Weakness continues and new tariffs kicking in will only make it worse: Highlights Is there slack in the labor market or isn’t there? Judging by September’s 3.5 percent unemployment rate, a rate that falls below Econoday’s consensus range, there may not be much available capacity at all. Yet wage pressures, as measured by average hourly earnings, eased significantly in September for a 2.9 percent year-on-year growth rate that is the lowest since July last year. Payroll growth itself is running a notch or two below last year and is well under 200,000, but it is still very solid as well as steady and would look to further test the labor market’s available capacity. Nonfarm payrolls rose 136,000 in September with August revised sharply higher, up an additional 38,000 to

Topics:

WARREN MOSLER considers the following as important: Economic Releases

This could be interesting, too:

WARREN MOSLER writes Consumer sentiment, real retail sales, industrial production, wages

WARREN MOSLER writes New manufacturers orders, vehicle sales, unemployment claims, rents, oil prices

WARREN MOSLER writes Saudi price hike, private payrolls, new hires, corporate profits

WARREN MOSLER writes Pending home sales, Durable goods orders, oil rigs and production

Weakness continues and new tariffs kicking in will only make it worse:

Highlights

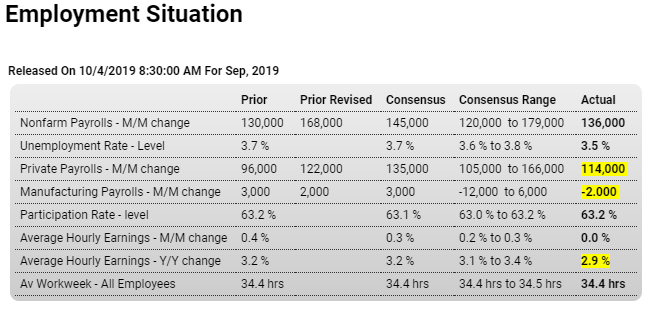

Is there slack in the labor market or isn’t there? Judging by September’s 3.5 percent unemployment rate, a rate that falls below Econoday’s consensus range, there may not be much available capacity at all. Yet wage pressures, as measured by average hourly earnings, eased significantly in September for a 2.9 percent year-on-year growth rate that is the lowest since July last year.

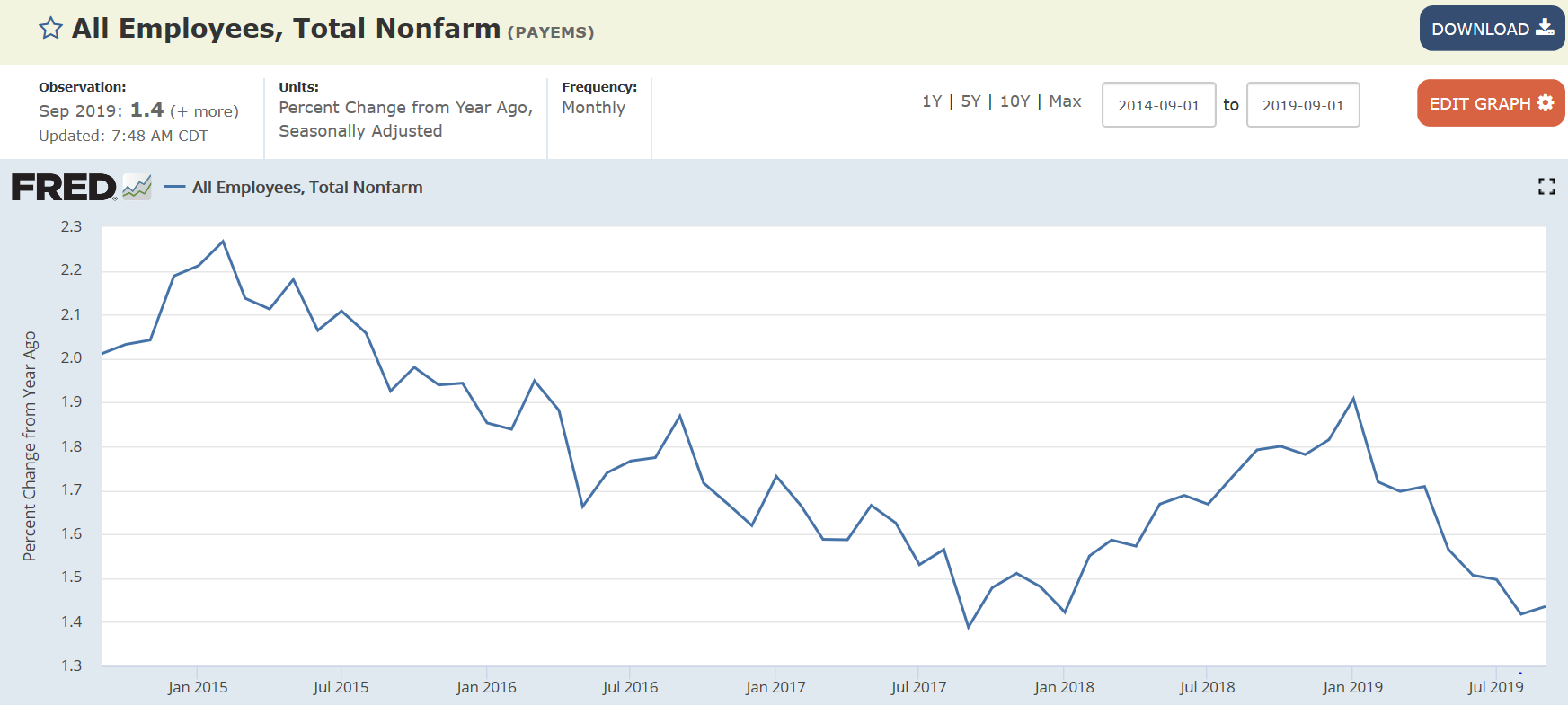

Payroll growth itself is running a notch or two below last year and is well under 200,000, but it is still very solid as well as steady and would look to further test the labor market’s available capacity. Nonfarm payrolls rose 136,000 in September with August revised sharply higher, up an additional 38,000 to 168,000. Yet manufacturing, the economy’s weak link right now due to slowing global trade, is showing weakness, down 2,000 in September versus expectations for a 3,000 gain. Over the last three months this sector has added only 4,000 payroll jobs, a detail that won’t miss the eye of Federal Reserve policy makers who are focused specifically, and with concern, on the health of this sector.

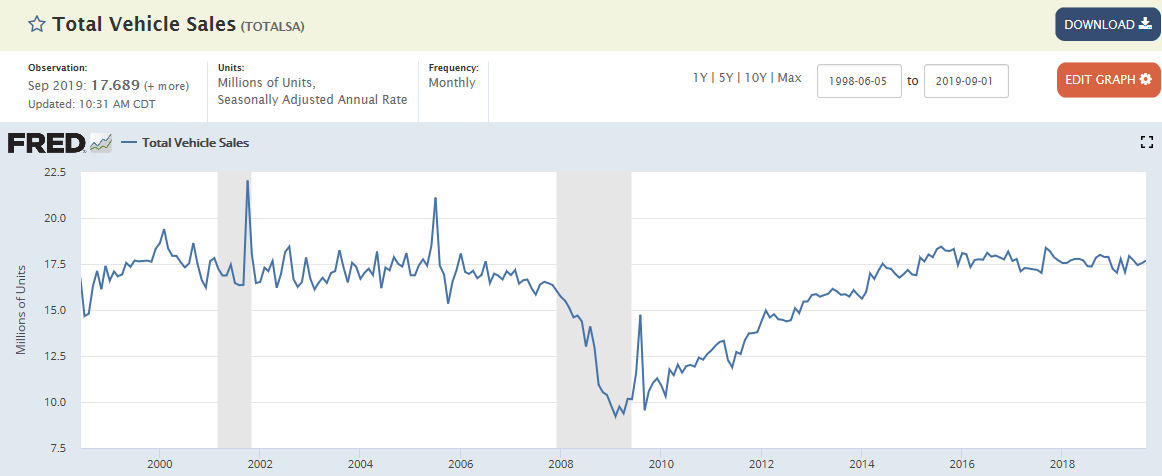

After the great oil capex collapse, the blip up from the tax cuts has been more than offset by the tariffs:

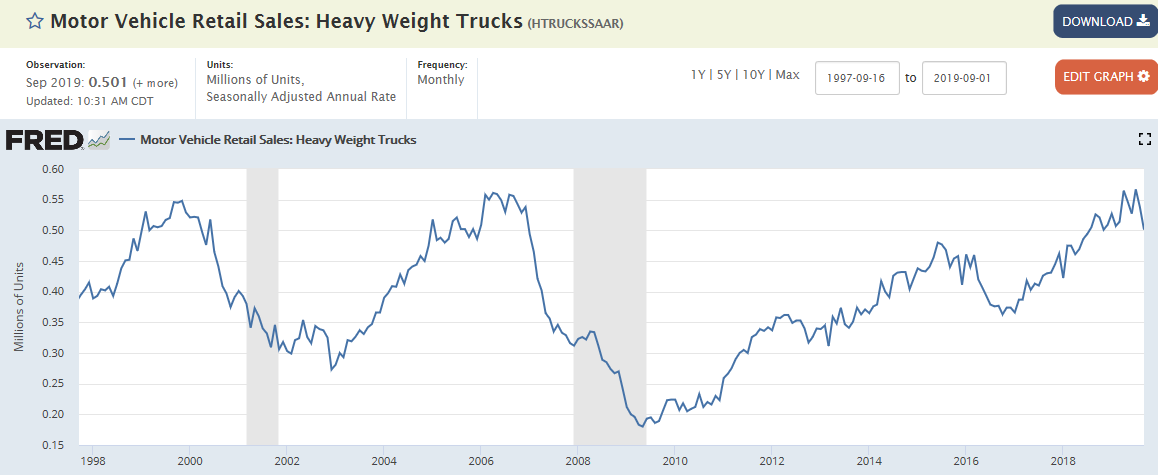

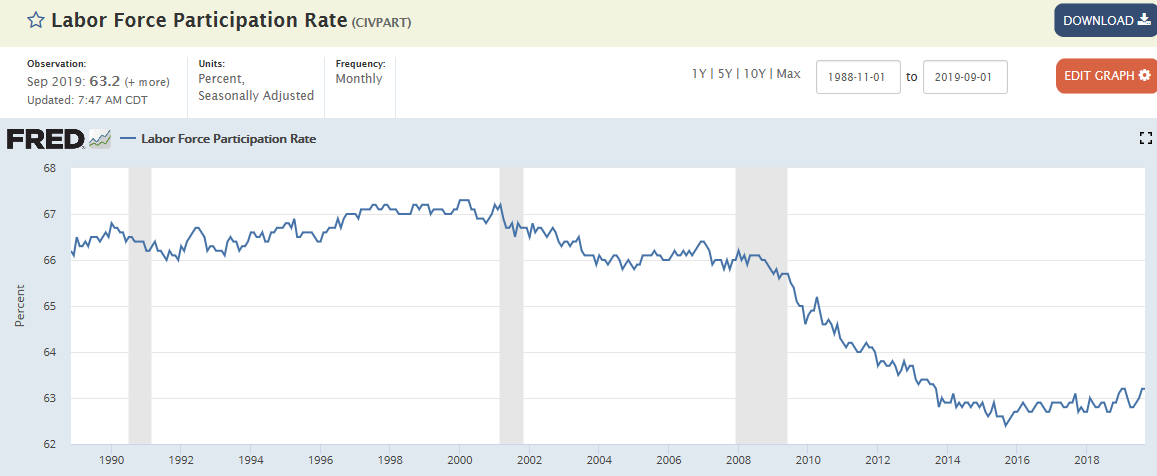

Down to the lows and then sideways:

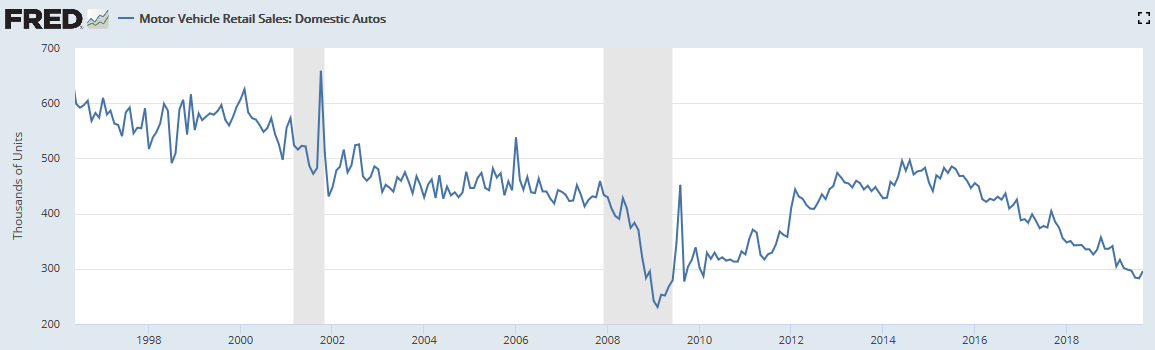

Stalled out 3 years ago at levels from 20 years ago: