Still in contraction: China Imports Tumble in June Imports to China plunged 7.3 percent from a year earlier to USD 161.86 billion in June 2019, much worse than forecasts of a 4.5 percent drop, a further sign of weak domestic demand that could lead Beijing to add more stimulus. Purchases fell for: unwrought copper (-27.2 percent); iron ore (-9.7 percent); and soybeans (-25.1 percent) amid higher tariff on US cargoes and following outbreaks of African swine fever. By contrast, increases were seen in imports of crude oil (15.2 percent) and coal (6.4 percent). Among China’s largest trade partners, imports fell from the US (-31.4 percent), South Korea (-21.9 percent), Taiwan (-7.4 percent) and Japan (-5 percent), but grew from the EU (8.6 percent), Australia (8.8 percent)

Topics:

WARREN MOSLER considers the following as important: Economic Releases

This could be interesting, too:

WARREN MOSLER writes Consumer sentiment, real retail sales, industrial production, wages

WARREN MOSLER writes New manufacturers orders, vehicle sales, unemployment claims, rents, oil prices

WARREN MOSLER writes Saudi price hike, private payrolls, new hires, corporate profits

WARREN MOSLER writes Pending home sales, Durable goods orders, oil rigs and production

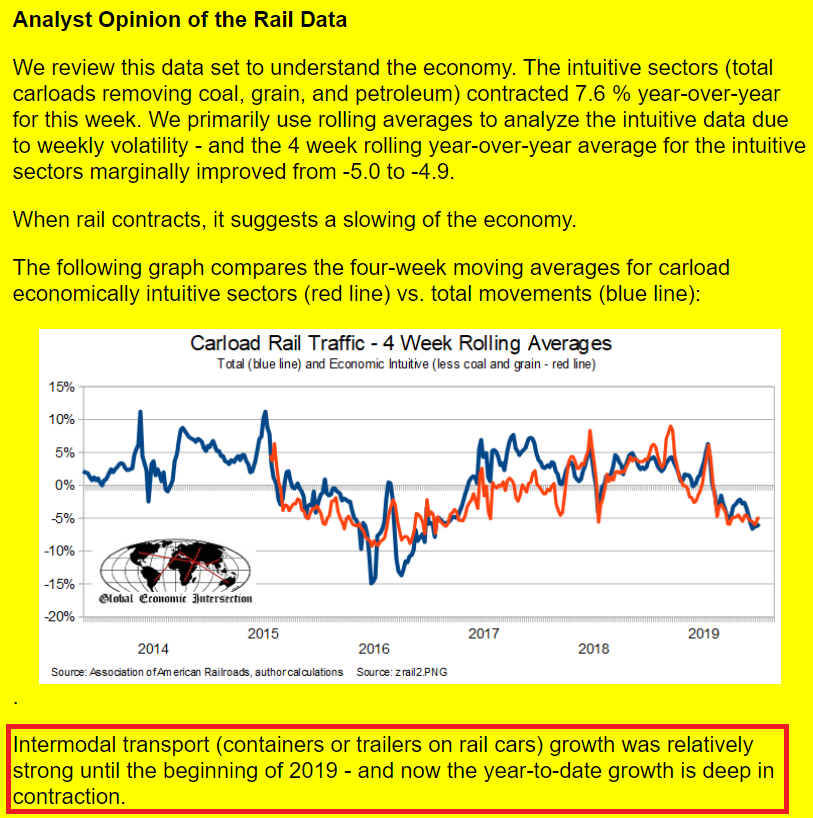

Still in contraction:

China Imports Tumble in June

Imports to China plunged 7.3 percent from a year earlier to USD 161.86 billion in June 2019, much worse than forecasts of a 4.5 percent drop, a further sign of weak domestic demand that could lead Beijing to add more stimulus. Purchases fell for: unwrought copper (-27.2 percent); iron ore (-9.7 percent); and soybeans (-25.1 percent) amid higher tariff on US cargoes and following outbreaks of African swine fever. By contrast, increases were seen in imports of crude oil (15.2 percent) and coal (6.4 percent). Among China’s largest trade partners, imports fell from the US (-31.4 percent), South Korea (-21.9 percent), Taiwan (-7.4 percent) and Japan (-5 percent), but grew from the EU (8.6 percent), Australia (8.8 percent) and ASEAN (0.4 percent).