakness for ISM’s sample, down another point and in deep contraction at 44.1. Elsewhere contraction is roughly as deep as September, including production down nearly a point to 46.2 and employment up 1.4 points but still under

Topics:

WARREN MOSLER considers the following as important: Economic Releases

This could be interesting, too:

WARREN MOSLER writes Consumer sentiment, real retail sales, industrial production, wages

WARREN MOSLER writes New manufacturers orders, vehicle sales, unemployment claims, rents, oil prices

WARREN MOSLER writes Saudi price hike, private payrolls, new hires, corporate profits

WARREN MOSLER writes Pending home sales, Durable goods orders, oil rigs and production

The slow motion train wreck continues unabated and when employment goes bad, it all goes bad:

Highlights

On the low side of expectations but not at increasing rates of contraction are the results of ISM’s manufacturing report for October. At 48.3, the index missed Econoday’s consensus by 1 point but gained a 1/2 point from September. New orders improved nearly 2 points in October but, at 49.1, are still under breakeven 50. New export orders, however, improved markedly, up more than 9 points and back over 50 at 50.4. Yet total backlogs are a major weakness for ISM’s sample, down another point and in deep contraction at 44.1.

Elsewhere contraction is roughly as deep as September, including production down nearly a point to 46.2 and employment up 1.4 points but still under 50 at 47.7. The sample drew down their raw material inventories but less so than September while, in a sign that capacity constraints are minimal, supplier delivery times posted a rare outright decline in the month. Given the indication from delivery times, the prices paid index is not surprisingly pointing to lower prices, down more than 4 points to 45.5.

The good news in this report is the rise in export orders, a move confirmed by the PMI manufacturing report which was released earlier this morning. Yet overall conditions are still very soft and are not pointing to any year-end acceleration for a sector that has been holding back the 2019 economy and where export-related trouble has helped trigger three straight rate cuts from the Federal Reserve.