Worse than expected and in contraction year over year: Highlights The housing market firmed in the early Spring but has since flattened out. Existing home sales came in softer-than-expected at a 5.270 million annual rate in June which, however, is right in line with the 3-month average of 5.280 million. This average started the year at roughly 5.1 million. Single-family resales fell 1.5 percent in the month to a 4.690 million pace while condo sales, the second and much smaller component in the report, fell 3.3 percent to 580,000. By region, the Northeast and Midwest posted mid-single digit monthly gains with the South and West posting mid-single digit declines. For home sellers, the good news is centered in prices which rose a sharp 2.7 percent to a median 5,700. For

Topics:

WARREN MOSLER considers the following as important: Economic Releases

This could be interesting, too:

WARREN MOSLER writes Consumer sentiment, real retail sales, industrial production, wages

WARREN MOSLER writes New manufacturers orders, vehicle sales, unemployment claims, rents, oil prices

WARREN MOSLER writes Saudi price hike, private payrolls, new hires, corporate profits

WARREN MOSLER writes Pending home sales, Durable goods orders, oil rigs and production

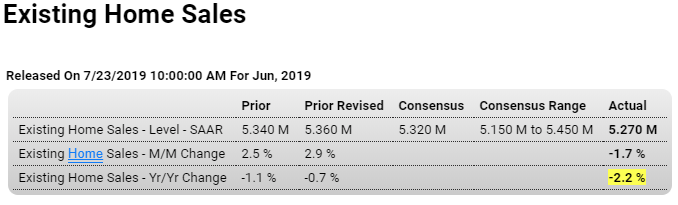

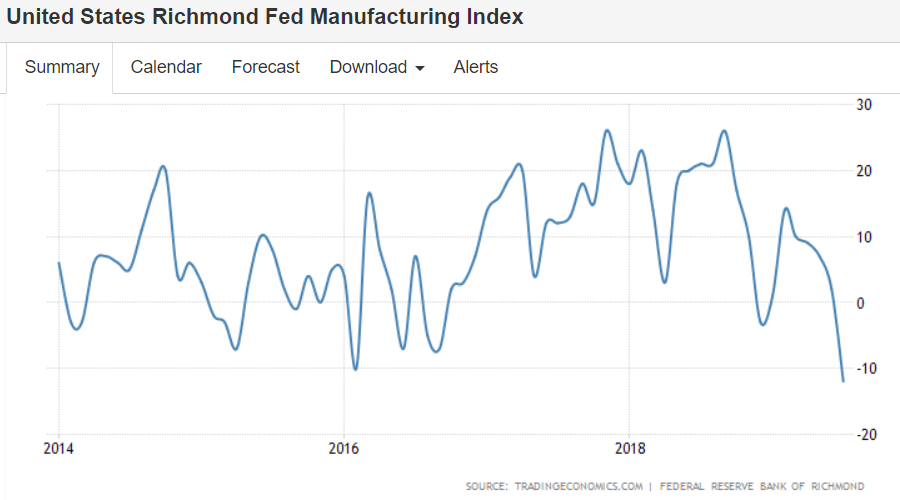

Worse than expected and in contraction year over year:

Highlights

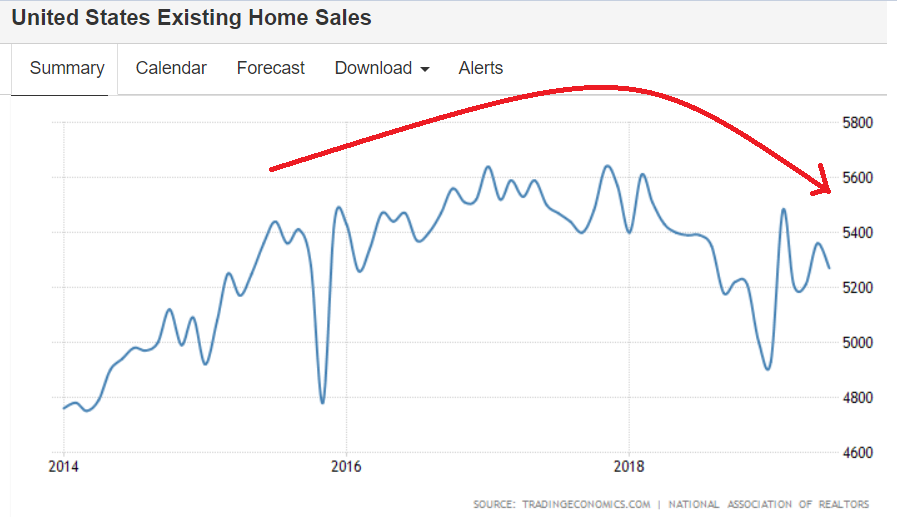

The housing market firmed in the early Spring but has since flattened out. Existing home sales came in softer-than-expected at a 5.270 million annual rate in June which, however, is right in line with the 3-month average of 5.280 million. This average started the year at roughly 5.1 million.

Single-family resales fell 1.5 percent in the month to a 4.690 million pace while condo sales, the second and much smaller component in the report, fell 3.3 percent to 580,000. By region, the Northeast and Midwest posted mid-single digit monthly gains with the South and West posting mid-single digit declines.

For home sellers, the good news is centered in prices which rose a sharp 2.7 percent to a median $285,700. For buyers, the good news includes a 1.0 percent rise in supply on the market, at 1.930 million which nevertheless is dead flat on the year at zero.

Sales year-on-year are in negative ground at minus 2.2 percent in what should be an easy comparison against a weak 2018. Resales have only a limited impact on residential investment in contrast to new home sales which will be posted tomorrow. But if trends hold, even flat results for new home sales, given firmness early in the quarter, could still make for the first positive residential contribution, however modest, to GDP since 2017.

Lack of momentum in housing, which is unexpected this year given the strength of the jobs market and the fall in mortgage rates, will be one factor that doves can cite at next week’s FOMC meeting in favor a rate cut. Watch Friday for the first estimate of second-quarter GDP.

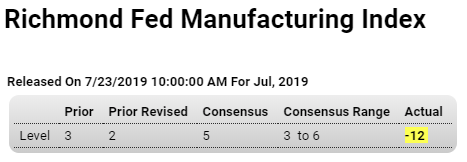

Bad:

Highlights

Fifth District manufacturing activity unexpectedly fell into contraction in July, according to the latest survey from the Richmond Fed, whose composite index fell 14 points from June’s revised reading of 2 to minus 12, its lowest level since January 2013. Coming in sharply below the range of analysts’ forecasts calling for a modest uptick in growth, the slowdown was driven by declines in in all three major components of the index, with shipments down 18 points to minus 13, new orders down 16 to minus 18, and the number of employees down 7 points to minus 3, the lowest level in more than three years.

Weakness was registered in nearly all components, with some posting double digit declines. Backlog of orders fell 29 points to minus 26, the lowest level since April 2009, while capacity utilization fell 20 points to minus 24. Companies reported worsening local business conditions, with the index plunging 25 points to minus 18, the largest monthly drop on record.

The one bright spot in an otherwise gloomy report were expectations over the next six months, as companies on balance saw improvement in most major components. Here, expected shipments were up 9 points 32 and expected new orders were up 9 points to 36, while expected local business conditions were up 14 points to 25.

On the inflation front, companies said both prices paid and prices received grew at a significantly faster pace in July, though input price growth continued to outpace growth of output prices. Survey participants expected growth of both prices paid and prices received to slow in the near future.

The surprising weakness of today’s report contrasts with the Philly Fed and Empire State regional reports last week showing manufacturing rebounding in these regions. Despite the reported increase in input and output prices, the marked deterioration in the region’s manufacturing survey to the lowest level in six years is likely to bolster the dovish case for cutting the Fed funds rate at the FOMC meeting next week.

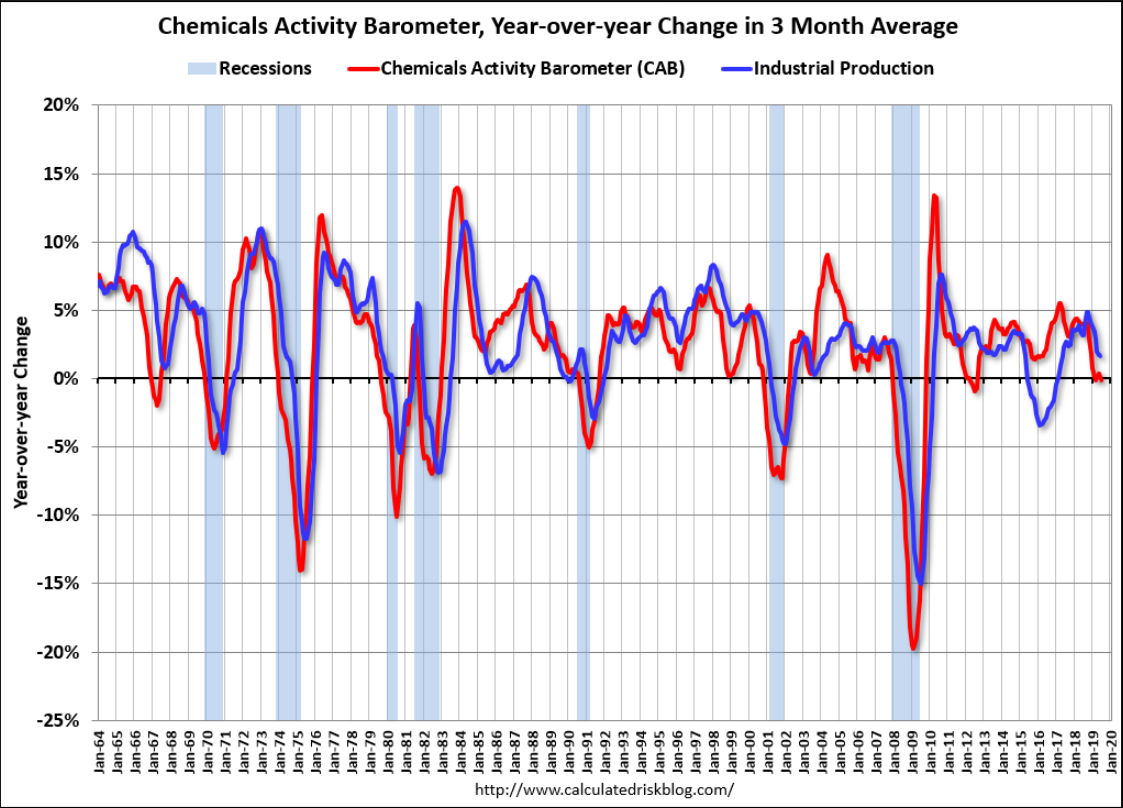

Not at all good- 3mo average now negative year over year:

Chemical Activity Barometer Fell in July