Back down from already depressed levels even as mortgage rates fall: US New Home Sales Fall Unexpectedly Sales of new single-family houses in the US dropped 7.8% from the previous month to a seasonally adjusted annual rate of 626 thousand in May, compared to market expectations of a 1.9% increase, as purchases plunged in the West and Northeast. It was the lowest sales since December despite lower mortgage rates and solid job market. US Home Price Growth Eases to 7-Year Low: Case-Shiller The S&P CoreLogic Case-Shiller 20-city home price index in the US rose 2.5 percent year-on-year in April 2019, easing from a revised 2.6 percent increase in the previous month and missing market expectations of 2.6 percent. It was the smallest annual gain in house prices since August

Topics:

WARREN MOSLER considers the following as important: Economic Releases

This could be interesting, too:

WARREN MOSLER writes Consumer sentiment, real retail sales, industrial production, wages

WARREN MOSLER writes New manufacturers orders, vehicle sales, unemployment claims, rents, oil prices

WARREN MOSLER writes Saudi price hike, private payrolls, new hires, corporate profits

WARREN MOSLER writes Pending home sales, Durable goods orders, oil rigs and production

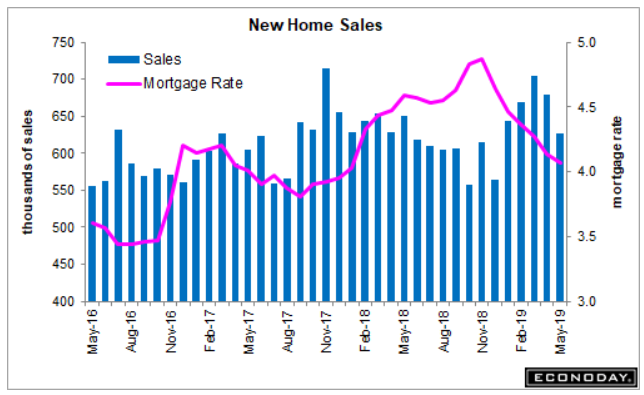

Back down from already depressed levels even as mortgage rates fall:

US New Home Sales Fall Unexpectedly

Sales of new single-family houses in the US dropped 7.8% from the previous month to a seasonally adjusted annual rate of 626 thousand in May, compared to market expectations of a 1.9% increase, as purchases plunged in the West and Northeast. It was the lowest sales since December despite lower mortgage rates and solid job market.

US Home Price Growth Eases to 7-Year Low: Case-Shiller

The S&P CoreLogic Case-Shiller 20-city home price index in the US rose 2.5 percent year-on-year in April 2019, easing from a revised 2.6 percent increase in the previous month and missing market expectations of 2.6 percent. It was the smallest annual gain in house prices since August 2012. Las Vegas recorded the biggest increase in home prices (7.1 percent), followed by Phoenix (6.0 percent) and Tampa (5.6 percent), while the smallest gains were reported in San Diego (0.8 percent), Los Angeles (1.5 percent) and San Francisco (1.8 percent). Prices in Seattle were unchanged. The national index, covering all nine US census divisions, went up 3.5 percent in April, down from a 3.7 percent rise in the prior month.

Richmond Fed report:

Fifth District Manufacturing Activity Below Forecasts

The Manufacturing Activity Index in the US fifth district fell to 3 in June 2019 from 5 in May, below market consensus of 7. Employment (2 from 17 in May), raw materials (27 from 37) and finished goods (21 from 26) dropped. Meanwhile, shipments (7 from 2) and new orders (1 from 0) improved. On the price front, price pressures eased for prices paid (1.58 from 2.21) while accelerated for prices received (1.68 from 1.53). Firms were optimistic about growth in the coming months.

Consumer confidence drops more than expected, reaching its lowest point in nearly two years