Real final sales slowing, and business equipment growth negative: From the NY Fed, reads like credit growth slowing: Total Household Debt Rises for 19th Straight Quarter, Now Nearly Trillion Above Previous Peak The report includes a one-page summary of key takeaways and their supporting data points. Overarching trends from the Report’s summary include: Housing Debt Mortgage balances rose by 0 billion, to .2 trillion. Mortgage originations declined to 4 billion from 1 billion, the lowest level seen since the third quarter of 2014. Mortgage delinquencies improved slightly, with 1.0% of mortgage balances 90 or more days delinquent, down from 1.1% in the fourth quarter of 2018. Non-Housing Debt Outstanding student loan debt increased by billion, to .49

Topics:

WARREN MOSLER considers the following as important: Economic Releases

This could be interesting, too:

WARREN MOSLER writes Consumer sentiment, real retail sales, industrial production, wages

WARREN MOSLER writes New manufacturers orders, vehicle sales, unemployment claims, rents, oil prices

WARREN MOSLER writes Saudi price hike, private payrolls, new hires, corporate profits

WARREN MOSLER writes Pending home sales, Durable goods orders, oil rigs and production

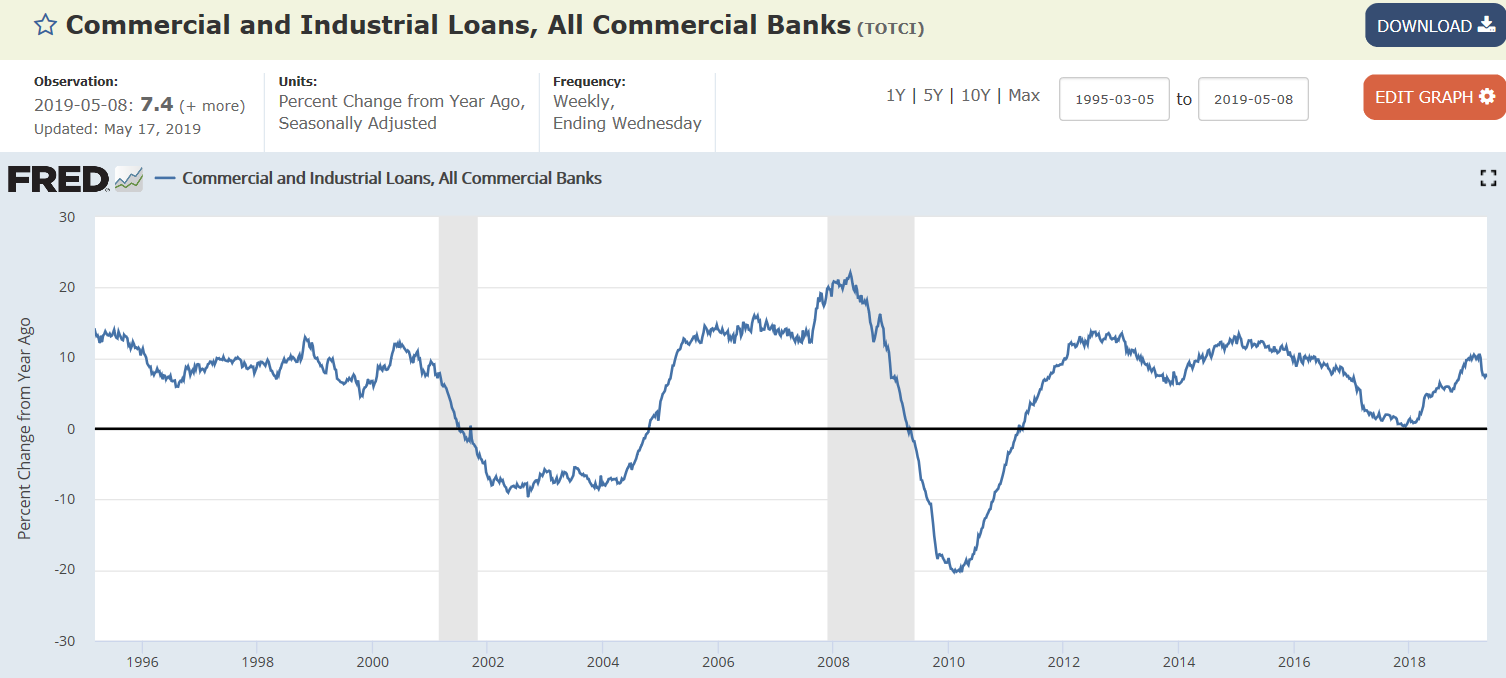

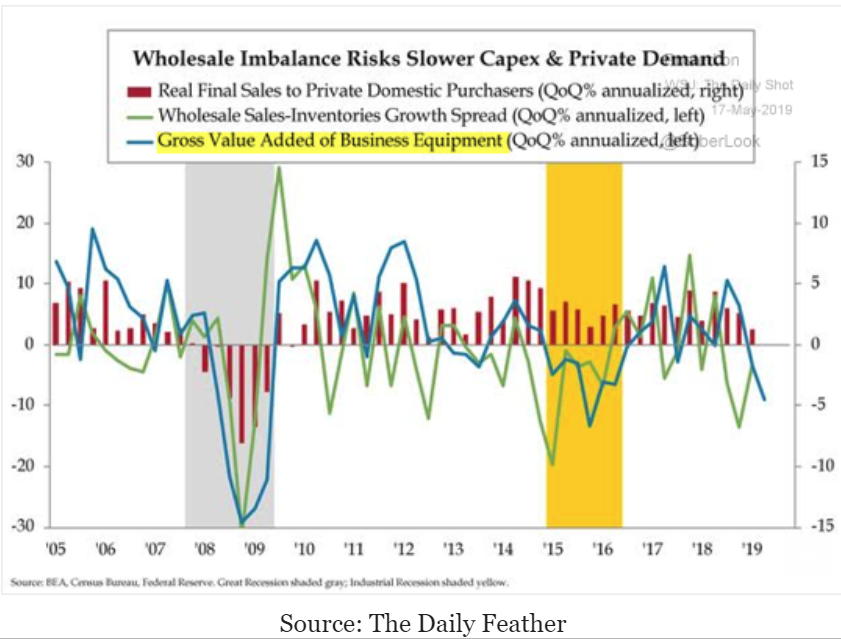

Real final sales slowing, and business equipment growth negative:

From the NY Fed, reads like credit growth slowing:

Total Household Debt Rises for 19th Straight Quarter, Now Nearly $1 Trillion Above Previous Peak

The report includes a one-page summary of key takeaways and their supporting data points. Overarching trends from the Report’s summary include:

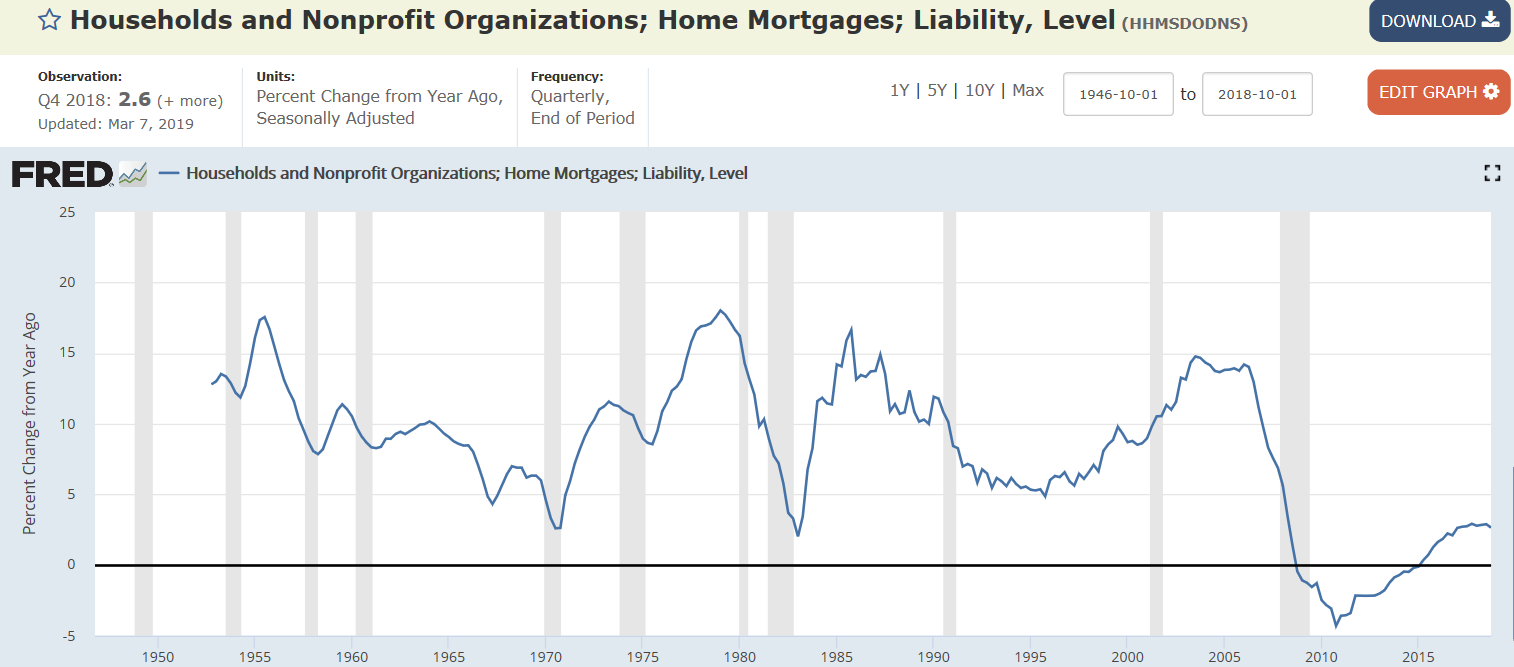

Housing Debt

Mortgage balances rose by $120 billion, to $9.2 trillion. Mortgage originations declined to $344 billion from $401 billion, the lowest level seen since the third quarter of 2014. Mortgage delinquencies improved slightly, with 1.0% of mortgage balances 90 or more days delinquent, down from 1.1% in the fourth quarter of 2018. Non-Housing Debt

Outstanding student loan debt increased by $29 billion, to $1.49 trillion. Newly originated auto loans totaled $139 billion, continuing a long-running growth trend. Credit card balances fell slightly, to $848 billion from $870 billion.

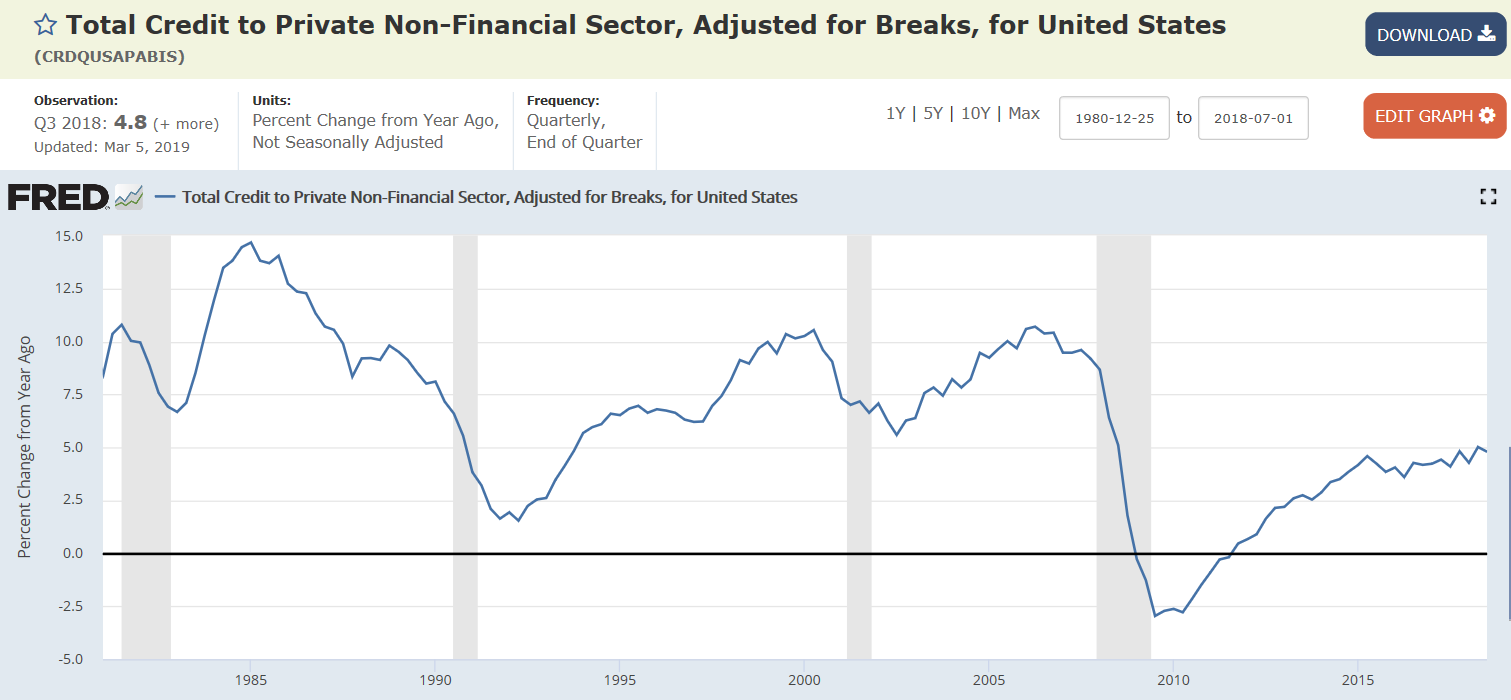

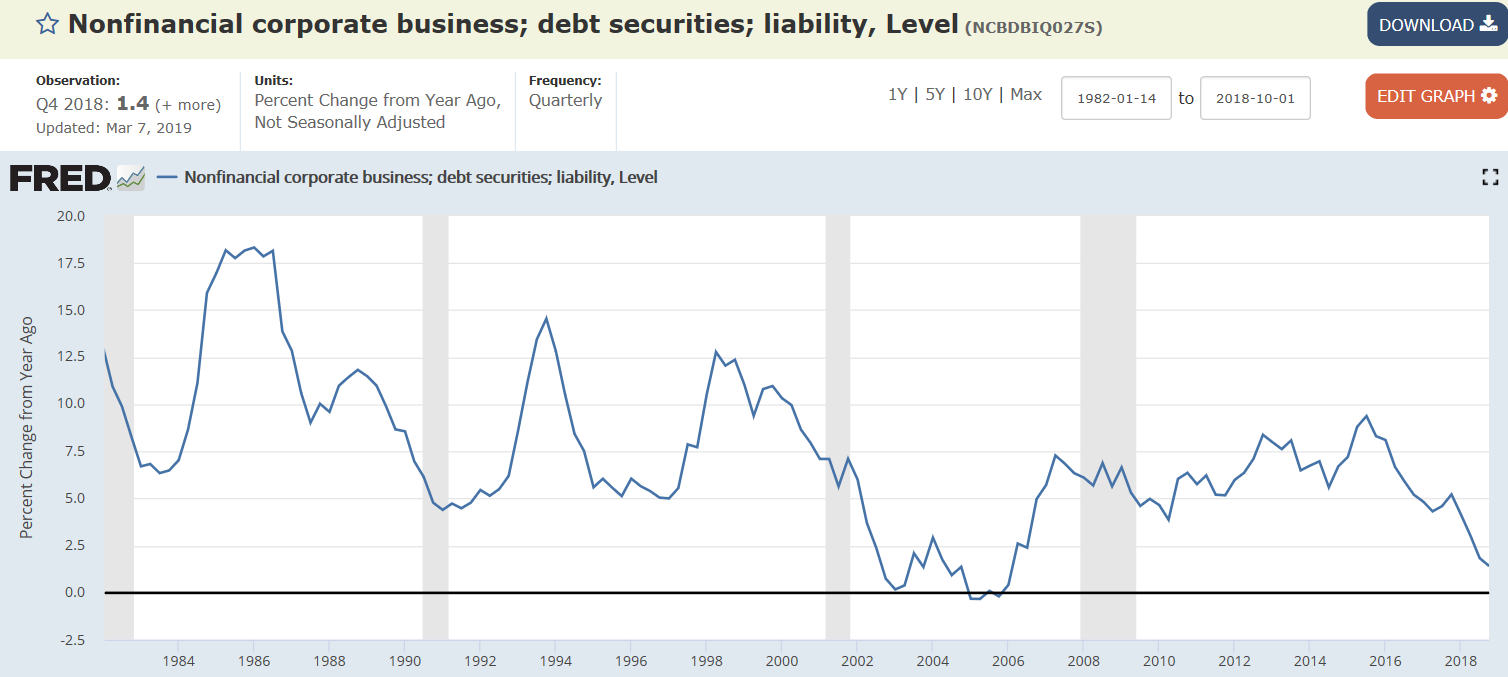

Through year end- credit growth low and slowing:

Only through q3 available:

As of year end:

Rolled over?