Looks like there was a drop in employment growth by firms with under 50 employees: ‘Last hire first fired’ has made this a leading indicator in prior cycles: Heavy-Duty Truck Orders Hit the Brakes in March Trucking companies slammed the brakes on orders for heavy-duty trucks in March, signaling caution amid long backlogs for delivery and a softening freight market. North American freight carriers ordered 15,700 Class 8 trucks, the big rigs used for regional and long-haul routes, according to a preliminary report from ACT Research. That is a 66% drop compared with March 2018, and the lowest level since October 2016, when tepid shipping demand meant many transportation companies held back on upgrading or expanding their fleets. The slide in March, in which orders also

Topics:

WARREN MOSLER considers the following as important: Economic Releases

This could be interesting, too:

WARREN MOSLER writes Consumer sentiment, real retail sales, industrial production, wages

WARREN MOSLER writes New manufacturers orders, vehicle sales, unemployment claims, rents, oil prices

WARREN MOSLER writes Saudi price hike, private payrolls, new hires, corporate profits

WARREN MOSLER writes Pending home sales, Durable goods orders, oil rigs and production

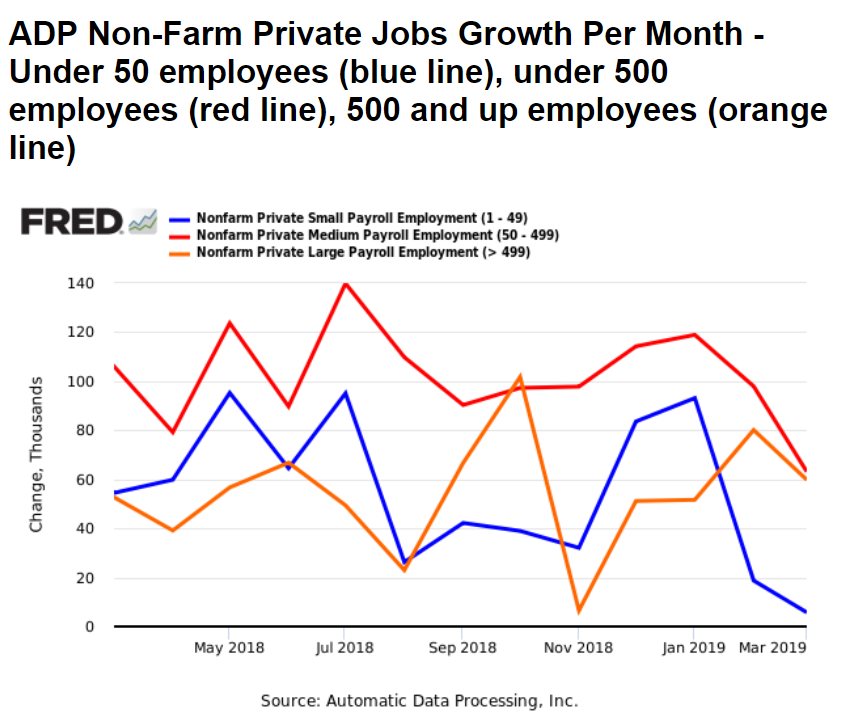

Looks like there was a drop in employment growth by firms with under 50 employees:

‘Last hire first fired’ has made this a leading indicator in prior cycles:

Heavy-Duty Truck Orders Hit the Brakes in March

Trucking companies slammed the brakes on orders for heavy-duty trucks in March, signaling caution amid long backlogs for delivery and a softening freight market.

North American freight carriers ordered 15,700 Class 8 trucks, the big rigs used for regional and long-haul routes, according to a preliminary report from ACT Research. That is a 66% drop compared with March 2018, and the lowest level since October 2016, when tepid shipping demand meant many transportation companies held back on upgrading or expanding their fleets.

The slide in March, in which orders also declined 6.7% from February, follows a long surge in fleet expansion in 2018, when trucking companies riding one of the strongest freight markets in years rushed to order new trucks, outpacing manufacturers’ production capacity.

“Orders have gotten weak because you can’t get a truck this year,” said Tim Denoyer, an ACT vice president and senior analyst

The drop in orders could help burn through those backlogs. March is the fourth straight month in which new orders were significantly lower than the rate of new vehicle production, according to ACT.

Still, with few production slots available until 2020, trucking companies may be holding back because it is difficult to determine if they will have enough business at that point to support extra capacity.

Shipping demand has been slipping in the first quarter of 2019. The average price for hiring a truck on the spot market, where companies book last-minute transportation, was down 13.4% in March compared with the same month in 2018, according to online freight marketplace DAT Solutions LLC. The Cass Freight Index for U.S. shipments dropped 2.1% year-over-year in February, the third straight monthly decline.

Rail Week Ending 30 March 2019: Continuing Deeper In Contraction Year-to-Date

Week 13 of 2019 shows same week total rail traffic (from same week one year ago) contracted according to the Association of American Railroads (AAR) traffic data. The economically intuitive sectors rolling averages remain in contraction.

As previously discussed for the last 25 years:

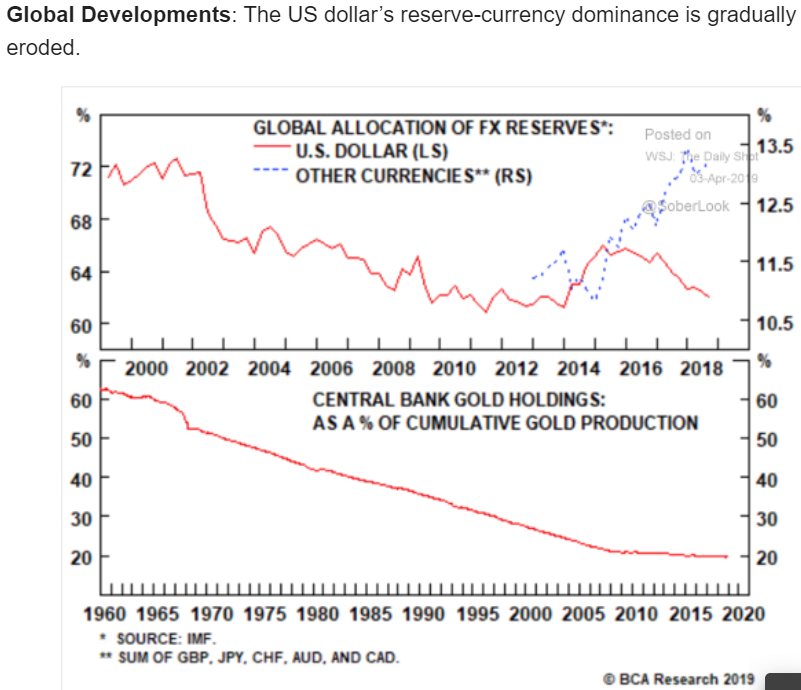

“But what if the dollars loses it’s reserve currency status?” Seems it’s already happened: