Asia’s exports to China plunge as economy stumbles (WSJ) Japan’s exports to China in January sank 17.4% on the year to 958.1 billion yen (.65 billion), accelerating from December’s 7% drop. South Korean exports to China in January slid 19% on the year, a steeper rate than in the previous two months of decline. Taiwan’s mainland-bound shipments, which make up 40% of its total, also fell for the third consecutive month in January by 7.5%. Singapore suffered a 25% plunge. Thailand saw a second straight monthly drop in December, declining 7.3% on weaker exports of IT components. Vietnam was the odd man out, with its first increase in three months in January. The global slowdown includes the US: Total existing-home sales, completed transactions that include single-family

Topics:

WARREN MOSLER considers the following as important: Economic Releases

This could be interesting, too:

WARREN MOSLER writes Consumer sentiment, real retail sales, industrial production, wages

WARREN MOSLER writes New manufacturers orders, vehicle sales, unemployment claims, rents, oil prices

WARREN MOSLER writes Saudi price hike, private payrolls, new hires, corporate profits

WARREN MOSLER writes Pending home sales, Durable goods orders, oil rigs and production

Asia’s exports to China plunge as economy stumbles

(WSJ) Japan’s exports to China in January sank 17.4% on the year to 958.1 billion yen ($8.65 billion), accelerating from December’s 7% drop. South Korean exports to China in January slid 19% on the year, a steeper rate than in the previous two months of decline. Taiwan’s mainland-bound shipments, which make up 40% of its total, also fell for the third consecutive month in January by 7.5%. Singapore suffered a 25% plunge. Thailand saw a second straight monthly drop in December, declining 7.3% on weaker exports of IT components. Vietnam was the odd man out, with its first increase in three months in January.

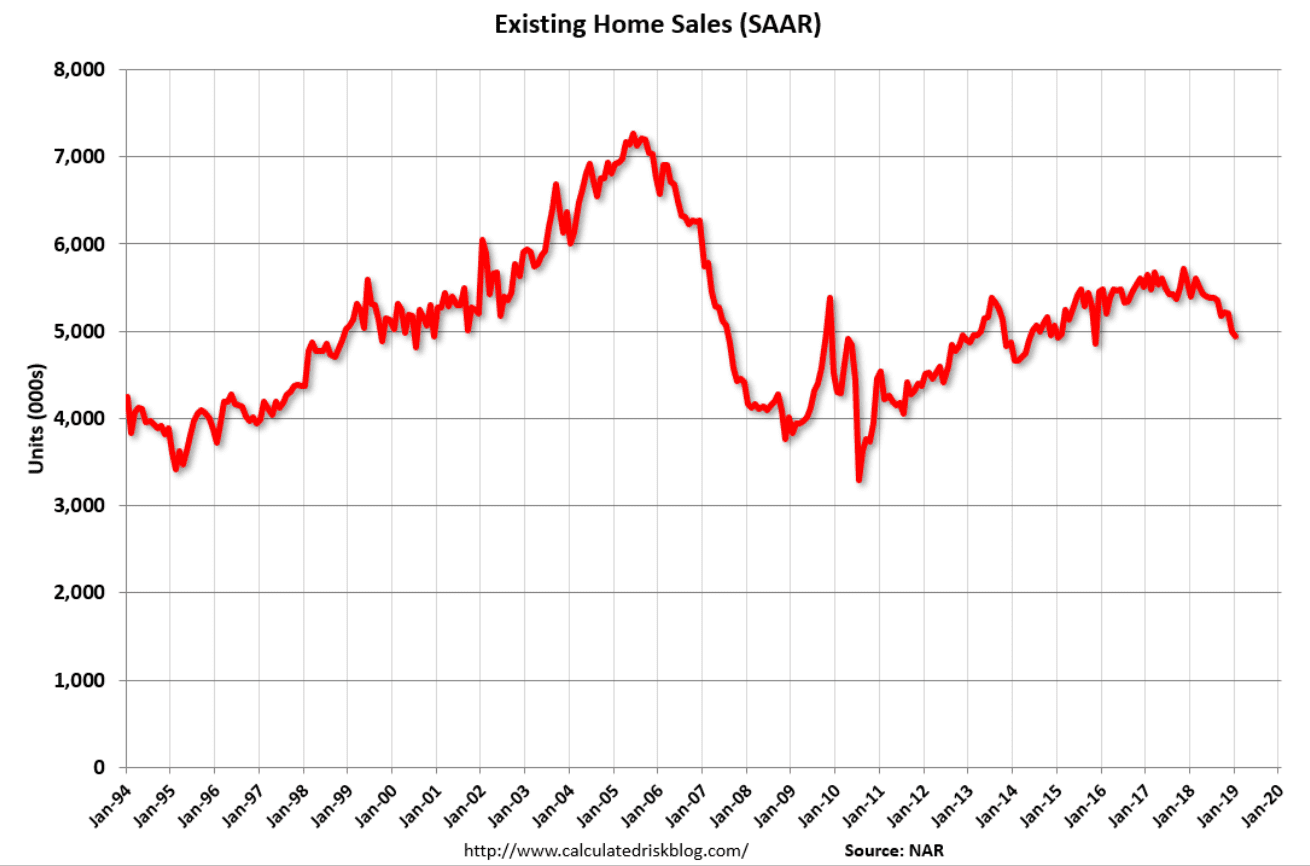

The global slowdown includes the US:

Total existing-home sales, completed transactions that include single-family homes, townhomes, condominiums and co-ops, decreased 1.2 percent from December to a seasonally adjusted annual rate of 4.94 million in January. Sales are now down 8.5 percent from a year ago (5.40 million in January 2018).

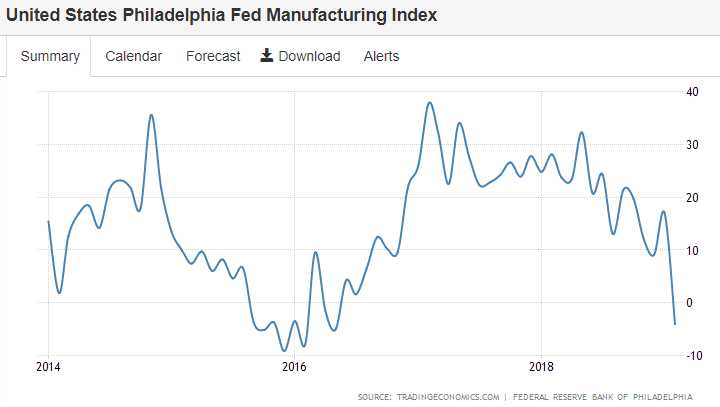

Not good:

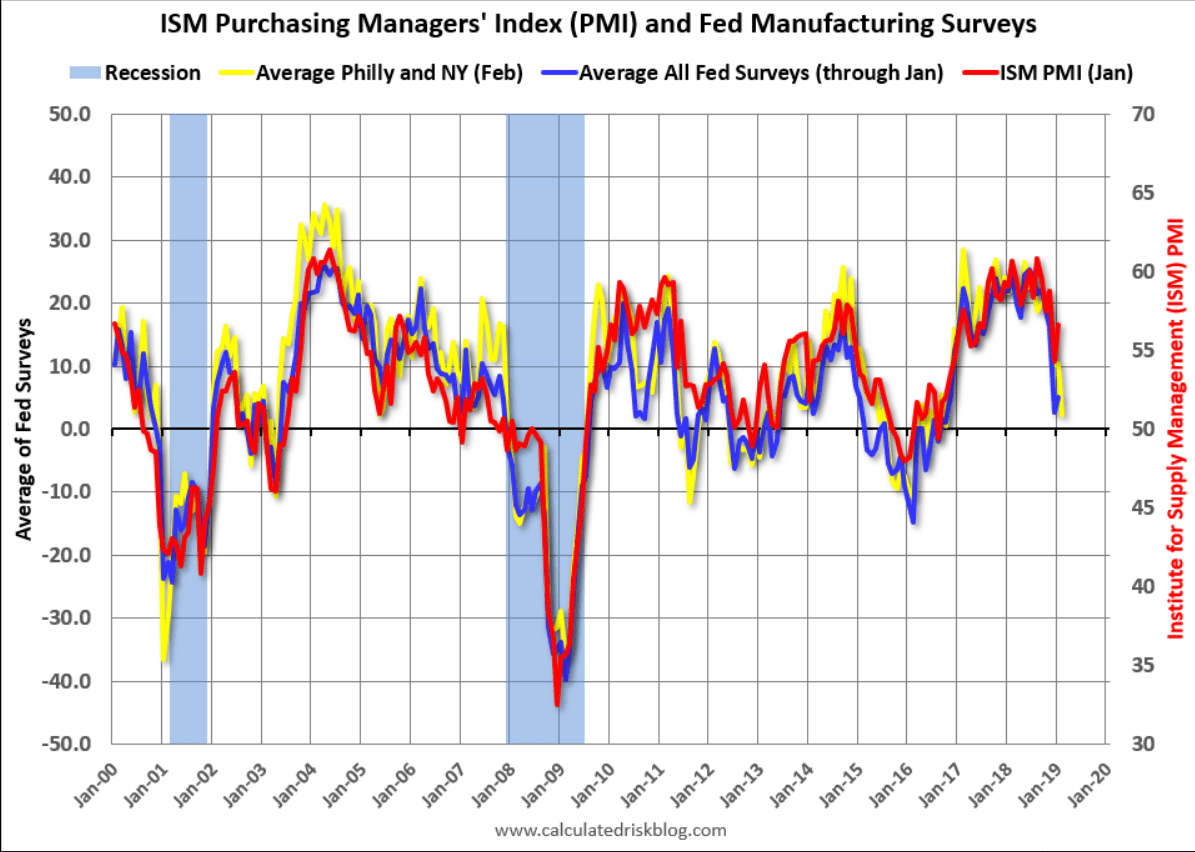

Highlights

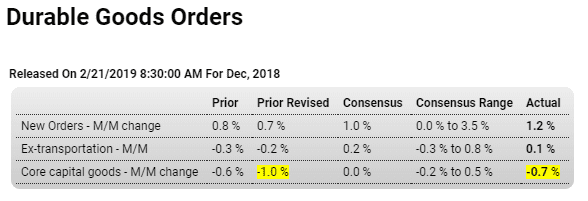

The 1.2 percent headline rise in December durable goods masks weakness for business investment. New orders for core capital goods sank an unexpected 0.7 percent that falls well below Econoday’s consensus range. Magnifying what may be an emerging pivot lower for capital goods is a sharp downward revision to November, now at minus 1.0 percent.

Significant declines for a second month in a row were posted by machinery, computers as well as communications equipment which are all central to the capital goods group. But these are orders. Shipments of core capital goods actually rose 0.5 percent which will help offset a 0.2 percent shipment decline in November and may actually give a small boost to nonresidential fixed investment in next week’s fourth-quarter GDP report.

Jumping more than 50 percent, aircraft orders, as they often do in the durable goods report, skewed December’s headline higher. Vehicle orders were also strong, rising 2.1 percent and, together with the previously released vehicle surge in the manufacturing component of the industrial production report, point to a burst of late-year activity in the auto sector. But when excluding aircraft and vehicles as well as all other transportation equipment, orders inched only 0.1 percent higher in December vs Econoday’s consensus for a 0.2 percent gain.

An underlying softness is also indicated by total unfilled orders which have posted small declines in each of the last three reports. Unwanted inventories, however, do not appear to be a threat, rising only 0.2 percent vs a 0.8 percent increase for total shipments that pulls the inventory-to-shipments ratio down to 1.60 from November’s 1.61.

The factory sector was the economy’s star performer in 2018 and, on the surface at least, ended the year in strength especially for autos. But the weakness in business investment, and its negative implications for future productivity, point to hesitance among businesses which is consistent perhaps with easing indications for business confidence.

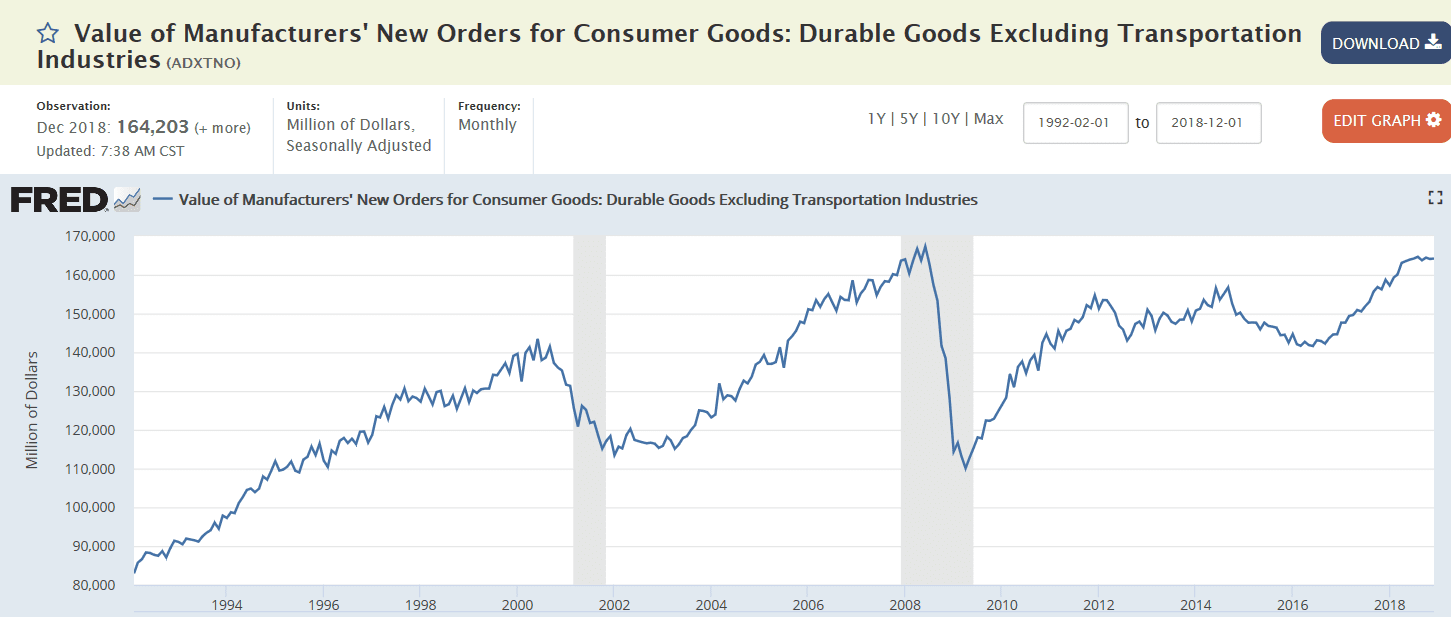

Flattened out below 2008 levels, not adjusted for inflation: